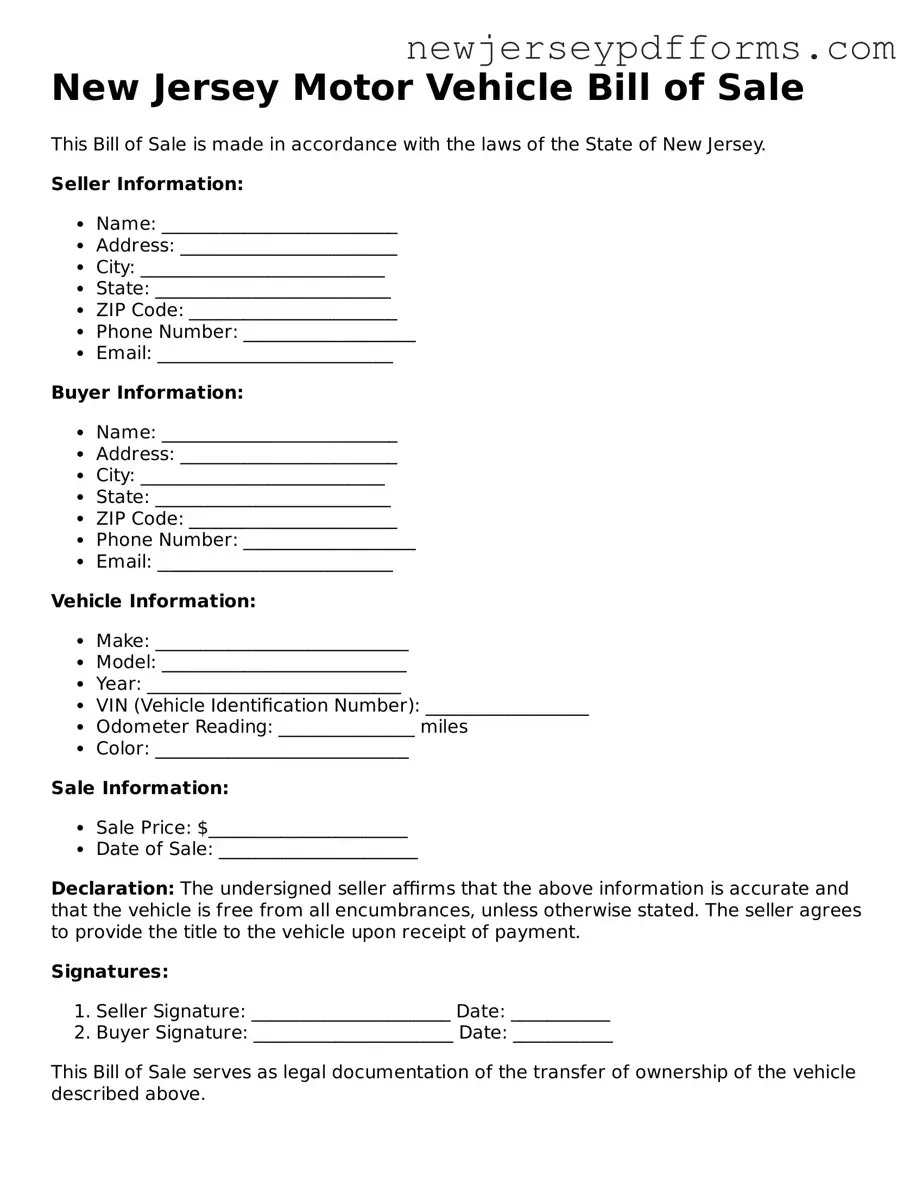

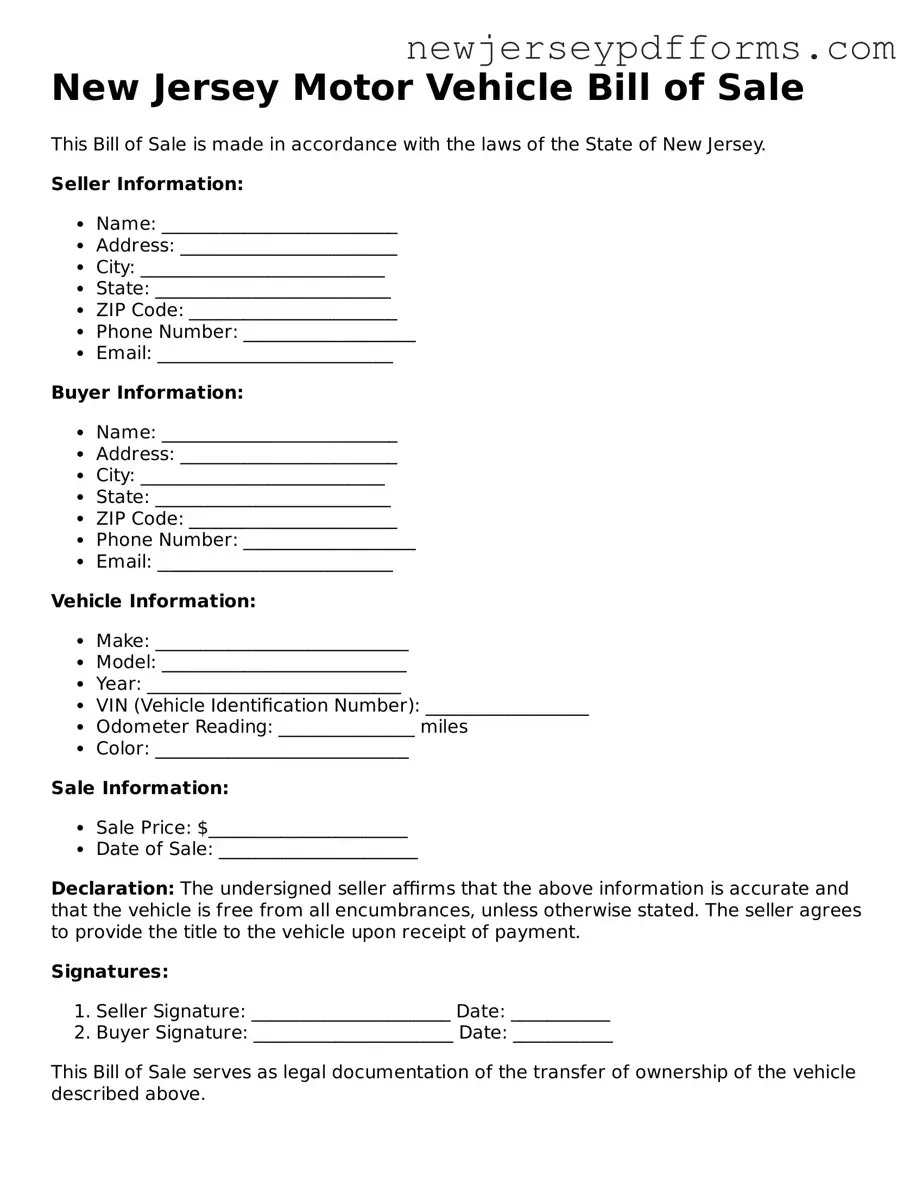

The New Jersey Motor Vehicle Bill of Sale form shares similarities with the Vehicle Title Transfer form. Both documents serve as proof of ownership transfer when a vehicle is sold. The Vehicle Title Transfer form requires the seller's signature and the buyer's information, similar to the Bill of Sale. Additionally, both forms may need to be submitted to the New Jersey Motor Vehicle Commission to complete the registration process.

The Odometer Disclosure Statement is another document akin to the Bill of Sale. This statement is required by federal law when a vehicle is sold. It provides a record of the vehicle's mileage at the time of sale. Like the Bill of Sale, it must be signed by both the seller and the buyer, ensuring transparency regarding the vehicle's condition and history.

The Application for Certificate of Ownership is also comparable. This document is used when a vehicle does not have a title, often for vehicles purchased from a private seller. It requires similar information as the Bill of Sale, including details about the vehicle and the parties involved in the transaction. Both documents are crucial for establishing legal ownership.

When it comes to managing your finances and tax obligations, having access to accurate documentation is essential. For individuals seeking to verify their tax history, the PDF Document Service offers a useful template for a Sample Tax Return Transcript, which summarizes critical tax details and can aid in various financial applications.

The Vehicle Registration Application is another related document. This form is necessary for registering a vehicle after purchase. It requires information about the vehicle and the owner, similar to the information collected in a Bill of Sale. Both documents facilitate the legal recognition of the vehicle's new owner.

The New Jersey Sales Tax Form ST-6 is similar in that it documents the sales transaction for tax purposes. When a vehicle is sold, the seller must report the sale, which is often reflected in the Bill of Sale. This form helps ensure that the appropriate sales tax is collected and reported to the state, reinforcing the transaction's legitimacy.

The Affidavit of Ownership is another document that can be used in conjunction with the Bill of Sale. This affidavit is often utilized when a vehicle's title is lost or unavailable. It serves as a sworn statement confirming the seller's ownership of the vehicle, similar to the ownership transfer aspect of the Bill of Sale.

The Release of Liability form is also relevant. This document protects the seller from future liability after the sale of the vehicle. It confirms that the seller is no longer responsible for the vehicle once the Bill of Sale is completed. Both documents work together to finalize the sale and clarify the responsibilities of both parties.

Lastly, the Certificate of Title is a fundamental document that confirms vehicle ownership. While the Bill of Sale provides proof of the transaction, the Certificate of Title is the official document that establishes legal ownership. Both documents are essential in the vehicle sale process, ensuring that ownership is transferred and recorded appropriately.