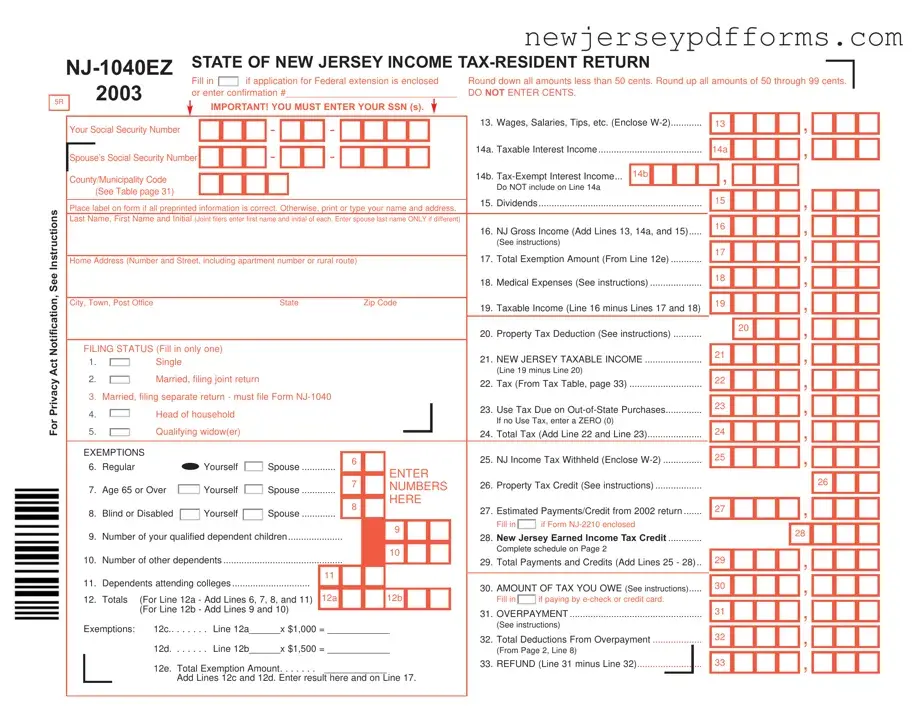

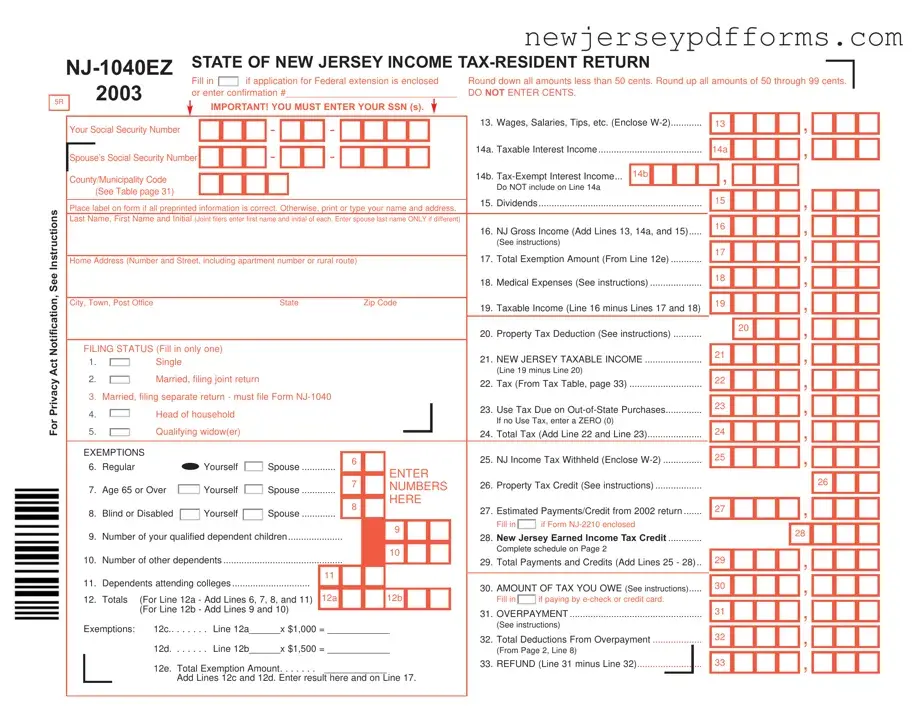

The NJ-1040EZ form is similar to the Federal Form 1040, which is the standard individual income tax return used by residents of the United States. Both forms serve the purpose of reporting income, calculating tax liabilities, and claiming refunds or credits. However, while the 1040 is used for federal tax purposes, the NJ-1040EZ is specifically tailored for New Jersey state income tax. This state-specific form simplifies the process for eligible taxpayers by allowing them to report basic income and deductions without the complexity found in the federal form.

Another document comparable to the NJ-1040EZ is the NJ-1040 form, which is a more detailed income tax return for New Jersey residents. Unlike the NJ-1040EZ, which is designed for simpler tax situations, the NJ-1040 can accommodate more complex financial circumstances, such as additional income sources or itemized deductions. Taxpayers with more intricate financial situations would benefit from using the NJ-1040 to ensure all relevant tax credits and deductions are claimed.

For those interested in horse transactions, the complete guide to the Horse Bill of Sale document is essential for understanding the legalities involved in ownership transfer.

The NJ-1040NR form, used by non-residents of New Jersey, shares similarities with the NJ-1040EZ in that both forms focus on reporting income and determining tax liability. However, the NJ-1040NR is specifically for individuals who earn income in New Jersey but do not reside in the state. This form allows non-residents to report their New Jersey-sourced income while still benefiting from certain deductions and credits, similar to the NJ-1040EZ for residents.

The New Jersey Property Tax Reimbursement Application is another document that relates to the NJ-1040EZ. This application allows eligible homeowners to receive reimbursement for property taxes paid, which can be a significant financial relief. While the NJ-1040EZ focuses on income tax, the property tax reimbursement application emphasizes the financial burden of property taxes, providing a different avenue for tax relief within the state.

The New Jersey Homestead Benefit Application is also similar in that it offers financial relief to homeowners based on property taxes. Like the NJ-1040EZ, this application aims to reduce the tax burden for residents. However, the Homestead Benefit focuses specifically on the property tax aspect, allowing residents to receive benefits based on their income and property taxes paid, which is an essential consideration for many New Jersey homeowners.

The IRS Form 1040-EZ, which is a simplified version of the federal 1040 form, is akin to the NJ-1040EZ in its purpose of streamlining the tax filing process for eligible individuals. Both forms are designed for straightforward tax situations, allowing taxpayers to complete their returns quickly and efficiently. However, the IRS Form 1040-EZ is used for federal income tax, while the NJ-1040EZ is specific to New Jersey state taxes.

The IRS Schedule A, used for itemizing deductions on the federal tax return, can be compared to the NJ-1040EZ in that both documents address deductions. While the NJ-1040EZ allows for certain standard deductions, Schedule A is used to detail itemized deductions for federal tax purposes. Taxpayers who choose to itemize on their federal return may find themselves needing to complete additional forms, while the NJ-1040EZ simplifies this process for state taxes.

The New Jersey Earned Income Tax Credit (EITC) application is also similar to the NJ-1040EZ. Both documents focus on providing financial relief to low-income individuals and families. The EITC application allows taxpayers to claim a credit based on their income and number of dependents, while the NJ-1040EZ enables them to report their income and claim any applicable credits. Both forms aim to support those who may be struggling financially.

The NJ-2210 form, which is used to calculate underpayment penalties for New Jersey taxpayers, is another document related to the NJ-1040EZ. While the NJ-1040EZ is focused on filing income tax returns, the NJ-2210 addresses potential penalties for those who did not pay enough tax throughout the year. This form serves as a safeguard for taxpayers to ensure they meet their tax obligations and avoid additional fees.

Lastly, the New Jersey Division of Taxation's Taxpayer Guide is similar to the NJ-1040EZ in that it provides essential information and resources for taxpayers. While the NJ-1040EZ is a specific form for filing taxes, the Taxpayer Guide offers comprehensive guidance on tax laws, filing procedures, and available credits and deductions. Both documents serve to assist taxpayers in navigating the tax system effectively.