The NJ-1065 Schedule A form is similar to the IRS Form 1065. Both documents serve to report the income, deductions, gains, and losses of a partnership. While the NJ-1065 Schedule A focuses on New Jersey-specific regulations and income derived from partnerships, the IRS Form 1065 is a federal form used to report the same types of financial information to the Internal Revenue Service. Both forms require detailed breakdowns of income sources and distributions to partners, ensuring that both state and federal authorities have accurate information regarding partnership earnings.

Another similar document is the IRS Schedule K-1 (Form 1065). This form is used to report each partner's share of the partnership's income, deductions, and credits. Just like the NJ-1065 Schedule A, the K-1 provides a breakdown of the income earned by the partnership and how it is distributed among partners. The K-1 is essential for partners to accurately report their individual income on their tax returns, reflecting the partnership's financial activities.

The NJ 1065 Schedule A form, while primarily focused on partnership income, has implications for those also seeking rental properties. For individuals navigating the rental application process, utilizing resources like the PDF Document Service can streamline the preparation of necessary documents, ensuring that all pertinent information is accurately recorded. This parallel highlights the importance of thorough documentation whether applying for rental properties or reporting income for partnerships.

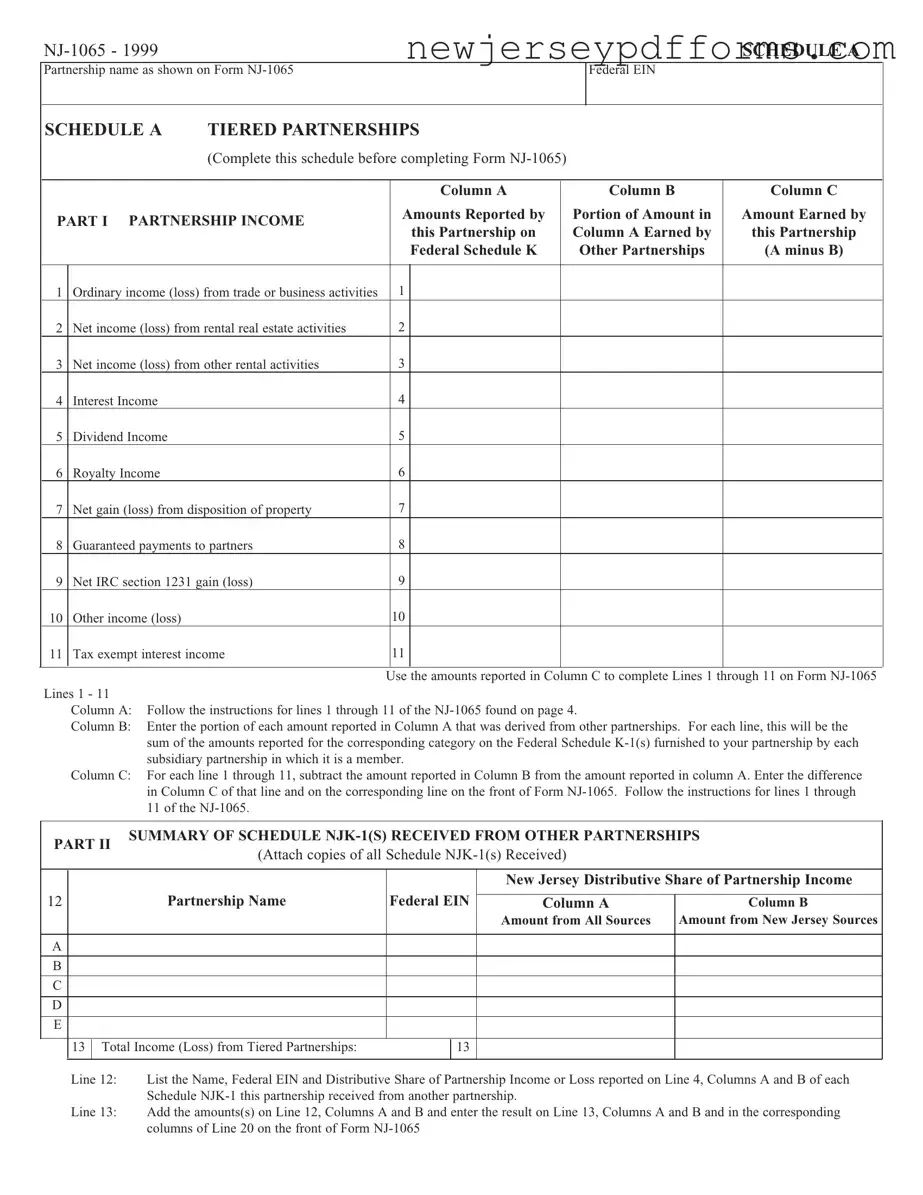

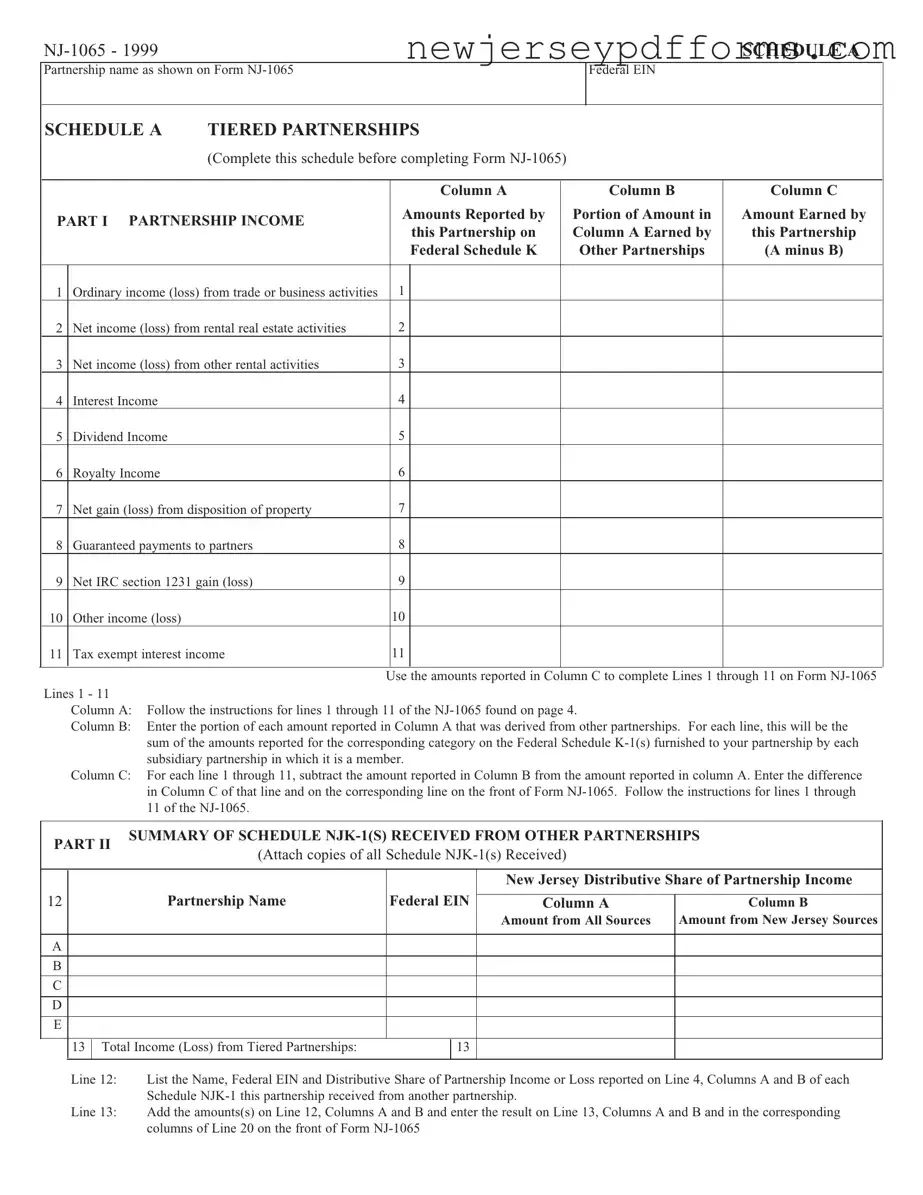

The New Jersey Partnership Return (Form NJ-1065) itself is closely related to the Schedule A. This form is the primary document used to report the overall financial status of the partnership to the state. While the Schedule A provides specific details about tiered partnerships and income distributions, the NJ-1065 encompasses the entire partnership's financial picture, including total income, deductions, and tax liability calculations.

Form NJ-K-1 is another document that aligns with the NJ-1065 Schedule A. This form is issued to each partner by the partnership and reports the partner's share of income, deductions, and credits from the partnership. Similar to the IRS K-1, the NJ-K-1 is crucial for partners to report their earnings to the New Jersey Division of Taxation. The NJ-K-1 ensures that each partner can accurately reflect their share of partnership income on their personal tax returns.

The IRS Form 1120-S, while primarily for S Corporations, shares similarities with the NJ-1065 Schedule A in how it reports income and distributions to shareholders. Both forms require detailed reporting of income sources and distributions, although the NJ-1065 focuses on partnerships specifically. This similarity in structure helps ensure that both types of entities provide clear and comprehensive financial information to tax authorities.

The New Jersey Corporation Business Tax Return (Form CBT-100) is another relevant document. While it is designed for corporations rather than partnerships, it shares a common goal of reporting income and tax liabilities to the state. Like the NJ-1065 Schedule A, the CBT-100 requires detailed reporting of income sources, deductions, and tax calculations, ensuring transparency in financial reporting for both partnerships and corporations.

Lastly, the IRS Form 990 is relevant for tax-exempt organizations and shares a commonality with the NJ-1065 Schedule A in that both require detailed financial reporting. Although the Form 990 is for non-profit organizations, it still demands a breakdown of income sources and expenditures. This level of detail is essential for maintaining transparency and accountability in financial reporting, which is a principle upheld by both forms.