What is a New Jersey Deed form?

A New Jersey Deed form is a legal document used to transfer ownership of real estate from one party to another within the state of New Jersey. This document serves as proof of the transaction and outlines the details of the transfer, including the names of the parties involved, a description of the property, and any conditions or considerations associated with the transfer.

What types of deeds are available in New Jersey?

New Jersey recognizes several types of deeds, including the General Warranty Deed, Special Warranty Deed, and Quitclaim Deed. A General Warranty Deed offers the highest level of protection for the buyer, as it guarantees that the seller holds clear title to the property. A Special Warranty Deed provides limited guarantees, typically covering only the period during which the seller owned the property. A Quitclaim Deed, on the other hand, transfers whatever interest the seller has in the property without any warranties, making it less secure for the buyer.

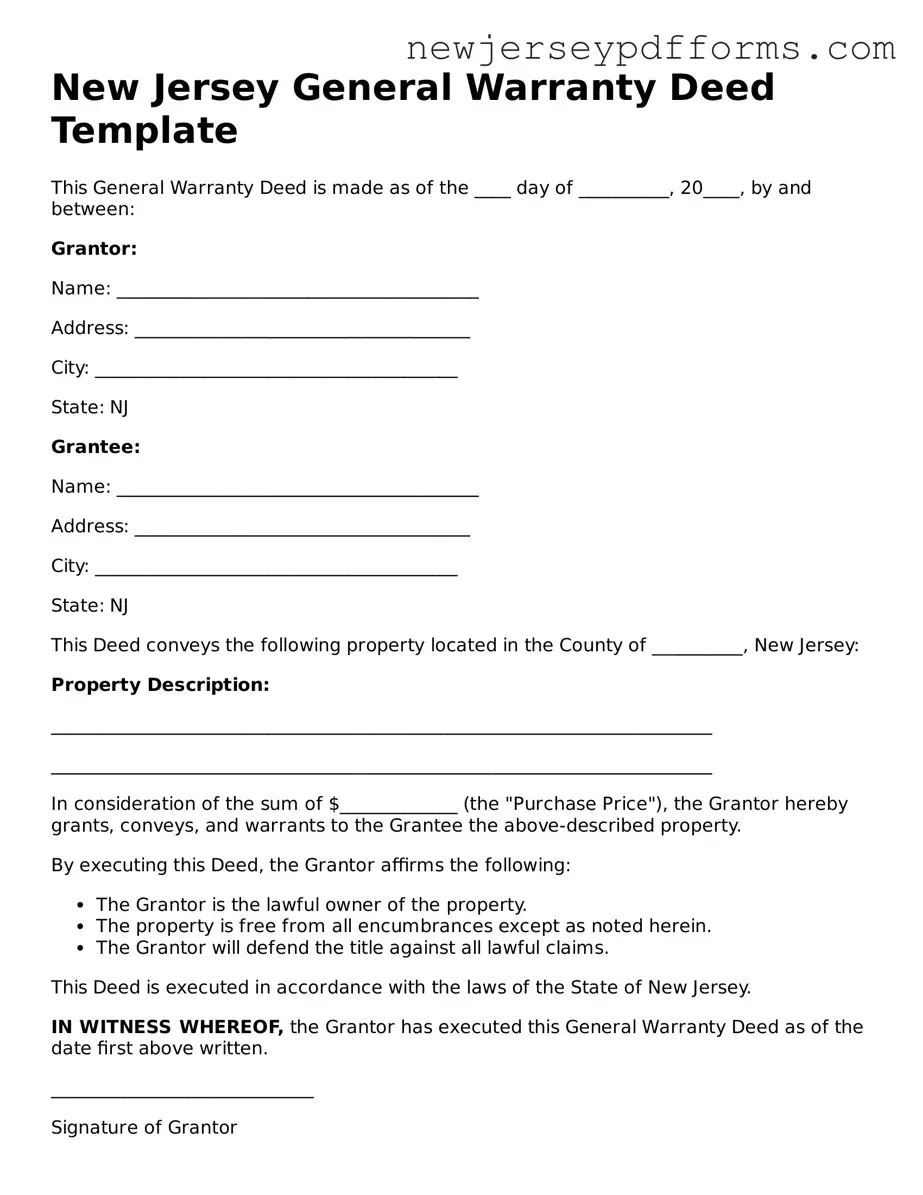

How do I fill out a New Jersey Deed form?

Filling out a New Jersey Deed form requires careful attention to detail. Begin by entering the names and addresses of the grantor (the seller) and the grantee (the buyer). Next, provide a clear and accurate description of the property being transferred, including its lot number, block number, and any relevant boundaries. Finally, include the date of the transfer and any consideration being exchanged, such as the sale price. It is advisable to have a legal professional review the completed form to ensure accuracy.

Do I need to notarize the New Jersey Deed form?

Yes, the New Jersey Deed form must be notarized. This means that the signatures of both the grantor and grantee need to be witnessed by a notary public. Notarization helps to verify the identities of the parties involved and ensures that the document is legally binding. After notarization, the deed should be recorded with the county clerk’s office to provide public notice of the property transfer.

What are the recording requirements for a New Jersey Deed?

In New Jersey, once the Deed form is completed and notarized, it must be recorded at the county clerk’s office where the property is located. Recording the deed is essential as it establishes public notice of the ownership transfer. There may be specific fees associated with recording, and it is important to check with the local county office for any additional requirements or forms that may be needed.

Are there any taxes associated with transferring property in New Jersey?

Yes, when transferring property in New Jersey, there are typically taxes involved. The seller is responsible for paying the Realty Transfer Fee, which is based on the sale price of the property. Additionally, depending on the specific circumstances, there may be other local taxes or fees that apply. It is wise to consult a tax professional or legal advisor to fully understand the financial implications of the property transfer.

Can I use a New Jersey Deed form for transferring property to a family member?

Absolutely. A New Jersey Deed form can be used to transfer property to a family member. However, it is important to consider the implications of such a transfer, including potential tax consequences and the impact on any existing mortgages. It may be beneficial to consult with a legal advisor to ensure that the transfer is executed correctly and to understand any potential legal ramifications.

What happens if I make a mistake on the New Jersey Deed form?

If a mistake is made on the New Jersey Deed form, it is crucial to correct it before the deed is recorded. Errors in names, property descriptions, or other details can lead to complications in the future. If the deed has already been recorded with mistakes, a corrective deed may need to be filed to rectify the situation. Seeking legal advice can help navigate the process of correcting any errors effectively.