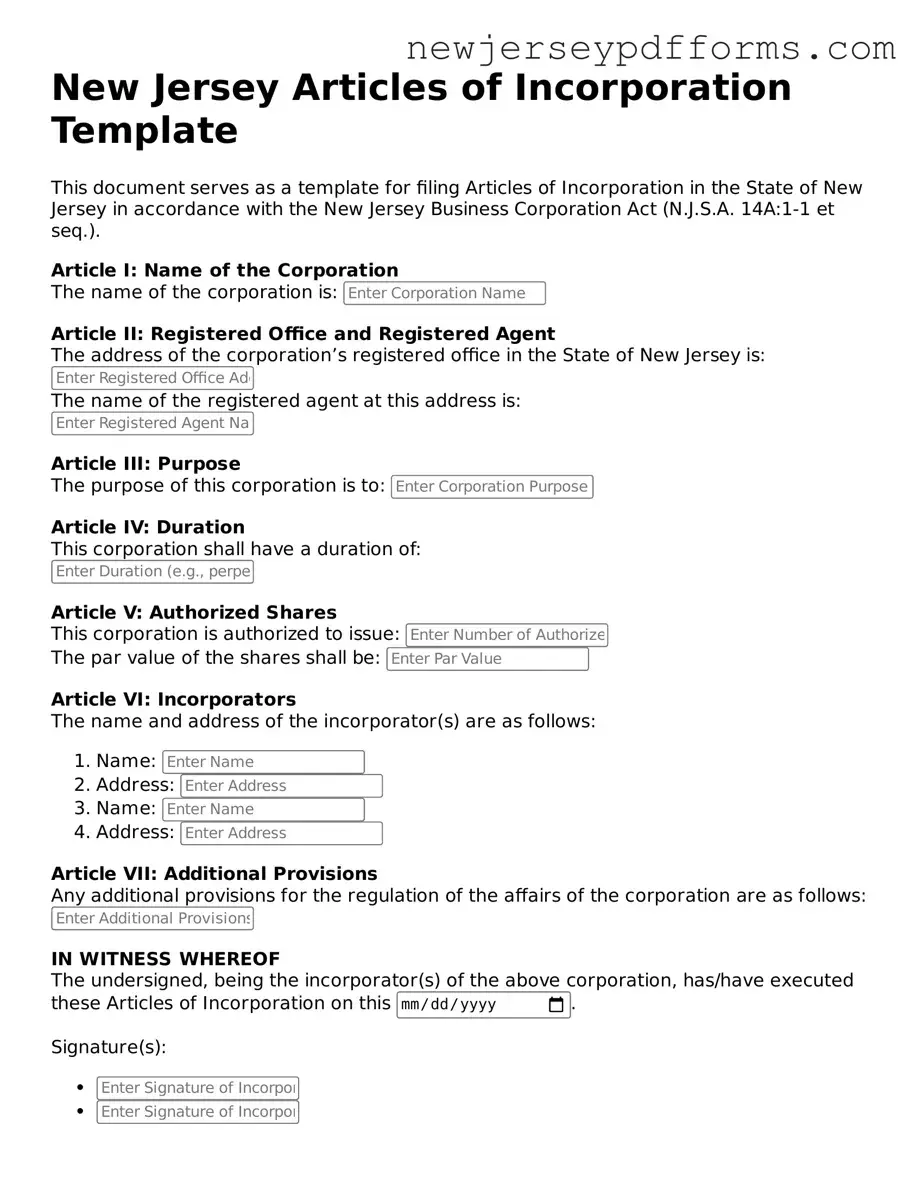

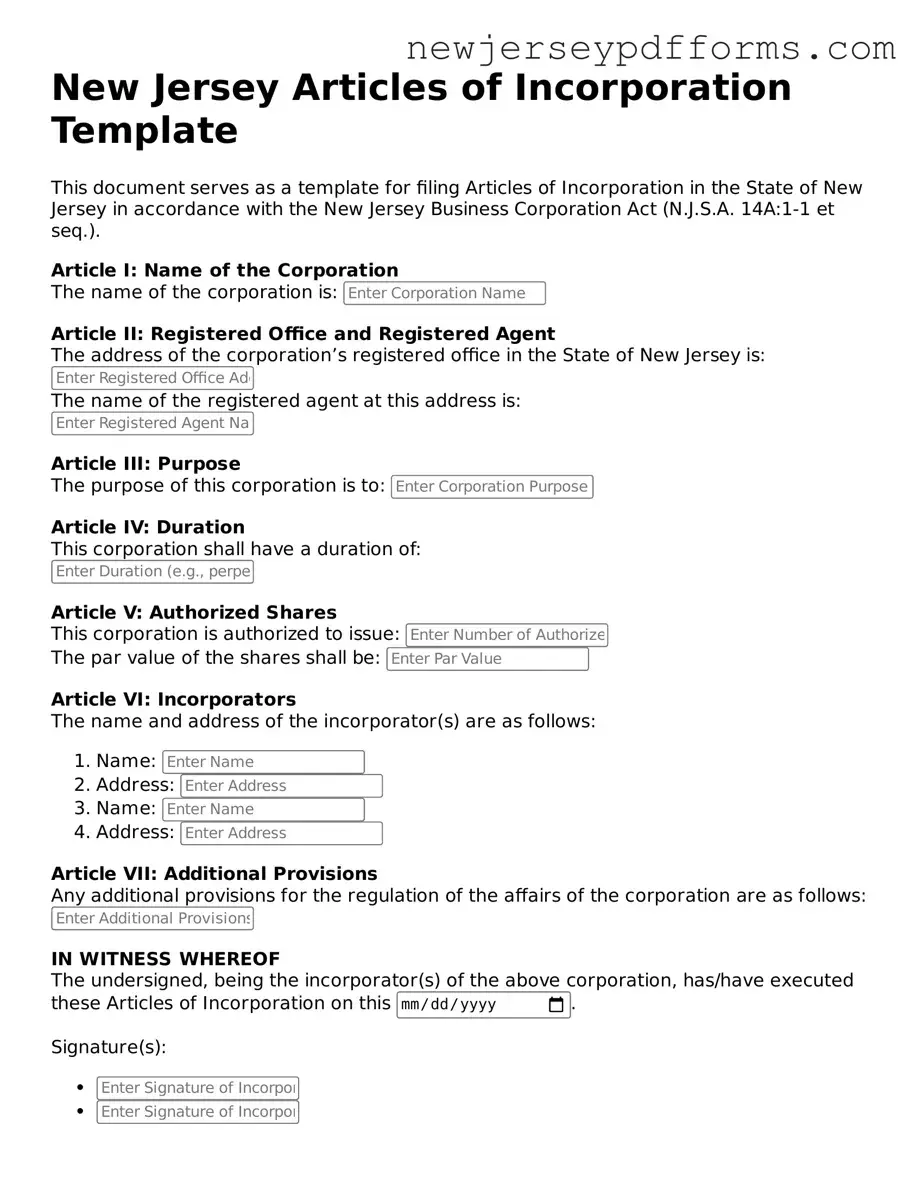

What is the purpose of the New Jersey Articles of Incorporation form?

The New Jersey Articles of Incorporation form is a legal document that establishes a corporation in the state. It outlines essential details about the corporation, such as its name, purpose, and structure. Filing this form is a crucial step in the incorporation process, allowing the business to operate as a separate legal entity and providing it with certain legal protections and benefits.

What information is required to complete the Articles of Incorporation?

To complete the Articles of Incorporation, you will need to provide several key pieces of information. This includes the name of the corporation, the purpose of the business, the address of the principal office, the names and addresses of the initial directors, and the registered agent's name and address. Additionally, you may need to specify the type of corporation, whether it is for-profit or non-profit.

How do I file the Articles of Incorporation in New Jersey?

Filing the Articles of Incorporation in New Jersey can be done online or by mail. If you choose to file online, you can visit the New Jersey Division of Revenue and Enterprise Services website, where you can complete the form electronically. Alternatively, you can download a paper form, fill it out, and mail it to the appropriate address. Be sure to include the required filing fee, which can vary based on the type of corporation.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in New Jersey typically ranges from $125 to $150, depending on the type of corporation you are establishing. It is important to check the latest fee schedule on the New Jersey Division of Revenue and Enterprise Services website, as fees may change over time. Payment can usually be made by credit card if filing online or by check if filing by mail.

How long does it take to process the Articles of Incorporation?

The processing time for the Articles of Incorporation can vary. Generally, online submissions are processed more quickly, often within a few business days. Mail submissions may take longer, sometimes up to several weeks. To expedite the process, consider using expedited service options, which may incur additional fees.

Can I amend the Articles of Incorporation after filing?

Yes, it is possible to amend the Articles of Incorporation after they have been filed. If there are changes to the corporation's name, purpose, or structure, an amendment must be filed with the state. This requires submitting the appropriate form along with any necessary fees. Keeping the Articles of Incorporation up to date is essential for compliance and maintaining good standing.

What happens if I do not file the Articles of Incorporation?

Failing to file the Articles of Incorporation means that your business will not be recognized as a legal entity in New Jersey. This can expose you to personal liability for business debts and obligations. Additionally, without incorporation, you may miss out on certain tax benefits and protections that come with being a formal corporation. It is advisable to complete this step to ensure legal protections for yourself and your business.

Do I need legal assistance to file the Articles of Incorporation?

While it is not mandatory to seek legal assistance when filing the Articles of Incorporation, it can be beneficial, especially for those unfamiliar with the process. A legal professional can help ensure that the form is completed accurately and that all necessary information is included. This can prevent delays and potential issues down the line. However, many individuals successfully file the form on their own with the right resources and guidance.