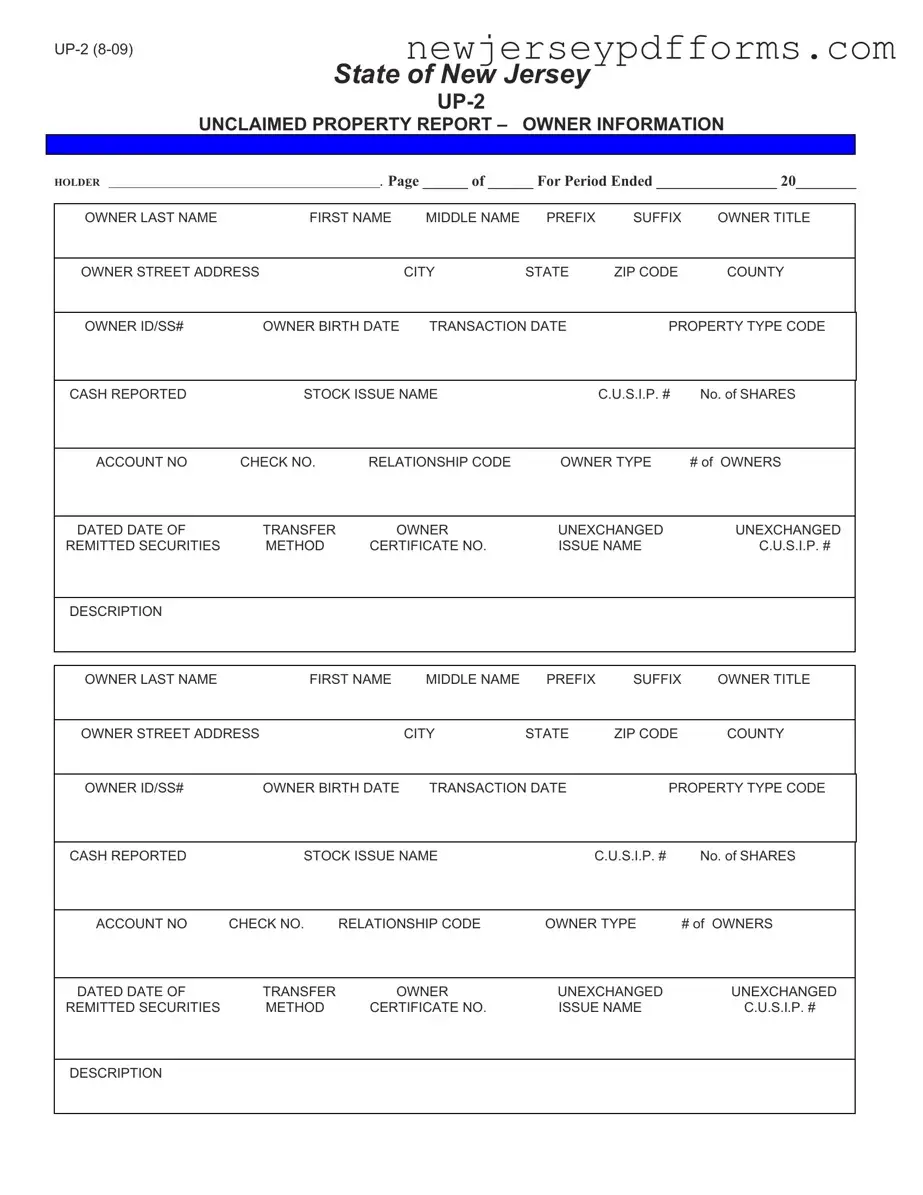

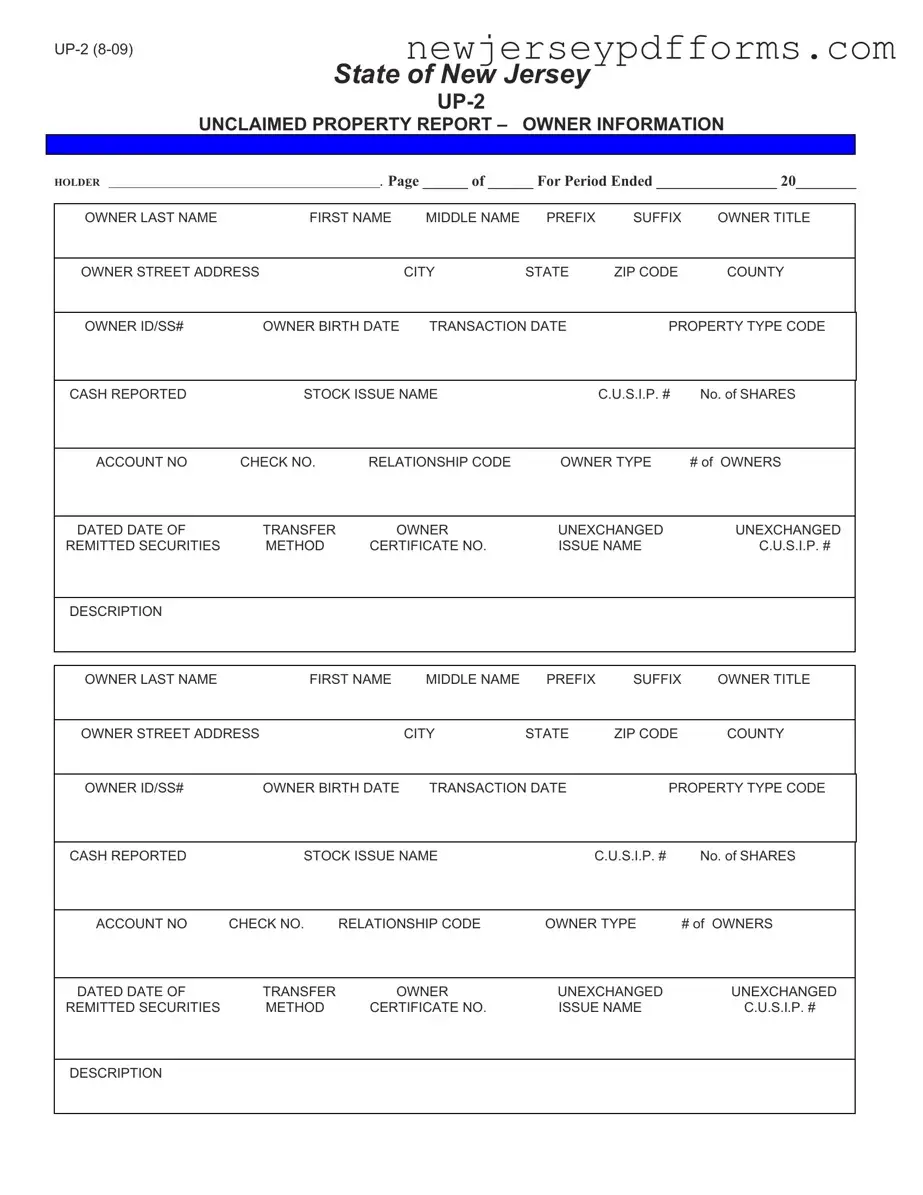

The New Jersey UP-2 form is similar to the IRS Form 1099, which reports income other than wages, salaries, and tips. Both documents serve the purpose of tracking financial transactions that may affect the tax obligations of individuals or entities. The UP-2 focuses on unclaimed property, while the 1099 captures various income types, such as interest, dividends, and freelance earnings. Each form requires detailed information about the owner, ensuring transparency and proper reporting to the relevant authorities.

Another document comparable to the UP-2 is the Uniform Unclaimed Property Act (UUPA) report. This report is filed by holders of unclaimed property to inform state authorities about assets that have not been claimed by their owners. Like the UP-2, the UUPA report includes specific details about the property and its owner, such as names, addresses, and types of property. Both documents aim to protect the rights of property owners and ensure that unclaimed assets are properly managed.

The New Jersey UP-2 form also resembles the state’s Business Entity Annual Report. This report is required for businesses to maintain good standing and includes essential information about the entity, such as its address and registered agent. While the UP-2 focuses on individual property owners, both documents require accurate information to facilitate proper record-keeping and compliance with state regulations.

Additionally, the UP-2 form is similar to the state’s Certificate of Good Standing. This certificate verifies that a business entity is compliant with state regulations and has fulfilled its filing obligations. Both documents serve as official records that confirm the status of property or business entities, providing assurance to stakeholders about their legal standing.

The New Jersey UP-2 form can also be compared to the Federal Form 5500, which is used to report information about employee benefit plans. Both forms require detailed reporting of ownership and financial information, ensuring compliance with regulations. While the UP-2 is focused on unclaimed property, Form 5500 ensures transparency in employee benefits, both aiming to protect the rights of individuals and entities involved.

In the realm of rental applications, just as the Rental Application form compiles critical details for landlords, it’s important to ensure that applicants provide complete and accurate information. For those seeking guidance on this process, templates can be extremely helpful. Utilizing resources like PDF Document Service can streamline the completion of rental applications, enhancing both the applicant's experience and the landlord's evaluation process.

Another similar document is the New Jersey Property Tax Statement. This statement provides property owners with information regarding their property taxes, including assessments and payments. Like the UP-2, it requires accurate owner details and property descriptions, serving as an official record for both property owners and the state.

The New Jersey UP-2 form also bears resemblance to the state’s Division of Revenue and Enterprise Services filings, which include various business registrations and updates. These filings require detailed information about business entities, akin to the owner information required on the UP-2. Both documents aim to maintain accurate records for state oversight and compliance.

Lastly, the UP-2 form is similar to the New Jersey Inheritance Tax Return. This return is filed to report the transfer of assets upon an individual’s death. Both documents necessitate comprehensive details about ownership and property types, ensuring that the state has accurate information regarding assets that may need to be claimed or reported for tax purposes.