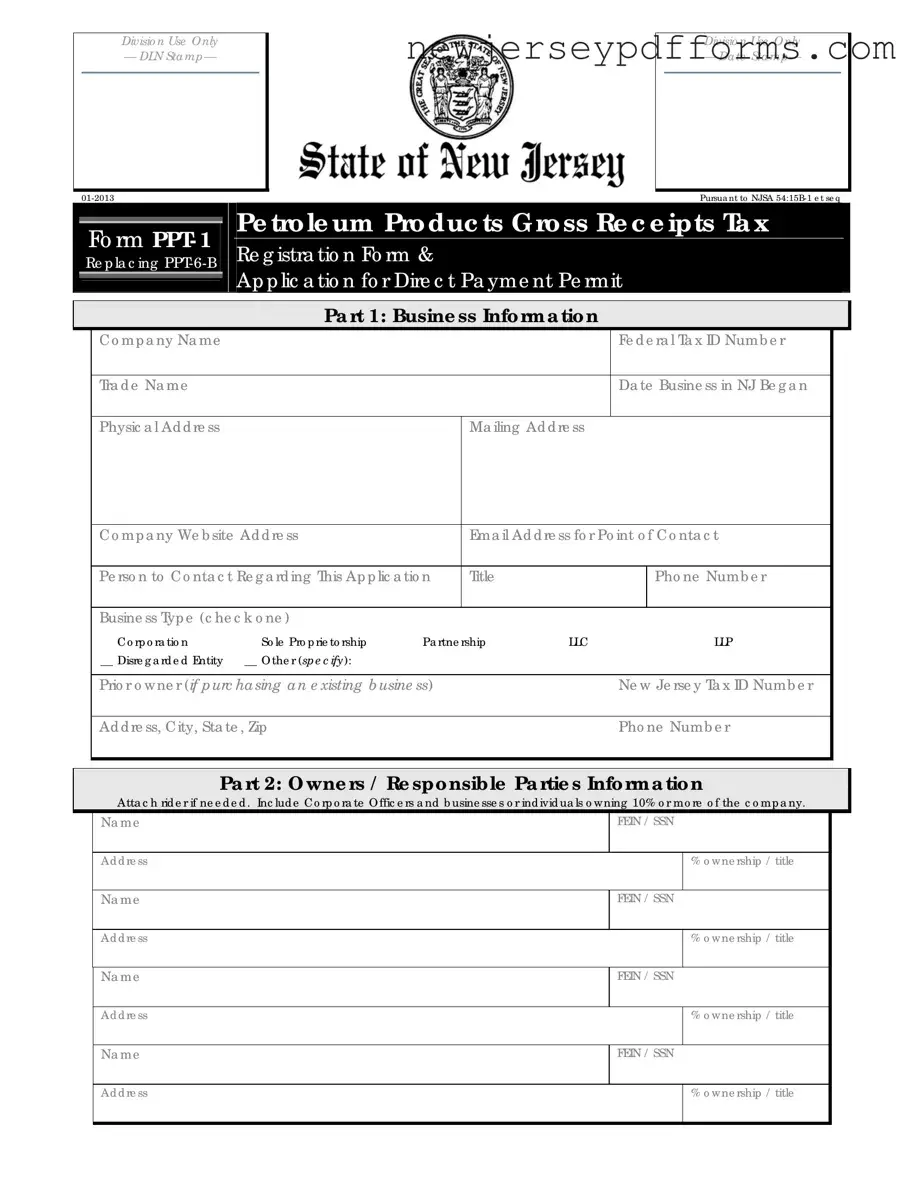

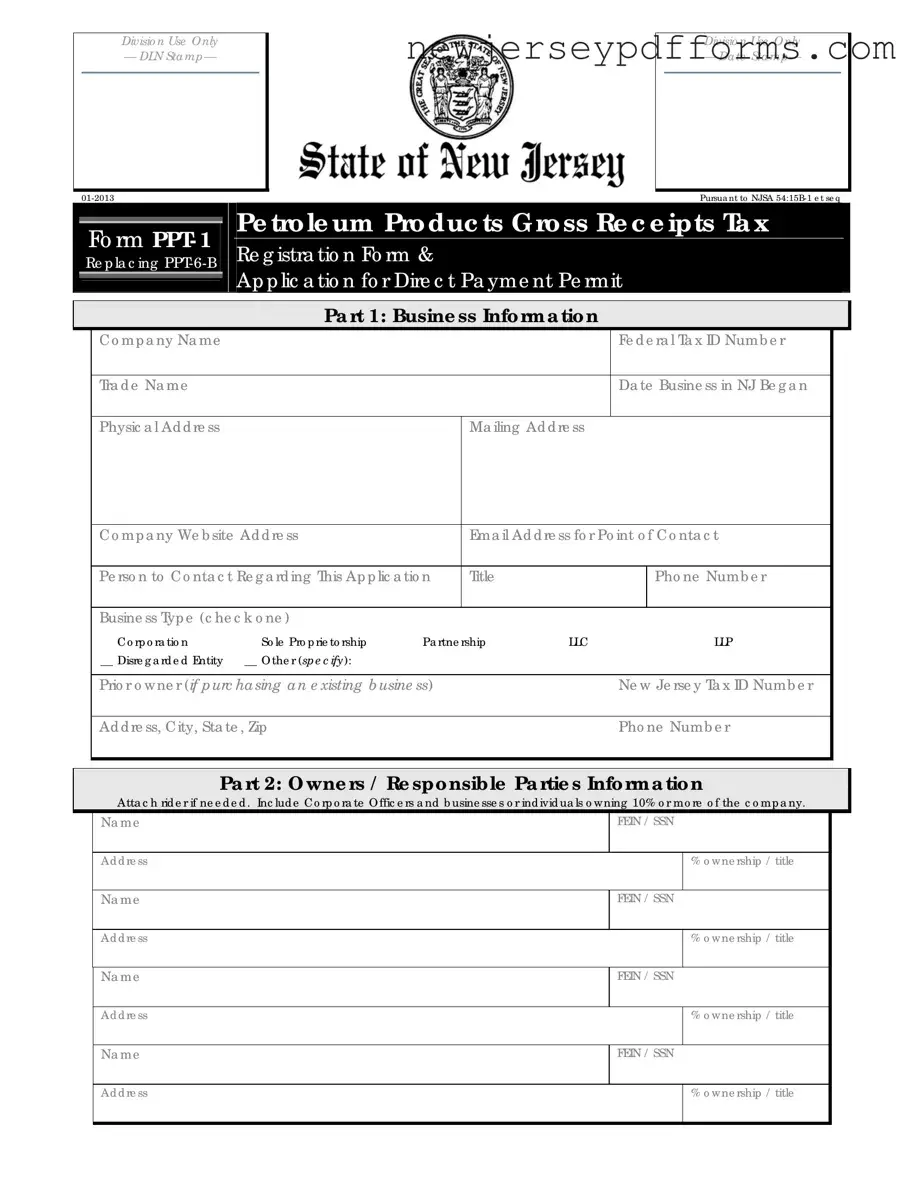

The New Jersey PPT-1 Registration Form is similar to the PPT-6-B form in that both documents are essential for businesses involved in the petroleum products industry. The PPT-1 form serves as a registration tool, allowing companies to officially register for the Petroleum Products Gross Receipts Tax. Like the PPT-6-B, it requires basic business information, including the company name, federal tax ID, and ownership details. Both forms aim to ensure that businesses comply with state tax regulations, facilitating proper tax collection and reporting.

For any limited liability company (LLC), having a solid understanding of necessary documentation, such as an Operating Agreement, is vital. This agreement not only outlines the management structure but also details the rights and responsibilities of its members, ensuring smooth operations. Businesses should also familiarize themselves with forms relevant to New Jersey regulations, like the one found at https://topformsonline.com/operating-agreement, which illustrates the significance of organizational clarity and compliance in maintaining a well-functioning business.

The New Jersey Business Registration Certificate is another document akin to the PPT-6-B form. This certificate is necessary for all businesses operating in New Jersey, confirming that they are registered with the state. Similar to the PPT-6-B, it collects information about the business structure, ownership, and contact details. Both documents serve to establish a legal presence in the state and ensure compliance with local business laws.

The New Jersey Sales Tax Certificate of Authority is also comparable to the PPT-6-B form. This certificate allows businesses to collect sales tax from customers and remit it to the state. Like the PPT-6-B, it requires detailed information about the business, including ownership and contact information. Both documents are crucial for tax compliance, ensuring that businesses properly handle tax obligations related to their operations.

The New Jersey Corporation Business Tax (CBT) form shares similarities with the PPT-6-B form as well. This form is required for corporations operating in New Jersey and involves reporting income and paying taxes accordingly. Like the PPT-6-B, the CBT form necessitates detailed business information, including ownership details and contact information. Both forms are vital for tax compliance and provide the state with necessary information about the business's financial activities.

The New Jersey Partnership Return of Income is another document that is similar to the PPT-6-B form. This return is specifically for partnerships and requires them to report their income and expenses. Just like the PPT-6-B, it collects detailed information about the partners and the business structure. Both documents ensure that the state has accurate information for tax purposes and helps facilitate the correct collection of taxes owed.

The New Jersey Limited Liability Company (LLC) Registration form is also comparable to the PPT-6-B form. This form is used to register an LLC with the state, providing essential information about the business and its owners. Similar to the PPT-6-B, it requires details such as the business name, federal tax ID, and ownership structure. Both forms are necessary for establishing a legal business entity in New Jersey and ensuring compliance with state regulations.

Finally, the New Jersey Certificate of Incorporation is akin to the PPT-6-B form in that it is a foundational document for corporations. This certificate officially establishes a corporation in New Jersey and requires similar information, including the business name, registered agent, and ownership details. Both documents are critical for legal recognition and compliance within the state, ensuring that businesses operate within the framework of New Jersey law.