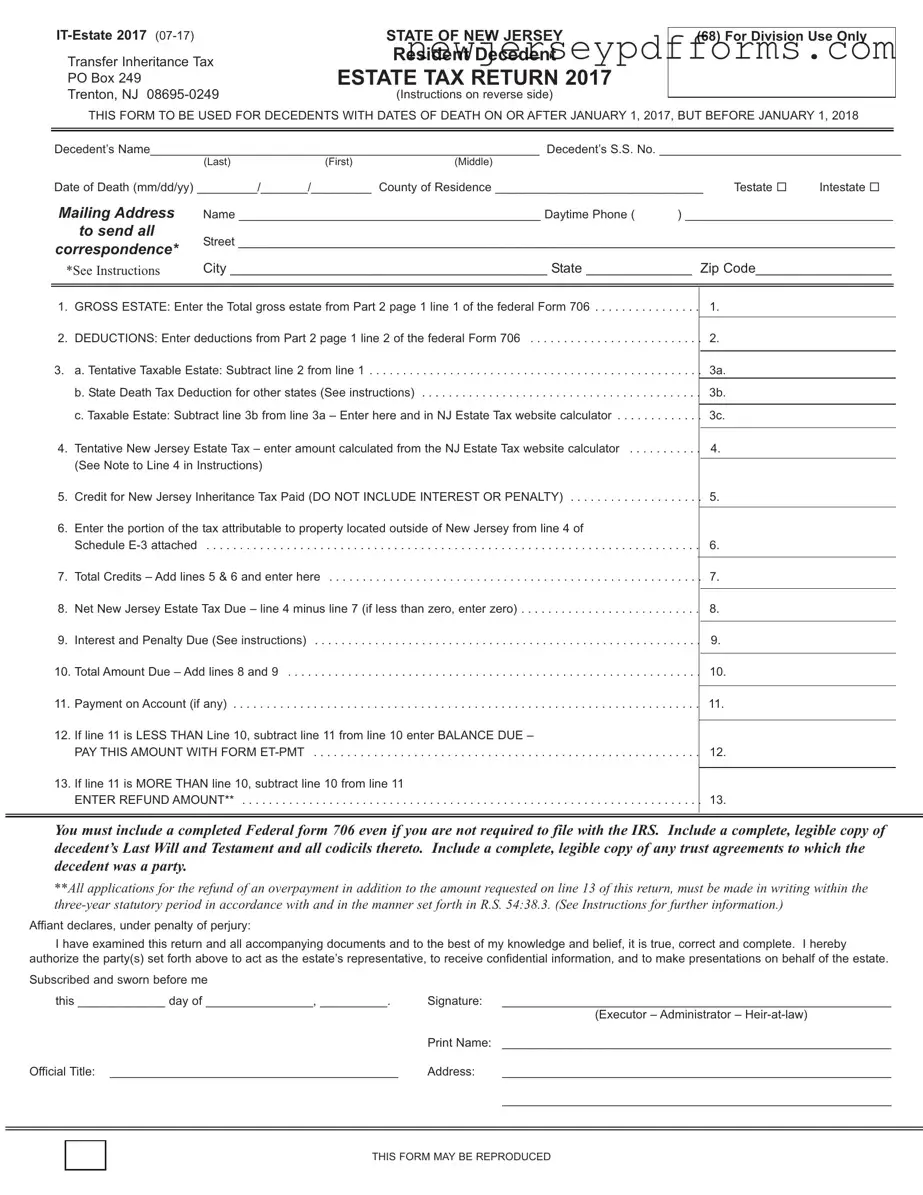

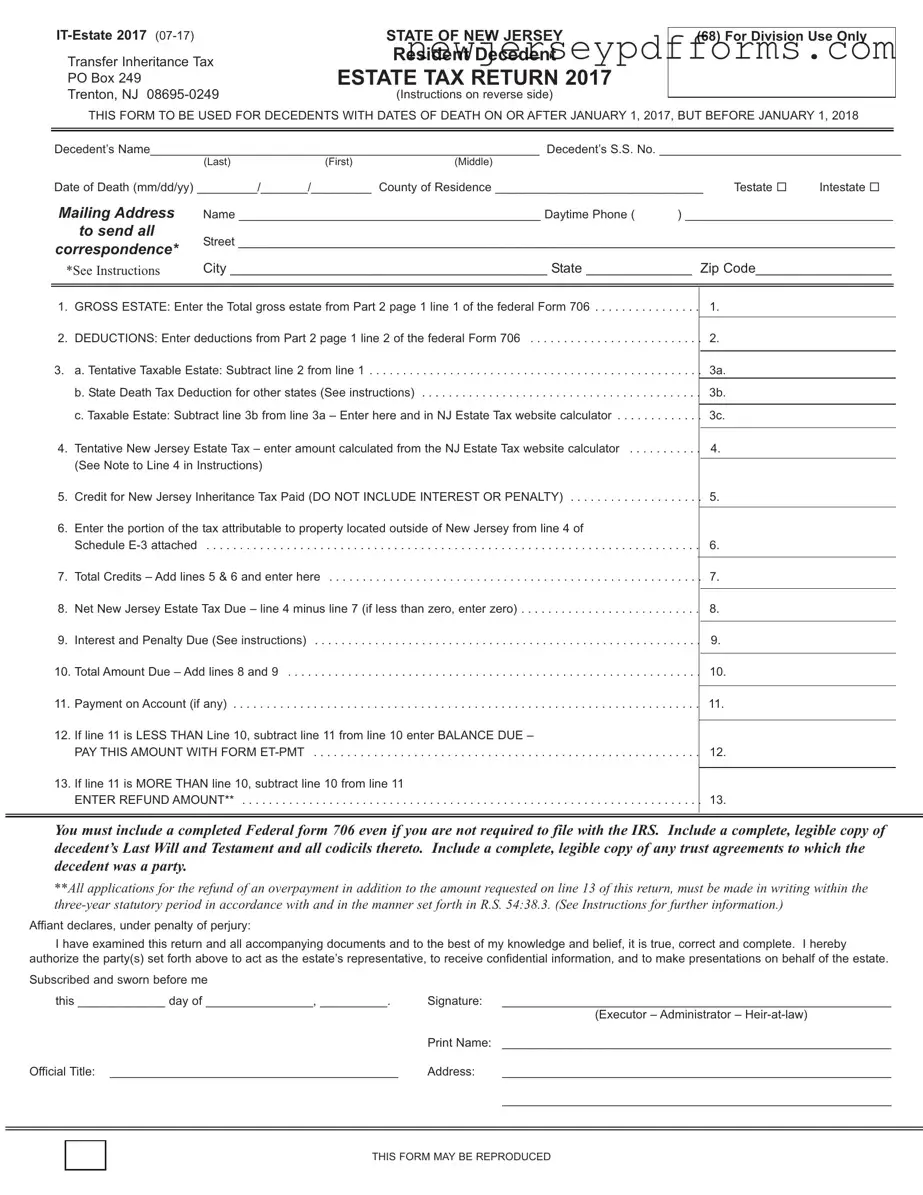

Printable New Jersey Estate Tax Return Form

The New Jersey Estate Tax Return form is a crucial document required for estates with a gross value exceeding a specified threshold. This form ensures that the state collects the appropriate taxes owed on the estate of a deceased resident. Completing this form accurately and submitting it on time is essential to avoid potential penalties and interest charges.

To get started on your New Jersey Estate Tax Return, please fill out the form by clicking the button below.

Open Editor Here

Printable New Jersey Estate Tax Return Form

Open Editor Here

Open Editor Here

or

Download New Jersey Estate Tax Return PDF Form

Complete the form before time runs out

Edit your New Jersey Estate Tax Return online and complete it quickly.