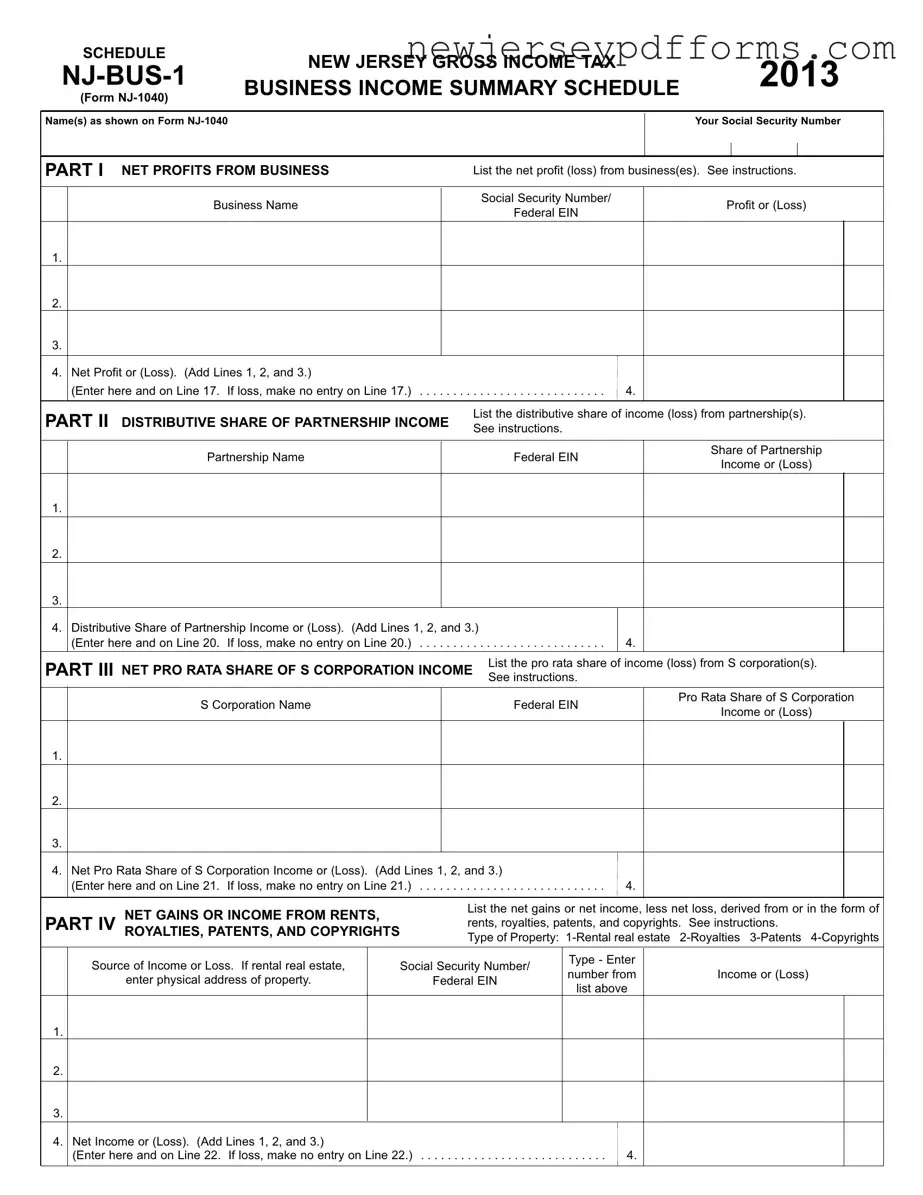

The NJ-1040 Schedule NJ-BUS-1 form is similar to the IRS Schedule C (Form 1040), which is used by sole proprietors to report income or loss from a business. Both forms require the taxpayer to detail their business income and expenses, allowing them to determine their net profit or loss. The Schedule C also includes sections for reporting specific types of income, just like the NJ-BUS-1. However, while Schedule C is a federal form, the NJ-BUS-1 is specific to New Jersey, reflecting the state's tax regulations.

Another document that shares similarities with the NJ-BUS-1 is the IRS Form 1065, which is used by partnerships to report income, deductions, and credits. Both forms require a breakdown of income and losses from business activities. The NJ-BUS-1 includes a section for reporting distributive shares of partnership income, mirroring the way Form 1065 allocates income to partners. This makes it easier for partners to report their share of income on their individual tax returns.

The NJ-1040 Schedule NJ-BUS-1 is also comparable to the IRS Form 1120-S, which is used by S corporations to report income. Like the NJ-BUS-1, Form 1120-S allows S corporations to report their income, deductions, and credits. The NJ-BUS-1 includes a section for net pro rata shares of S corporation income, similar to how Form 1120-S distributes income to shareholders. Both forms emphasize the importance of reporting income accurately to ensure compliance with tax laws.

Additionally, the NJ-BUS-1 is akin to the IRS Schedule E (Form 1040), which is used to report income from rental real estate, royalties, and other sources. Both forms require taxpayers to list their income sources and calculate net income or loss. The NJ-BUS-1 specifically includes a section for reporting income from rents, royalties, patents, and copyrights, making it a valuable tool for those who earn income from these sources.

The NJ-1040 Schedule NJ-BUS-1 is also similar to the IRS Form 1065-B, which is for electing large partnerships. This form serves a similar purpose in reporting partnership income and losses. Both forms require detailed information about income sources and distributions to partners. The NJ-BUS-1's focus on distributive shares of partnership income aligns with the reporting requirements found in Form 1065-B.

Another related document is the IRS Form 990, which is used by tax-exempt organizations to report their income and expenses. While the NJ-BUS-1 is for taxable entities, both forms require a detailed account of income sources. The NJ-BUS-1 includes sections for various types of income, similar to how Form 990 categorizes income for non-profit organizations. This allows for transparency in financial reporting.

The NJ-BUS-1 also has similarities with the IRS Form 1041, which is used for estates and trusts to report income. Both forms require the reporting of income and losses, although they cater to different entities. The NJ-BUS-1 includes sections for various income sources, similar to how Form 1041 details income from different assets held in the estate or trust.

Moreover, the NJ-1040 Schedule NJ-BUS-1 can be compared to the IRS Form 8862, which is used to claim the Earned Income Credit after disallowance. While the purpose of these forms is different, both require detailed information about income sources to determine eligibility for tax benefits. The NJ-BUS-1's focus on business income can impact a taxpayer's overall income calculation, just as Form 8862 impacts eligibility for credits.

Understanding the various tax forms available is crucial for accurate reporting and compliance. For instance, the NJ-1040 Schedule NJ-BUS-1 form parallels other essential documents like the Schedule C and Form 1065, each serving distinct purposes in business taxation. As individuals navigate these forms, they may encounter situations where they need to grant authority to another party for decision-making. In such cases, resources like the PDF Document Service can provide necessary templates, ensuring that their legal affairs are handled appropriately and in accordance with their wishes.

Lastly, the NJ-BUS-1 has a resemblance to the IRS Form 1040-X, which is used to amend a previously filed tax return. Both forms require detailed reporting of income and losses, although the 1040-X is specifically for corrections. If a taxpayer realizes they made an error in reporting their business income on the NJ-1040, they might need to use the NJ-BUS-1 to amend their income reporting, similar to how the 1040-X is used for federal returns.