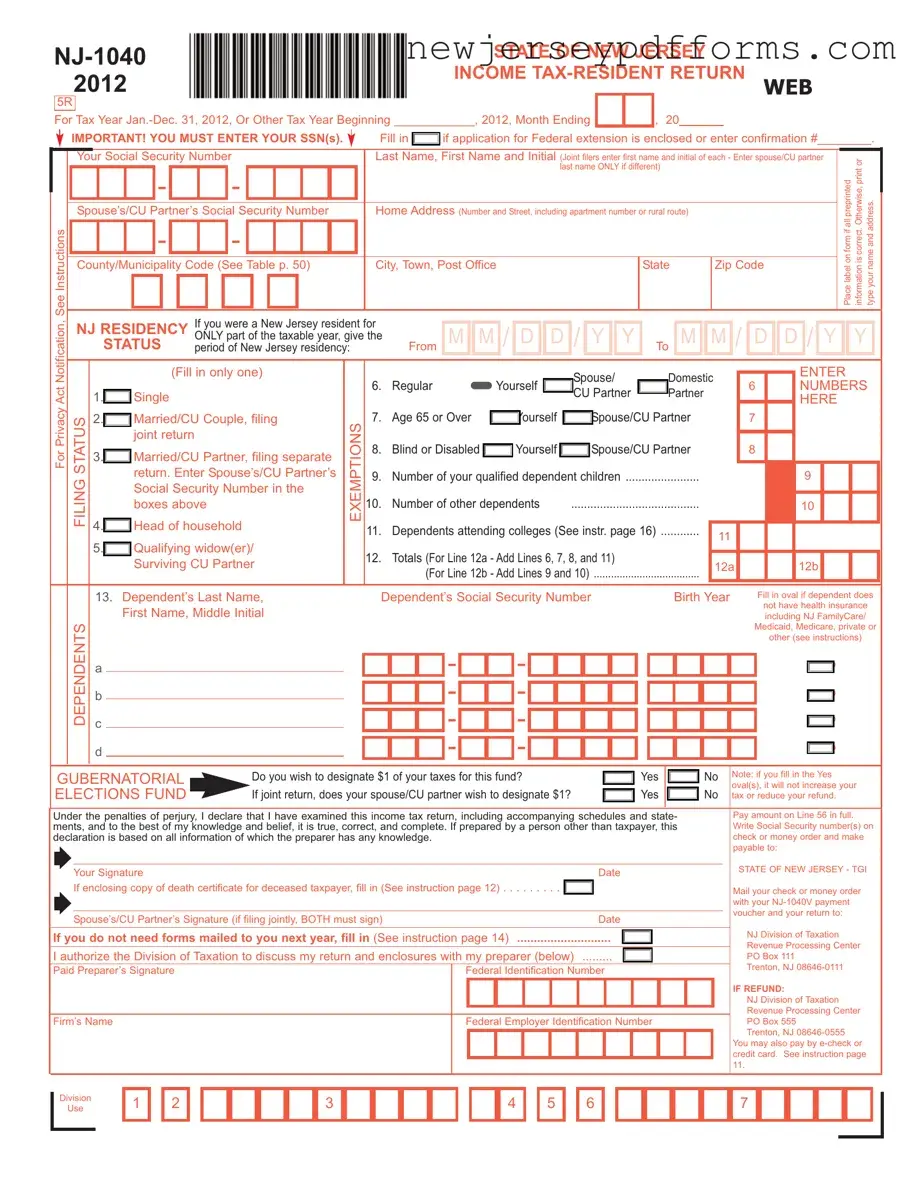

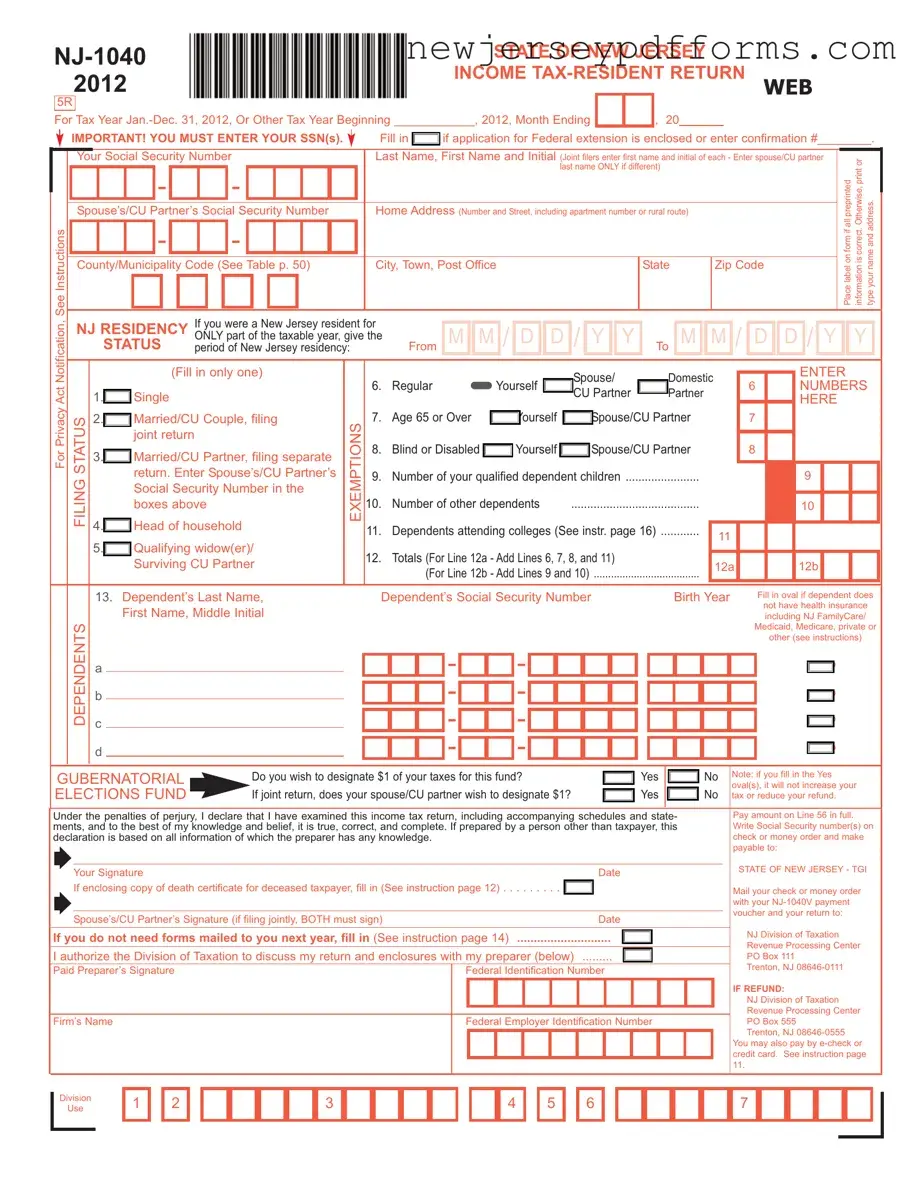

The NJ-1040 form is comparable to the IRS Form 1040, which is the standard individual income tax return form used in the United States. Both forms require taxpayers to report their income, claim deductions, and determine their tax liability. While the IRS Form 1040 is used for federal income tax purposes, the NJ-1040 is specifically for New Jersey state income tax. Each form contains sections for personal information, income sources, deductions, and tax credits, making them structurally similar but tailored to their respective tax jurisdictions.

Another similar document is the NYS IT-201, the New York State Resident Income Tax Return. Like the NJ-1040, the NYS IT-201 is designed for residents of New York to report their income and calculate state taxes. Both forms include sections for personal details, filing status, and exemptions. However, the NYS IT-201 has unique lines and schedules that pertain specifically to New York tax laws, reflecting the differences in state taxation policy.

The CA Form 540 is California's equivalent to the NJ-1040. This form serves California residents for reporting income and calculating state taxes. Both forms require information about income, deductions, and credits. However, the CA Form 540 incorporates specific California tax laws and credits, such as the California Earned Income Tax Credit, making it distinct from New Jersey’s offerings.

Understanding the significance of various state tax forms is crucial for residents aiming to navigate their financial responsibilities effectively. Each form, including the NJ-1040, plays a vital role in ensuring compliance with tax regulations, while also offering opportunities for deductions and credits. For those interested in legal matters like the PDF Document Service, the precision and attention to detail in these forms are paramount to avoid discrepancies and penalties.

The FL Form 1040 is another relevant document, although Florida does not impose a state income tax. The form is used for reporting federal income tax but may include state-specific information for residents who have other taxable income or are subject to different tax laws. While the NJ-1040 requires detailed income reporting, the FL Form 1040 focuses more on federal obligations, highlighting the differences in state tax systems.

The IL-1040 form is utilized by residents of Illinois for state income tax purposes. Similar to the NJ-1040, it requires taxpayers to report income, exemptions, and tax credits. Both forms have sections for personal information and filing status. However, the IL-1040 includes specific line items for Illinois tax credits, such as the Property Tax Credit, which is not found on the NJ-1040.

The TX Form 1040 is worth mentioning, even though Texas does not have a state income tax. This form is primarily for federal tax reporting but can include state-specific information for residents who may have other tax obligations. While the NJ-1040 requires comprehensive income reporting and deductions, the TX Form 1040 focuses on federal compliance without state income tax considerations.

The PA-40 is the Pennsylvania Personal Income Tax Return, which is similar to the NJ-1040 in that both forms are used by residents to report income and calculate state taxes. Each form has sections for personal information, income sources, and deductions. However, the PA-40 includes specific lines for Pennsylvania tax credits and adjustments, reflecting the unique aspects of Pennsylvania tax law.

The MA Form 1 is the Massachusetts Resident Income Tax Return, which shares similarities with the NJ-1040 in its structure and purpose. Both forms require taxpayers to report income, claim deductions, and calculate tax liabilities. However, the MA Form 1 includes specific provisions for Massachusetts tax credits, such as the Earned Income Credit, making it distinct from the New Jersey form.

The OH IT 1040 is Ohio’s individual income tax return, which parallels the NJ-1040 in its function as a state tax form. Taxpayers in both states use these forms to report income and determine tax obligations. While both forms include sections for personal information and deductions, the OH IT 1040 has unique lines for Ohio-specific tax credits and adjustments, showcasing the differences in state tax regulations.

Lastly, the MI-1040 is the Michigan Individual Income Tax Return. This form is similar to the NJ-1040 in that it serves Michigan residents to report income and calculate state taxes. Each form requires personal information, income sources, and deductions. However, the MI-1040 incorporates specific Michigan tax laws and credits, which differentiates it from New Jersey’s tax form.