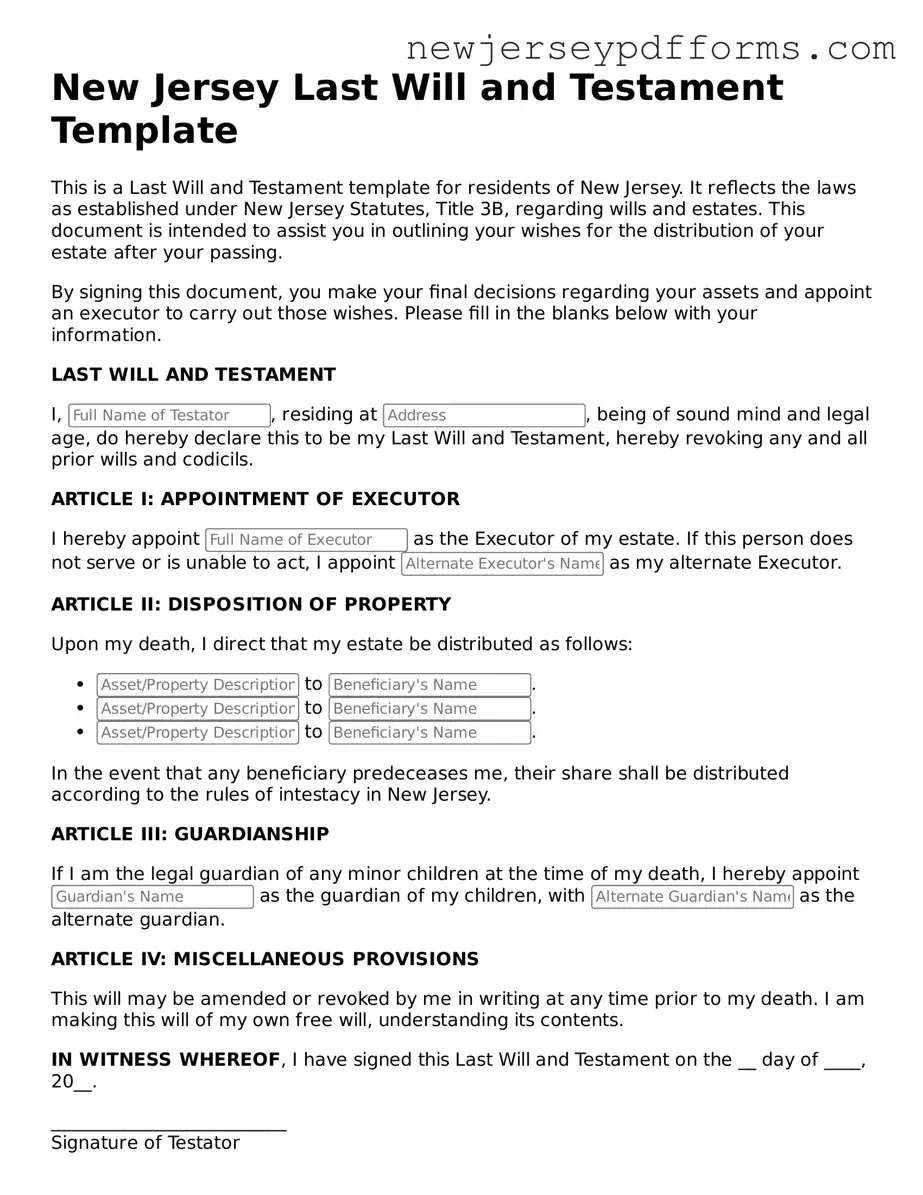

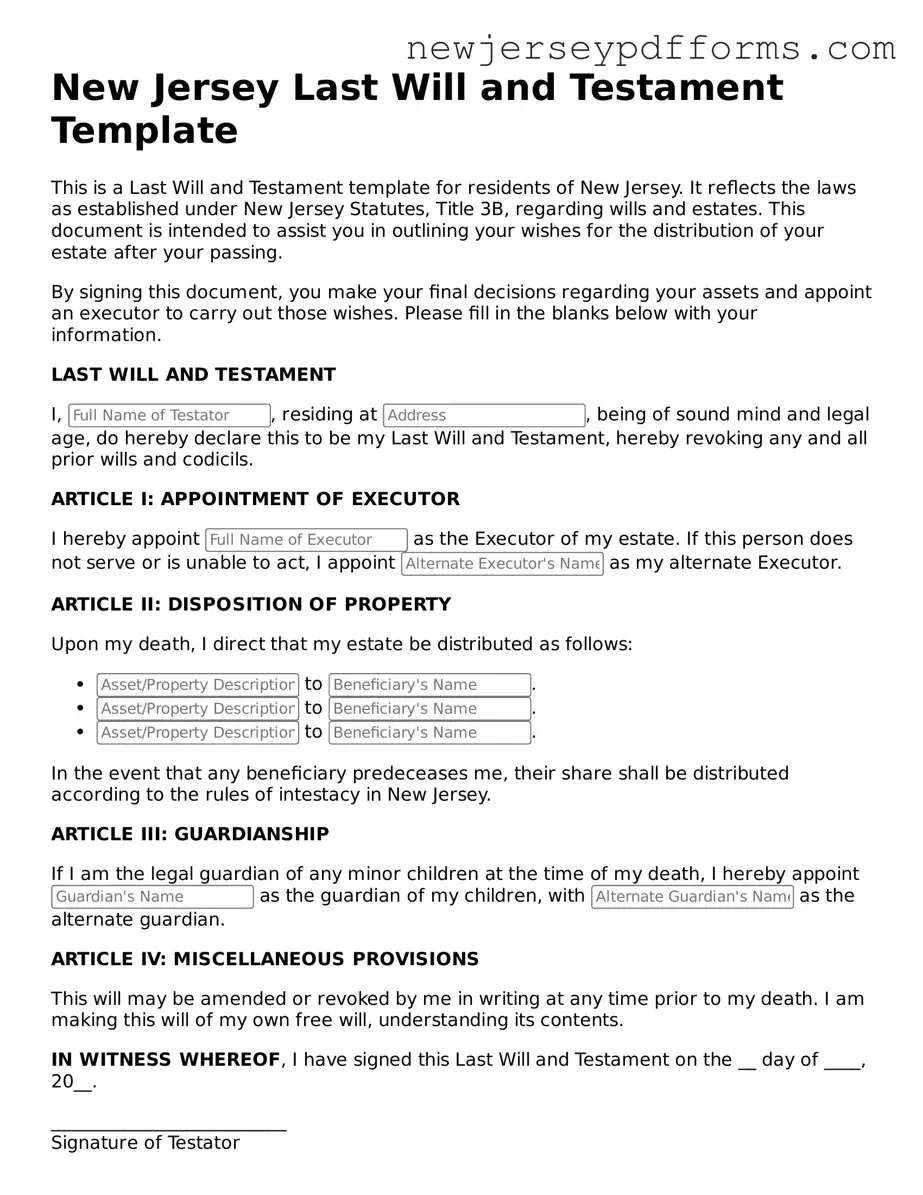

What is a Last Will and Testament in New Jersey?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be managed after their death. In New Jersey, this document allows individuals to specify beneficiaries, appoint guardians for minor children, and designate an executor to handle the estate's administration.

Who can create a Last Will and Testament in New Jersey?

Any person who is at least 18 years old and of sound mind can create a Last Will and Testament in New Jersey. It is important that the individual understands the implications of the document and can make decisions regarding their estate.

What are the requirements for a valid Last Will and Testament in New Jersey?

To be valid in New Jersey, a Last Will and Testament must be in writing, signed by the testator (the person making the will), and witnessed by at least two individuals. These witnesses must be present at the same time when the testator signs the will. Additionally, the will should clearly express the testator's intentions.

Can I make changes to my Last Will and Testament?

Yes, you can make changes to your Last Will and Testament at any time while you are alive. This can be done by creating a new will or by drafting a codicil, which is an amendment to the existing will. It is essential to follow the same formalities as the original will to ensure the changes are valid.

What happens if I die without a will in New Jersey?

If you die without a will, your estate will be distributed according to New Jersey's intestacy laws. This means that your assets will be divided among your relatives based on a predetermined hierarchy. This process may not reflect your wishes and can lead to complications for your loved ones.

Can I revoke my Last Will and Testament?

Yes, you can revoke your Last Will and Testament at any time. This can be done by creating a new will that explicitly states the previous will is revoked or by physically destroying the old will. It is advisable to inform your executor or family members of your decision to revoke the will.

Do I need a lawyer to create a Last Will and Testament in New Jersey?

While it is not required to have a lawyer to create a Last Will and Testament, consulting with one is highly recommended. A lawyer can ensure that the will complies with state laws, accurately reflects your wishes, and addresses any complex issues regarding your estate.

What is an executor, and how do I choose one?

An executor is the person responsible for managing your estate after your death. This includes settling debts, distributing assets, and ensuring that your wishes are carried out according to your will. When choosing an executor, consider someone trustworthy, organized, and willing to take on the responsibilities involved.

Can I include specific bequests in my Last Will and Testament?

Yes, you can include specific bequests in your Last Will and Testament. This means you can designate particular items or amounts of money to specific individuals or organizations. Clearly outlining these bequests helps avoid confusion and ensures your wishes are honored.

Is it necessary to notarize my Last Will and Testament in New Jersey?

No, notarization is not required for a Last Will and Testament in New Jersey. However, having the will notarized can provide additional evidence of its authenticity and may help streamline the probate process. It is often considered a good practice to have the will notarized, even if it is not mandatory.