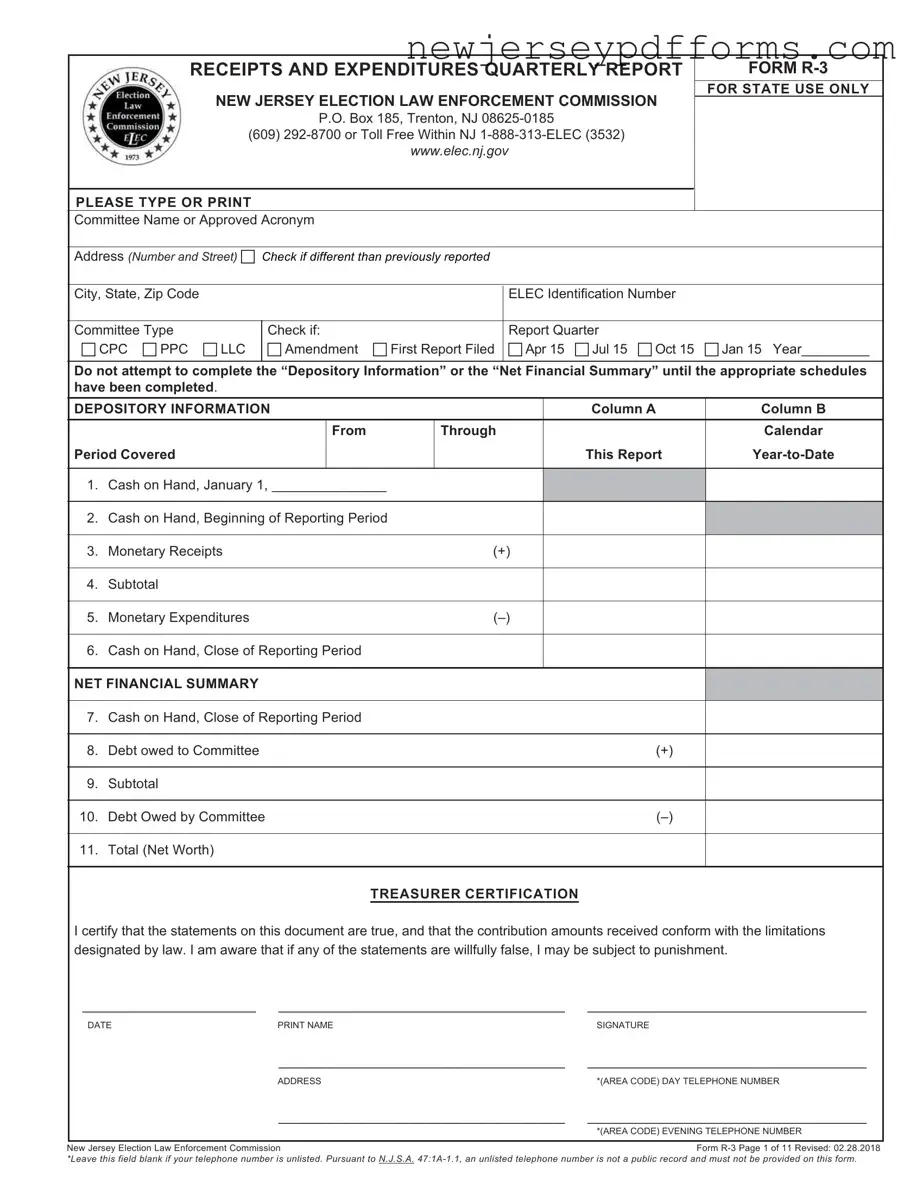

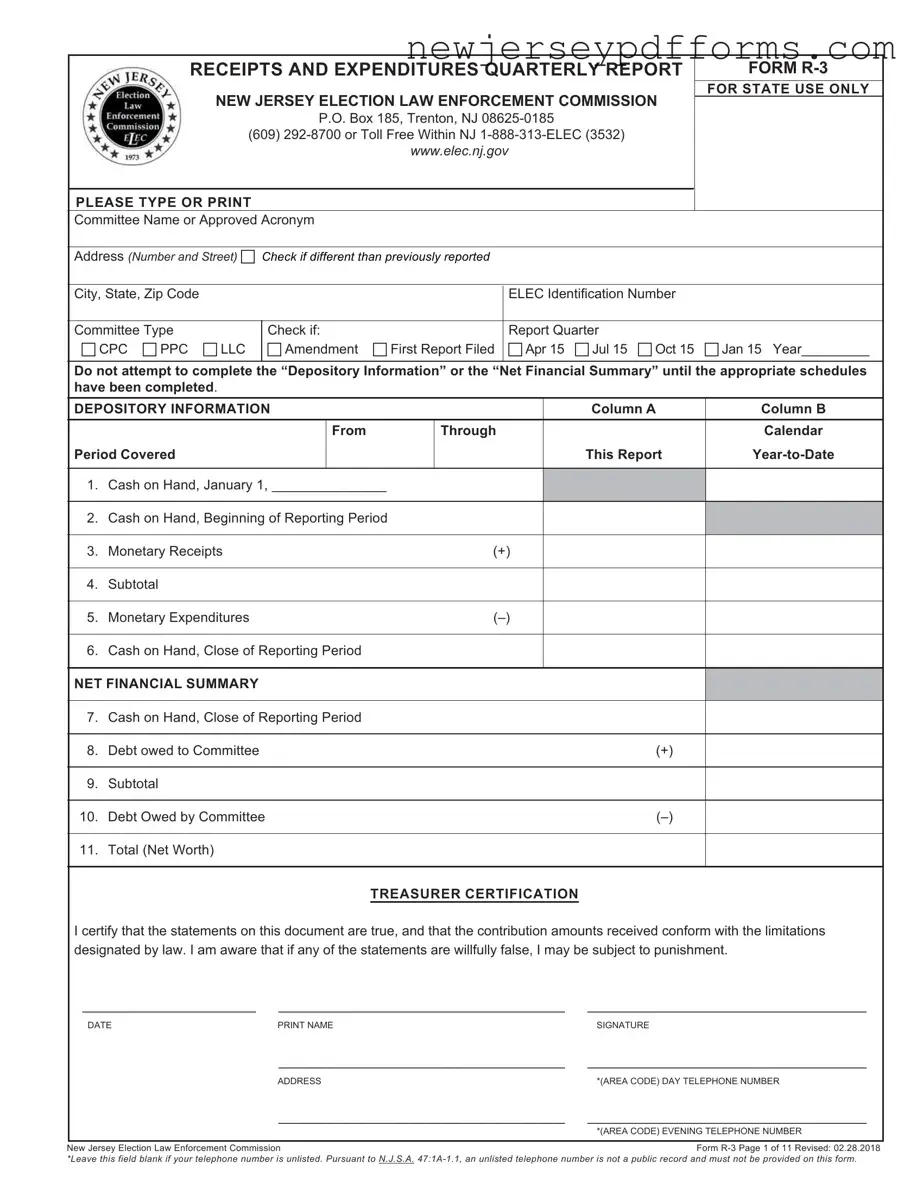

Filling out the New Jersey R-3 form can be a straightforward process, but many people make common mistakes that can lead to complications. One frequent error is neglecting to check the appropriate boxes for committee type and report quarter. This oversight can delay processing and cause confusion regarding the committee's status.

Another common mistake is failing to accurately report the cash on hand at the beginning of the reporting period. This number is crucial for understanding the committee's financial position. If this figure is incorrect, it can affect all subsequent calculations.

Many individuals also forget to complete the “Depository Information” section after filling out the monetary receipts and expenditures. This step is essential, as it provides a complete picture of the committee's finances. Skipping this part can lead to incomplete reports.

In addition, not providing detailed information for contributions can create issues. For example, failing to separate contributions of $300 or less from those exceeding that amount can lead to inaccurate totals. Each contribution must be documented correctly to comply with state regulations.

People often overlook the importance of the treasurer's certification section. This section requires a signature and date to validate the report. Without this certification, the report may be deemed invalid, leading to further complications.

Another mistake is not carrying forward totals correctly between pages. If the total receipts from one schedule do not match the totals on the main form, it can raise red flags during the review process. Double-checking these figures is vital for accuracy.

Individuals frequently misinterpret the “Net Financial Summary” section. This area summarizes the committee’s financial standing, and errors here can misrepresent the committee's overall health. Proper attention to detail is essential in this part of the form.

Some people also fail to provide complete information for loans received. This includes not documenting the terms of the loan or the lender's information. Incomplete loan information can lead to misunderstandings about the committee’s financial obligations.

Finally, many individuals do not keep copies of their submitted forms. This practice is important for record-keeping and can be helpful if any questions arise later. Keeping a copy ensures that you have a reference point for future filings.

By being aware of these common mistakes, individuals can improve their chances of submitting a complete and accurate New Jersey R-3 form, helping to ensure compliance with state election laws.