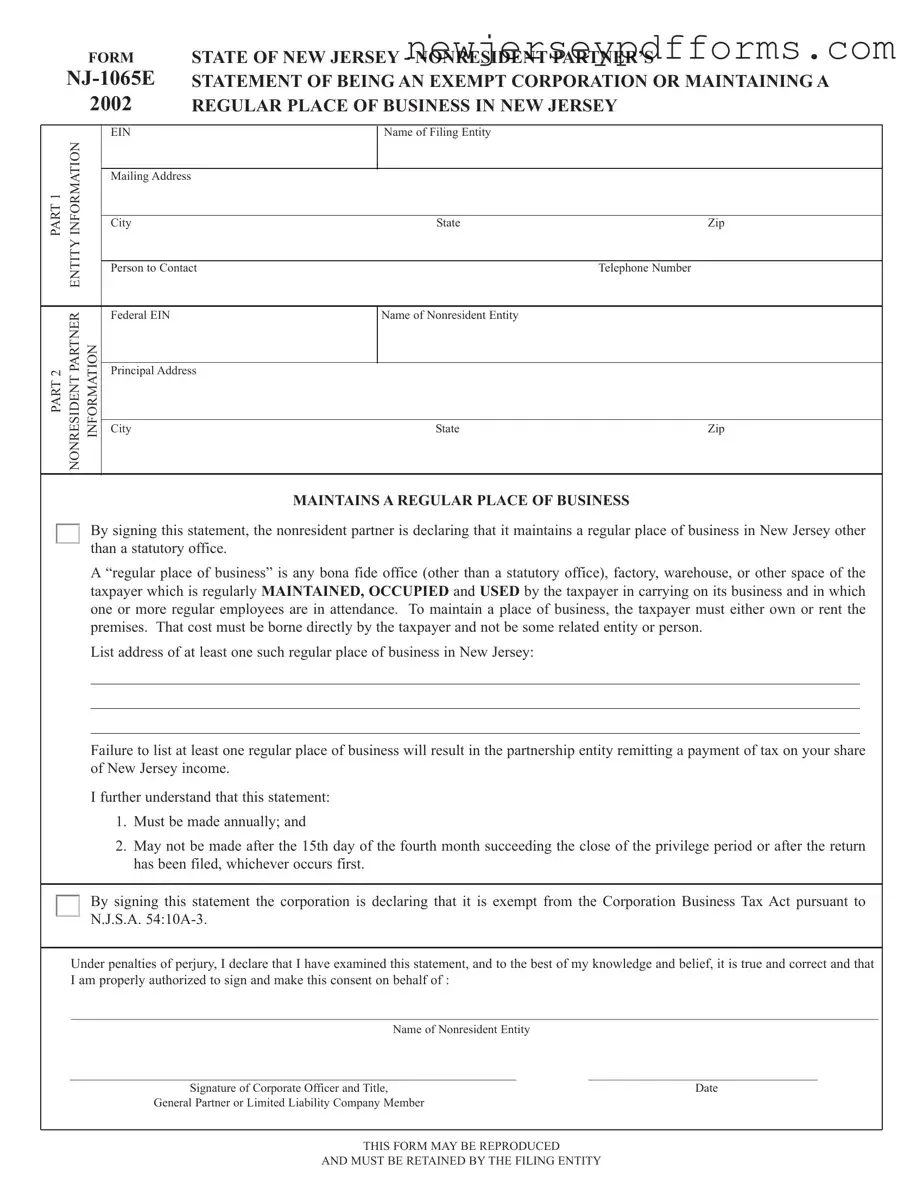

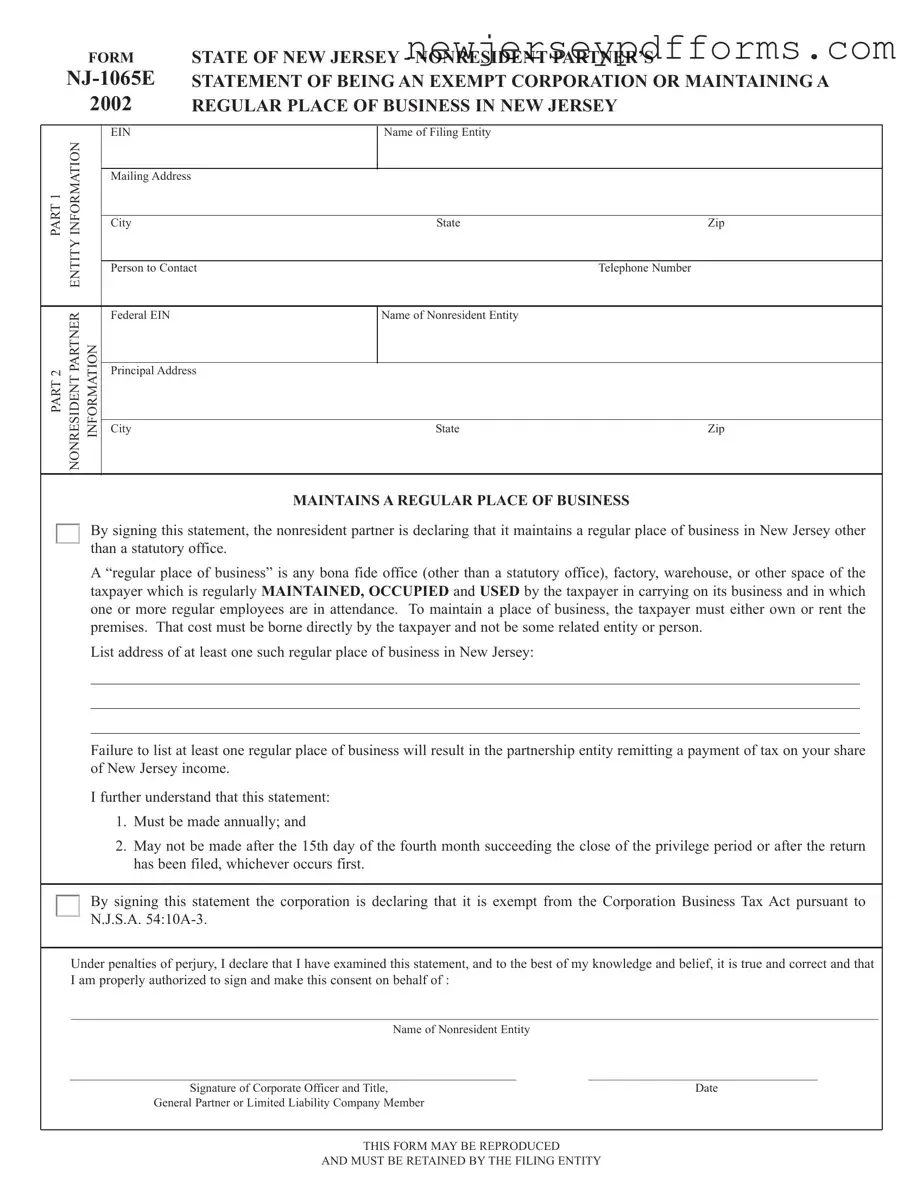

What is the NJ 1065E form?

The NJ 1065E form is a statement for nonresident partners of partnerships in New Jersey. It is used to declare whether a nonresident partner maintains a regular place of business in New Jersey or is exempt from the Corporation Business Tax Act. This form must be filed annually.

Who needs to file the NJ 1065E form?

Nonresident partners of partnerships that either maintain a regular place of business in New Jersey or are claiming an exemption from the Corporation Business Tax must file this form. It is crucial for compliance with New Jersey tax regulations.

What does it mean to maintain a regular place of business?

A regular place of business is defined as any bona fide office, factory, warehouse, or other space that is regularly occupied and used by the taxpayer in conducting business. It must have one or more regular employees in attendance and the taxpayer must either own or rent the premises.

What happens if a nonresident partner does not list a regular place of business?

If a nonresident partner fails to list at least one regular place of business on the NJ 1065E form, the partnership entity will be required to pay tax on the partner's share of New Jersey income. This emphasizes the importance of accurate reporting.

When is the NJ 1065E form due?

The NJ 1065E form must be submitted annually and cannot be filed after the 15th day of the fourth month following the end of the privilege period. It also cannot be submitted after the partnership's tax return has been filed.

What is the significance of signing the NJ 1065E form?

By signing the NJ 1065E form, the nonresident partner is declaring the truthfulness of the information provided and confirming their authorization to file on behalf of the entity. This statement is made under penalties of perjury, highlighting its legal importance.

Can the NJ 1065E form be reproduced?

Yes, the NJ 1065E form may be reproduced. However, it is essential that the filing entity retains a copy for its records, ensuring compliance and ease of reference in future filings.

What are the exemptions listed under the Corporation Business Tax Act?

Exemptions include various types of corporations such as those assessed based on gross receipts, nonprofit organizations, and certain utility companies. Each exemption has specific criteria that must be met to qualify.

Who should be contacted for questions regarding the NJ 1065E form?

For questions related to the NJ 1065E form, it is advisable to contact the person listed on the form as the point of contact. This individual can provide specific guidance and clarification regarding the filing process.

Is there a filing fee associated with the NJ 1065E form?

No, there is no filing fee specifically for submitting the NJ 1065E form. However, partnerships may have other tax obligations, so it is essential to review all applicable regulations.