The NJ-1040-O form serves as an opt-out request for taxpayers who prefer not to have their New Jersey income tax returns filed electronically. A similar document is the IRS Form 4868, which allows taxpayers to request an extension for filing their federal income tax returns. Both forms require personal information and signatures from the taxpayer. The primary purpose of the IRS Form 4868 is to provide additional time to file, while the NJ-1040-O focuses on opting out of electronic filing. Both documents aim to accommodate taxpayers' preferences regarding how their tax information is submitted.

Another comparable document is the IRS Form 1040. This is the standard form used by U.S. taxpayers to file their annual income tax returns. Like the NJ-1040-O, the IRS Form 1040 collects essential taxpayer information, including names, Social Security numbers, and income details. However, while the IRS Form 1040 is used for federal tax reporting, the NJ-1040-O specifically addresses state-level preferences for filing methods. Both forms share the goal of ensuring accurate and timely tax reporting.

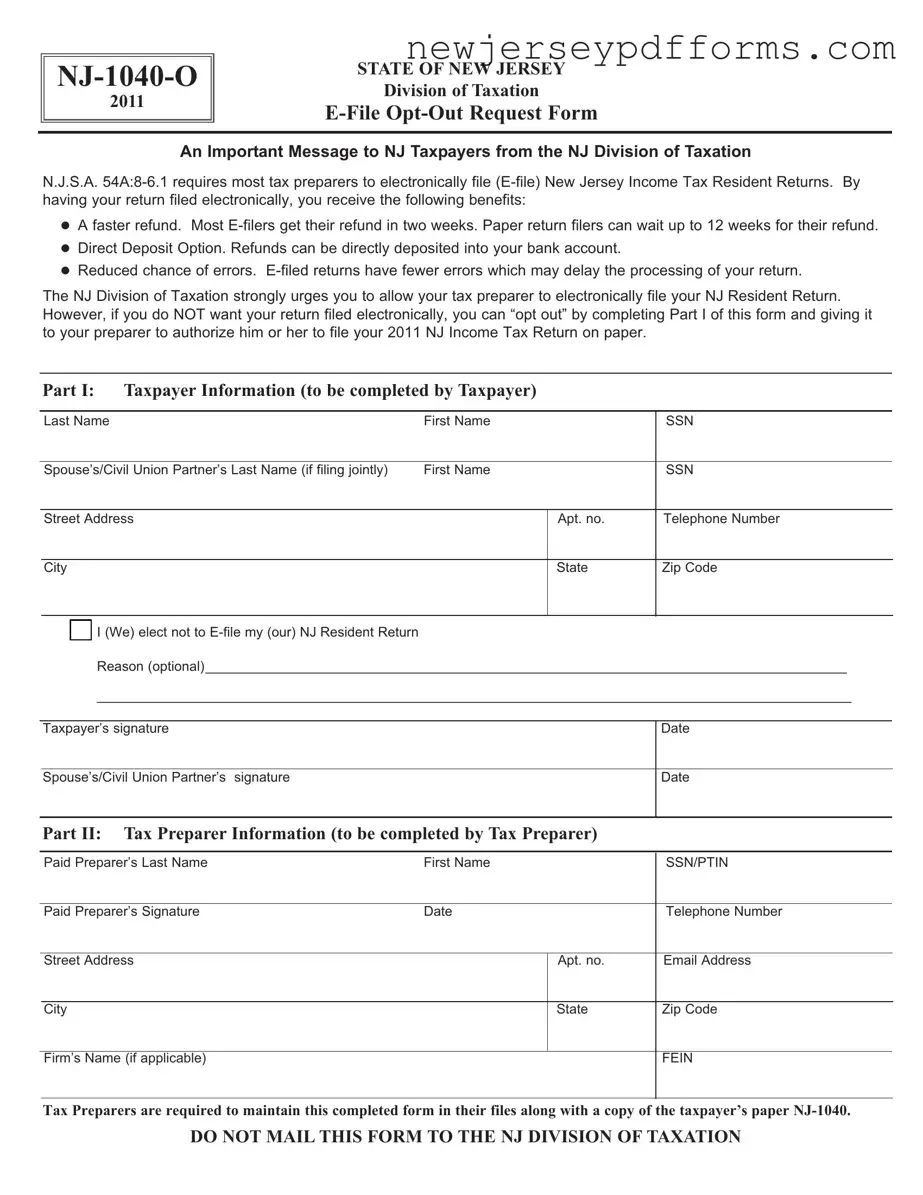

The NJ-1040 form itself is another relevant document. This form is the primary income tax return for New Jersey residents. Similar to the NJ-1040-O, it requires detailed personal information and is essential for calculating state tax obligations. The NJ-1040 is submitted electronically or by paper, while the NJ-1040-O is specifically designed for those opting out of electronic submission. Both forms are integral to the tax filing process in New Jersey.

The IRS Form 1040-X is also similar, as it is used to amend a previously filed federal tax return. Like the NJ-1040-O, it requires the taxpayer's information and is meant to address specific preferences or corrections in tax filing. The NJ-1040-O focuses on the method of filing, while the 1040-X is concerned with correcting errors or changes in income or deductions. Both forms facilitate accurate tax reporting and compliance.

Additionally, the NJ-1040-SR is relevant as it is designed for senior citizens filing their New Jersey income tax returns. This form simplifies the filing process for older taxpayers, similar to how the NJ-1040-O simplifies the decision-making process regarding electronic filing. Both forms cater to specific taxpayer demographics, ensuring that their unique needs are met during tax season.

The IRS Form W-4 is another document that bears similarities. It is used by employees to indicate their tax withholding preferences to their employers. Like the NJ-1040-O, it involves the taxpayer's personal information and allows for a choice regarding tax treatment. While the NJ-1040-O focuses on filing preferences, the W-4 addresses withholding preferences, both ultimately impacting the taxpayer's overall tax situation.

The NJ-1040-NR form is also noteworthy, as it is used by non-residents to file New Jersey income tax returns. Similar to the NJ-1040-O, it requires specific taxpayer information and serves a distinct purpose within the tax filing framework. Both forms are crucial for ensuring compliance with state tax laws, although they apply to different taxpayer statuses.

The IRS Form 8862 is relevant as well, as it is used to claim the Earned Income Tax Credit after a disallowance. This form requires personal information and serves as a request for reconsideration of tax benefits. Similar to the NJ-1040-O, it addresses taxpayer preferences and eligibility, although it focuses on tax credits rather than filing methods.

An Operating Agreement is an essential component for the effective management of an LLC, as it delineates the rights and responsibilities of its members while providing a clear framework for operation. Understanding the nuances of this document is vital for business success and can help mitigate potential conflicts. For detailed guidance, resources such as topformsonline.com/operating-agreement/ can offer valuable insights.

Lastly, the IRS Form 8888 is similar in that it allows taxpayers to allocate their federal tax refund to multiple accounts. This form, like the NJ-1040-O, involves taxpayer choices regarding their finances. While the NJ-1040-O pertains to the method of filing, the Form 8888 focuses on how refunds are distributed, both emphasizing the importance of taxpayer preferences in the tax process.