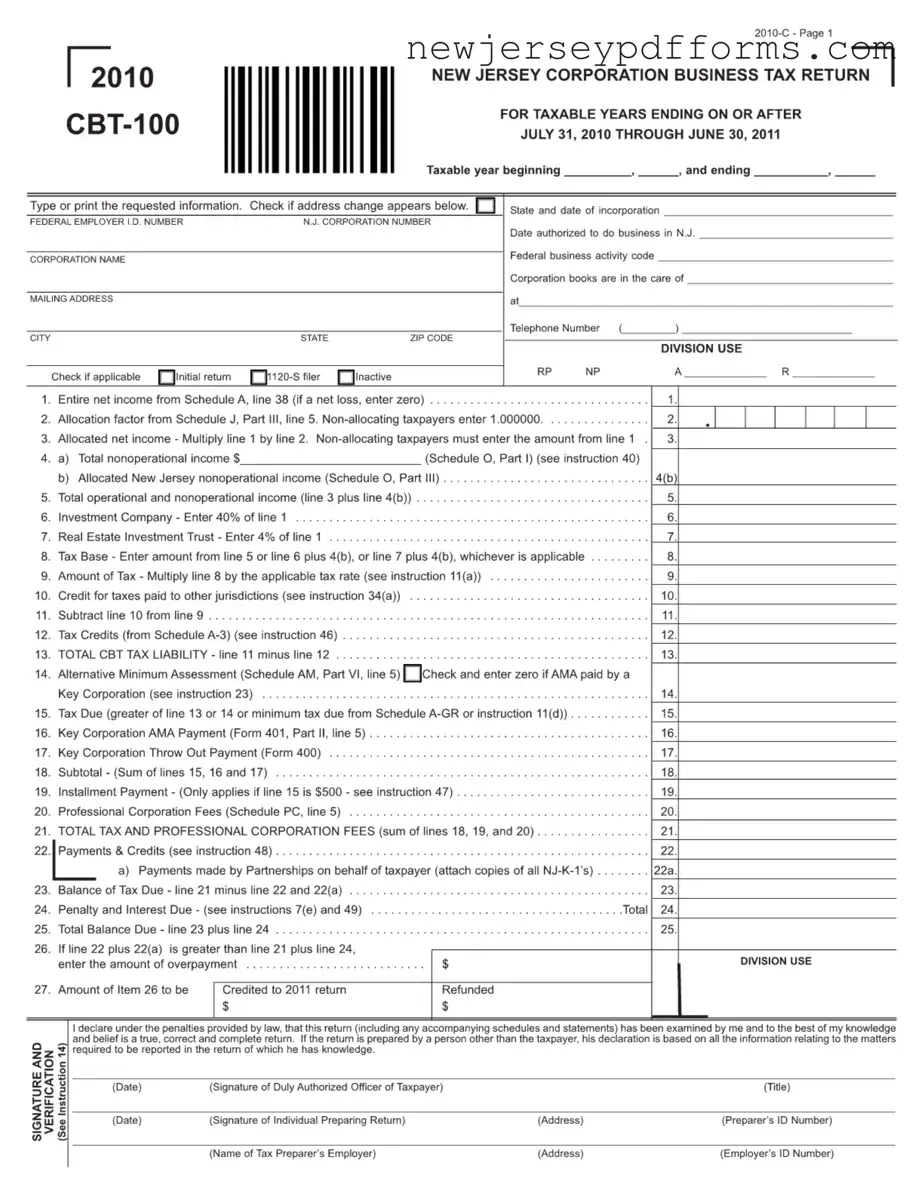

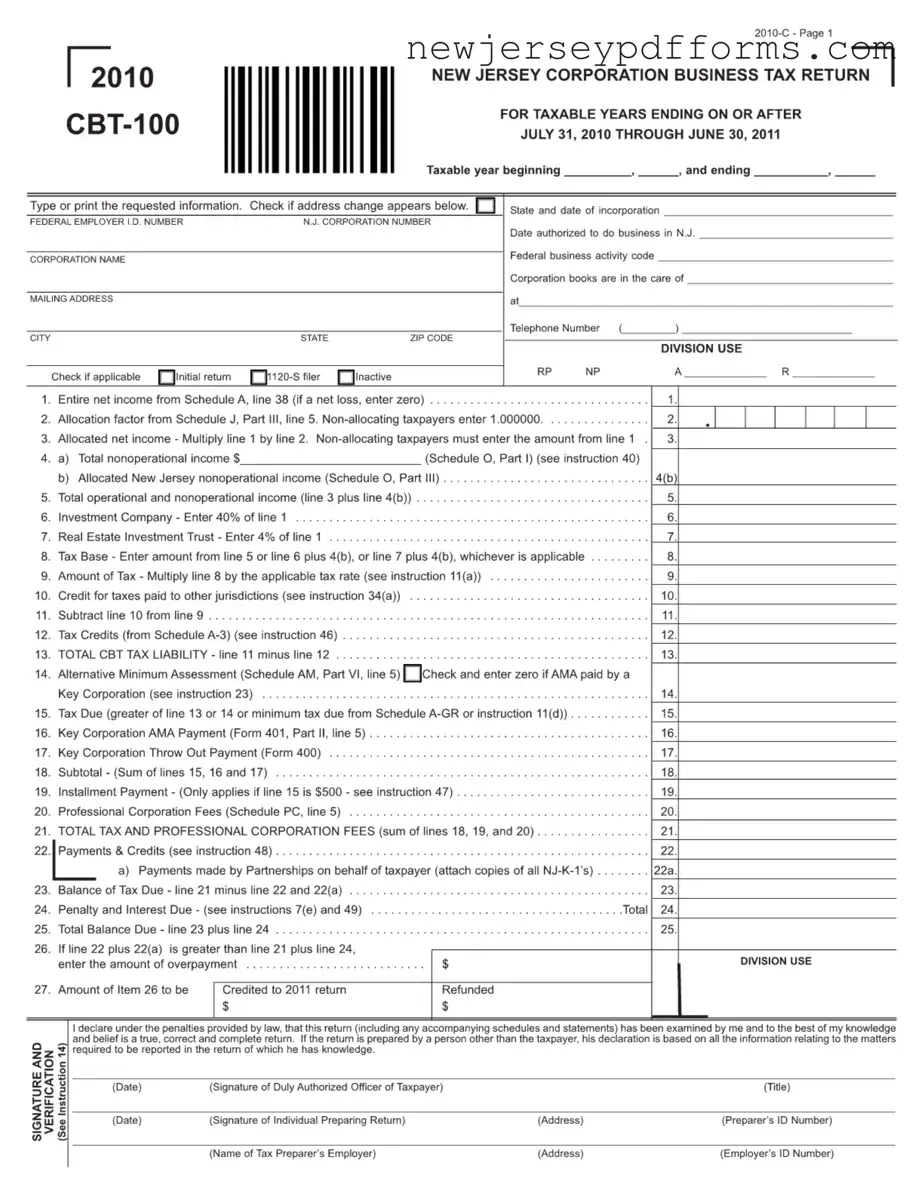

What is the New Jersey CBT-100 form?

The New Jersey CBT-100 form is the Corporation Business Tax Return that corporations doing business in New Jersey must file. It reports the corporation's income, deductions, and tax liability for a specific taxable year. This form is essential for compliance with New Jersey tax laws and is required for corporations incorporated in the state or authorized to do business there.

Who needs to file the CBT-100?

Any corporation that operates in New Jersey or has income sourced from New Jersey must file the CBT-100. This includes traditional corporations, S corporations, and certain other business entities. If your corporation is inactive or has not conducted business, you may still need to file to maintain compliance.

When is the CBT-100 due?

The CBT-100 form is typically due on the 15th day of the fourth month following the end of the corporation's fiscal year. For corporations that follow the calendar year, this means the due date is April 15. It's important to keep track of these deadlines to avoid penalties and interest on late filings.

What information is required on the CBT-100?

The CBT-100 requires various pieces of information, including the corporation's name, federal employer identification number, New Jersey corporation number, and taxable income. You'll also need to provide details on deductions, credits, and any adjustments to income. Accurate reporting is crucial for determining your tax liability.

What if my corporation has a net loss?

If your corporation incurs a net loss for the taxable year, you must still file the CBT-100. You will report the net loss on the appropriate lines, and it can potentially be carried forward to offset future taxable income. However, you cannot claim a tax refund for a net loss; it simply reduces future tax liabilities.

Are there any credits available on the CBT-100?

Yes, the CBT-100 allows corporations to claim various tax credits. These may include credits for taxes paid to other jurisdictions, investment credits, and credits for job creation or retention. Be sure to review the instructions carefully to determine eligibility for these credits and how to claim them.

How do I report income on the CBT-100?

Income is reported on Schedule A of the CBT-100. You'll need to detail your gross receipts, sales, and any deductions such as the cost of goods sold. The total income will be calculated by adding various sources of income, including dividends and royalties. Accurate reporting here is essential for determining your overall tax liability.

What happens if I file the CBT-100 late?

Filing the CBT-100 late can result in penalties and interest on the unpaid tax. The New Jersey Division of Taxation imposes these charges to encourage timely filing. If you anticipate being late, it’s advisable to file for an extension and pay any estimated tax due to minimize penalties.

Where can I find more information or assistance with the CBT-100?

For additional information, you can visit the New Jersey Division of Taxation's website, which provides detailed instructions and resources related to the CBT-100. You may also consider consulting a tax professional who specializes in corporate taxation in New Jersey for personalized assistance.