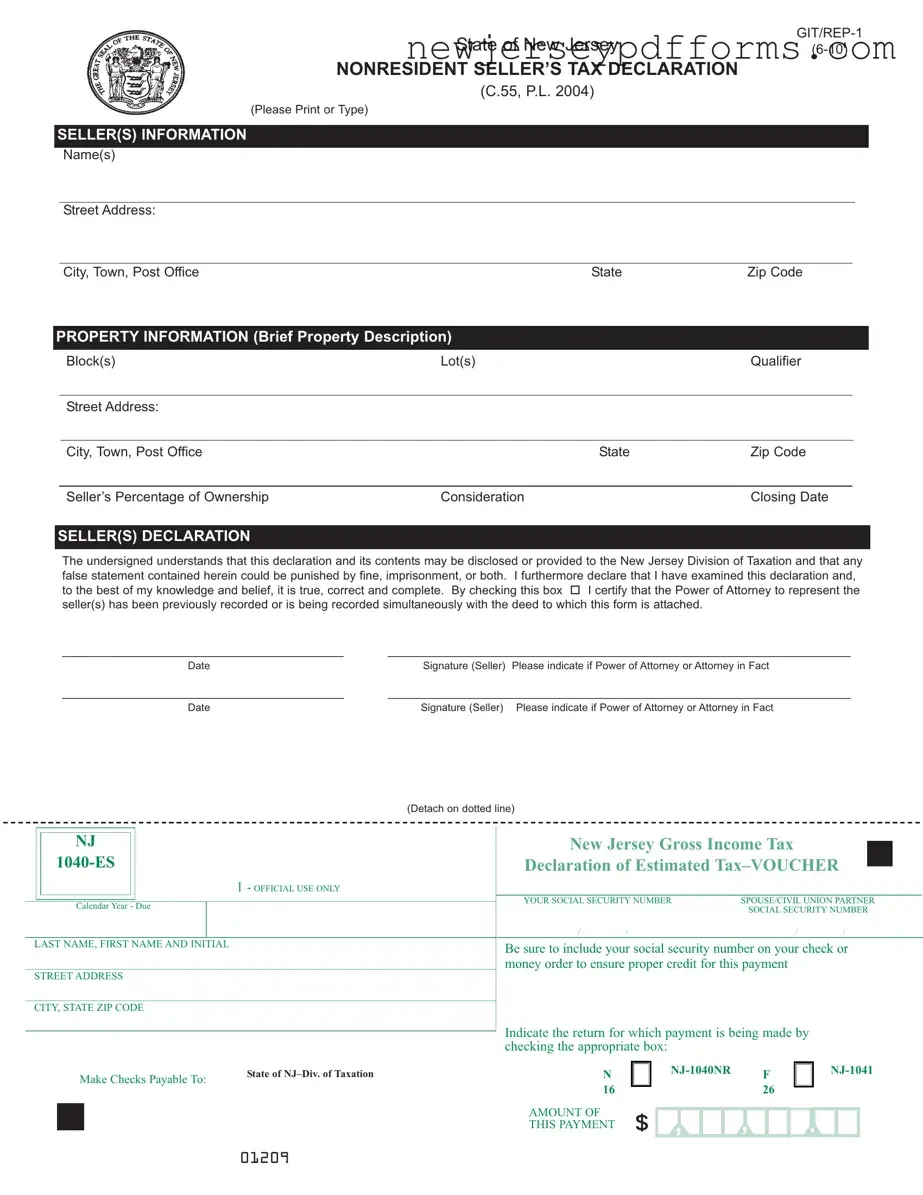

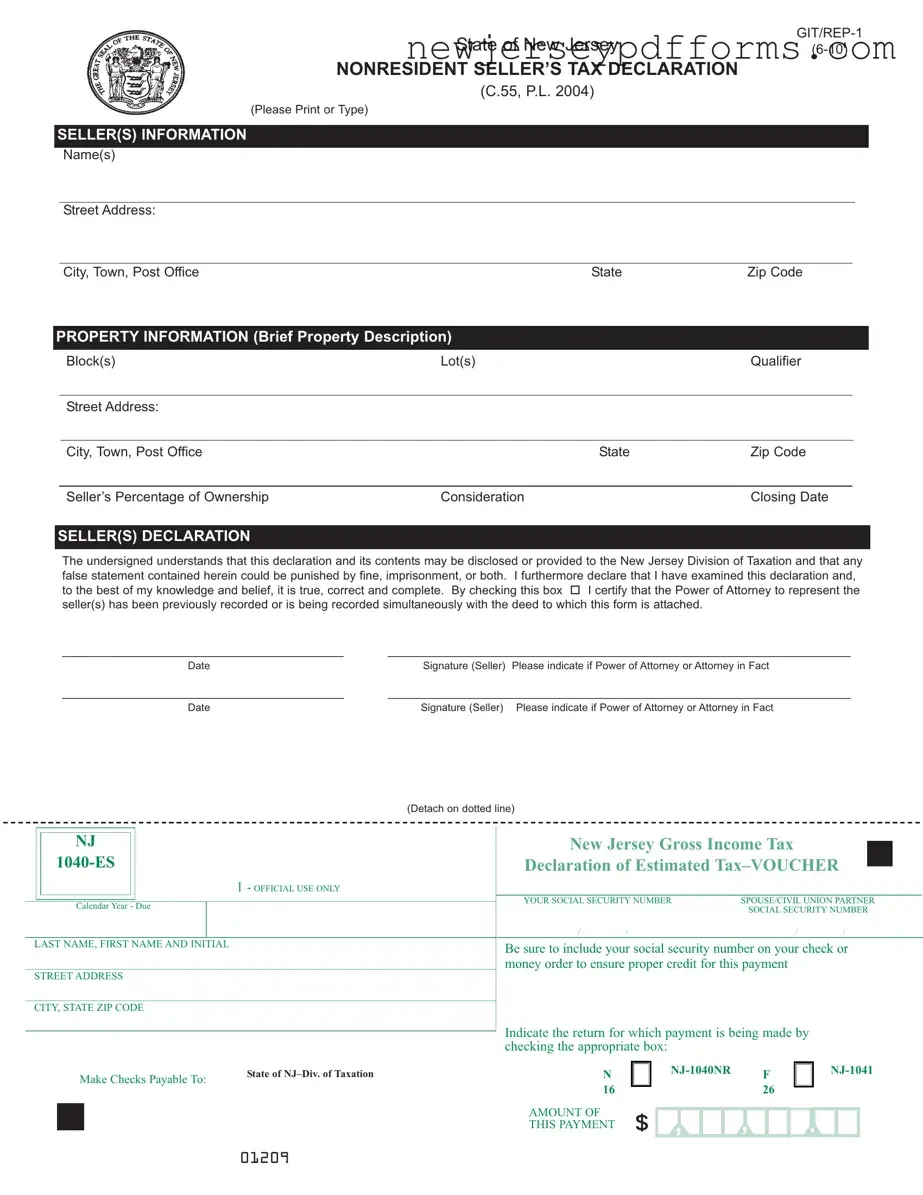

What is the NJ 1040-ES form?

The NJ 1040-ES form is a declaration of estimated tax for nonresident individuals, estates, or trusts selling property in New Jersey. This form is required for sales occurring on or after August 1, 2004, and it helps ensure that the appropriate taxes are paid on any gains from the sale of real estate.

Who needs to complete the NJ 1040-ES form?

Nonresident sellers, including individuals, estates, and trusts, must complete the NJ 1040-ES form when selling property in New Jersey. If there are multiple owners, separate forms are required for each seller, except for spouses or civil union partners who file jointly.

What information is required on the NJ 1040-ES form?

Key information includes the seller's name, address, property details (block, lot, and address), percentage of ownership, consideration (total compensation for the property), and the closing date. The seller must also provide their social security number or federal tax identification number.

How is the tax payment calculated on the NJ 1040-ES form?

Tax payment is calculated by multiplying the gain from the sale by the highest Gross Income Tax rate of 8.97%. However, the payment cannot be less than 2% of the total consideration received for the property. It’s important to determine the gain without considering any distributions made to beneficiaries by estates or trusts during the taxable year.

What happens if the NJ 1040-ES form is not completed correctly?

Failure to complete the NJ 1040-ES form in its entirety will result in the deed not being recorded. It's essential to provide all requested information accurately to avoid delays in the transaction.

When should the NJ 1040-ES form be submitted?

The NJ 1040-ES form must be completed at the time of closing. It should be given to the buyer or the buyer's attorney, who will then submit it to the county clerk when recording the deed.

What if I have a Power of Attorney?

If a representative is signing the NJ 1040-ES form on behalf of the seller, a Power of Attorney must be recorded prior to or simultaneously with the deed. Alternatively, a signed letter from the seller granting authority to the representative must accompany the form.

What should I do if the total consideration for the property is $1,000 or less?

If the total consideration for the property is $1,000 or less, you should complete the Seller’s Residency Certification/Exemption form GIT/REP-3 and check the appropriate box under Seller’s Assurances on the NJ 1040-ES form.

Where do I send the NJ 1040-ES form and payment?

The completed NJ 1040-ES form, along with the payment, should be forwarded by the County Clerk to the State of New Jersey, Revenue Processing Center, PO Box 222, Trenton, New Jersey 08646-0222. Ensure that the payment is made by check or money order, as cash is not accepted.