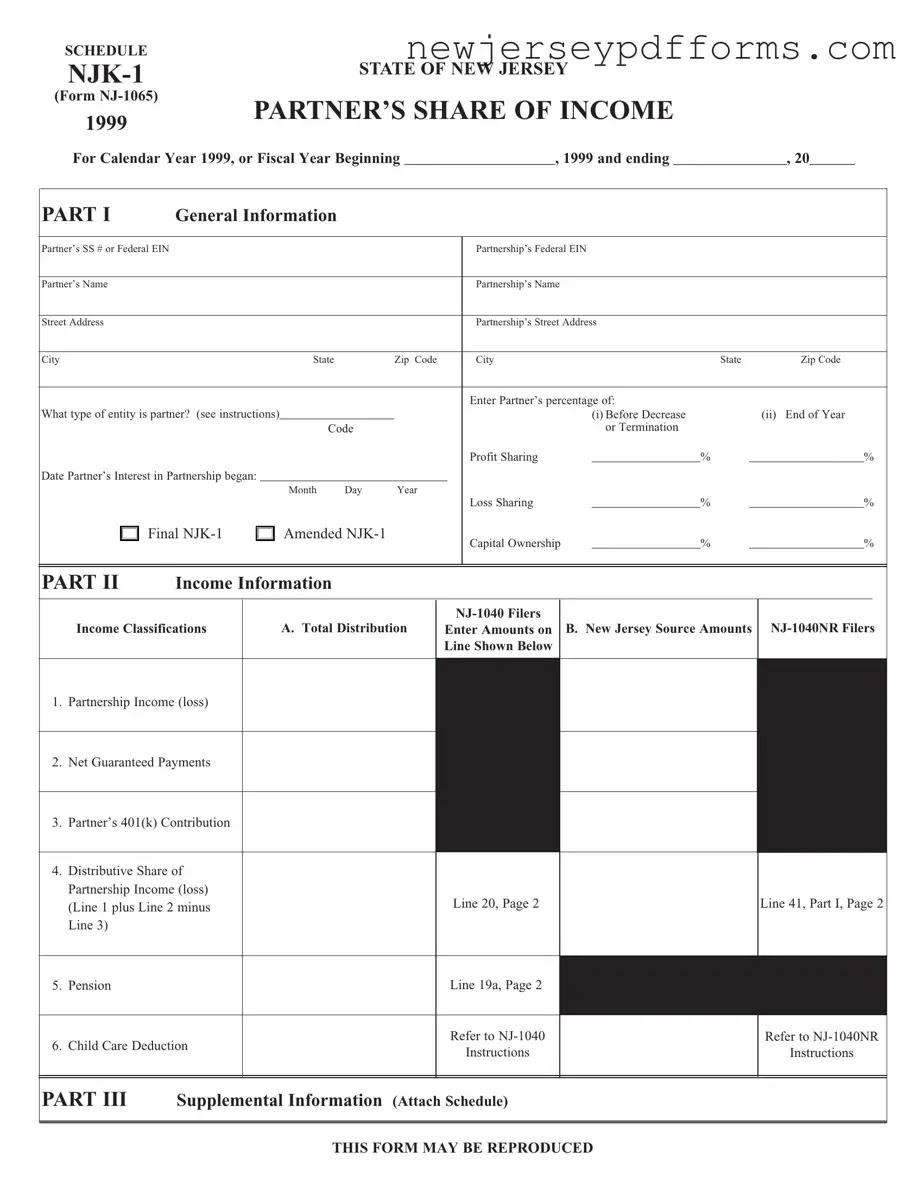

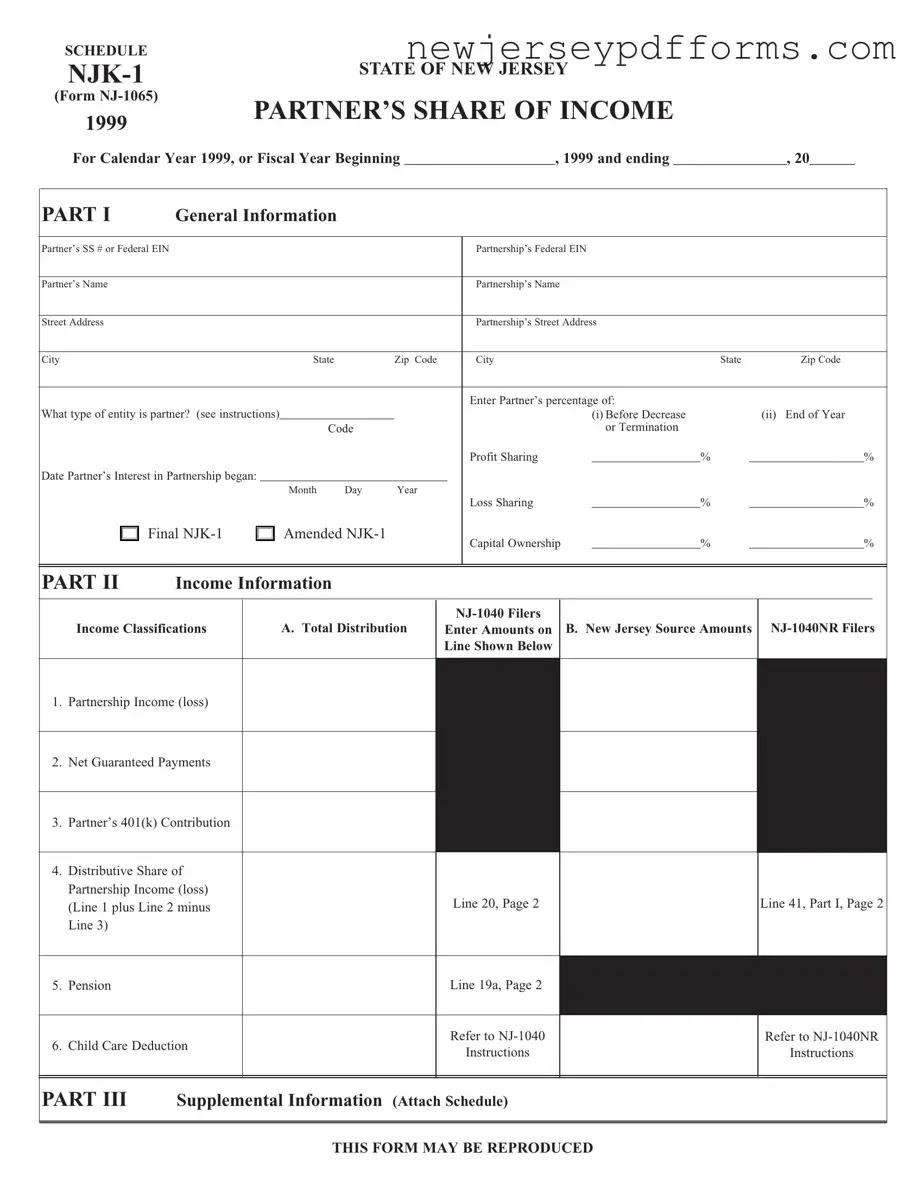

The NJ 1065 Schedule NJK-1 form is similar to the IRS Form K-1, which is used for reporting income, deductions, and credits from partnerships. Both forms provide a detailed breakdown of a partner’s share of income, losses, and other tax-related information. The IRS Form K-1 is essential for federal tax purposes, while the NJK-1 serves a similar function for state tax filings in New Jersey. Each form includes sections for identifying the partner and the partnership, as well as specific income classifications that need to be reported by the partner on their individual tax returns.

Another document comparable to the NJK-1 is the Schedule E (Form 1040), which is used by individual taxpayers to report income or loss from partnerships, S corporations, estates, trusts, and real estate. Like the NJK-1, Schedule E requires detailed reporting of income and losses associated with partnerships. The information from the NJK-1 is often transferred to Schedule E to ensure that partners accurately report their earnings on their federal tax returns. This connection underscores the importance of both forms in providing a comprehensive view of a partner’s financial involvement in a partnership.

The Form 1065, U.S. Return of Partnership Income, is also similar to the NJK-1. This federal form is filed by partnerships to report their income, deductions, gains, and losses. The information provided on Form 1065 directly impacts the NJK-1, as the partnership must first complete this form to determine how much income or loss each partner will receive. Essentially, the NJK-1 acts as a pass-through document that conveys the results of the Form 1065 to individual partners, ensuring they have the necessary information to file their own tax returns accurately.

Additionally, the New Jersey Division of Taxation’s NJ-1040 form bears similarities to the NJK-1. The NJ-1040 is the individual income tax return for residents of New Jersey, where taxpayers report their income, deductions, and credits. Information from the NJK-1 is used to fill out the NJ-1040, particularly in reporting partnership income. This relationship highlights how the NJK-1 serves as a critical link between partnership income reporting and individual tax obligations in New Jersey.

Lastly, the NJ-1040NR form, which is the non-resident income tax return for New Jersey, is also akin to the NJK-1. Non-residents who receive income from New Jersey partnerships must report this income on the NJ-1040NR. The NJK-1 provides essential details about the income earned from the partnership, which must be accurately reported on the non-resident tax return. This ensures that non-resident partners fulfill their tax responsibilities while also benefiting from the information provided in the NJK-1.