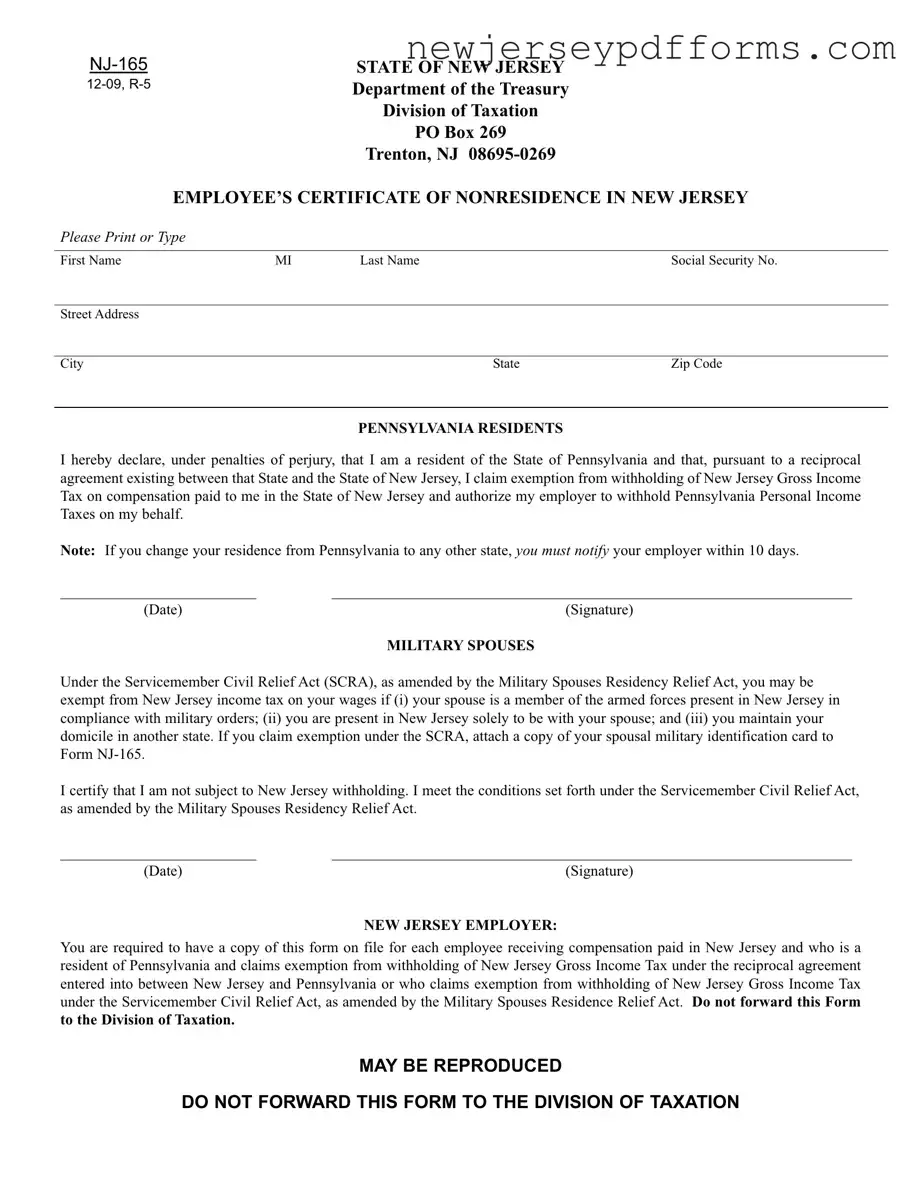

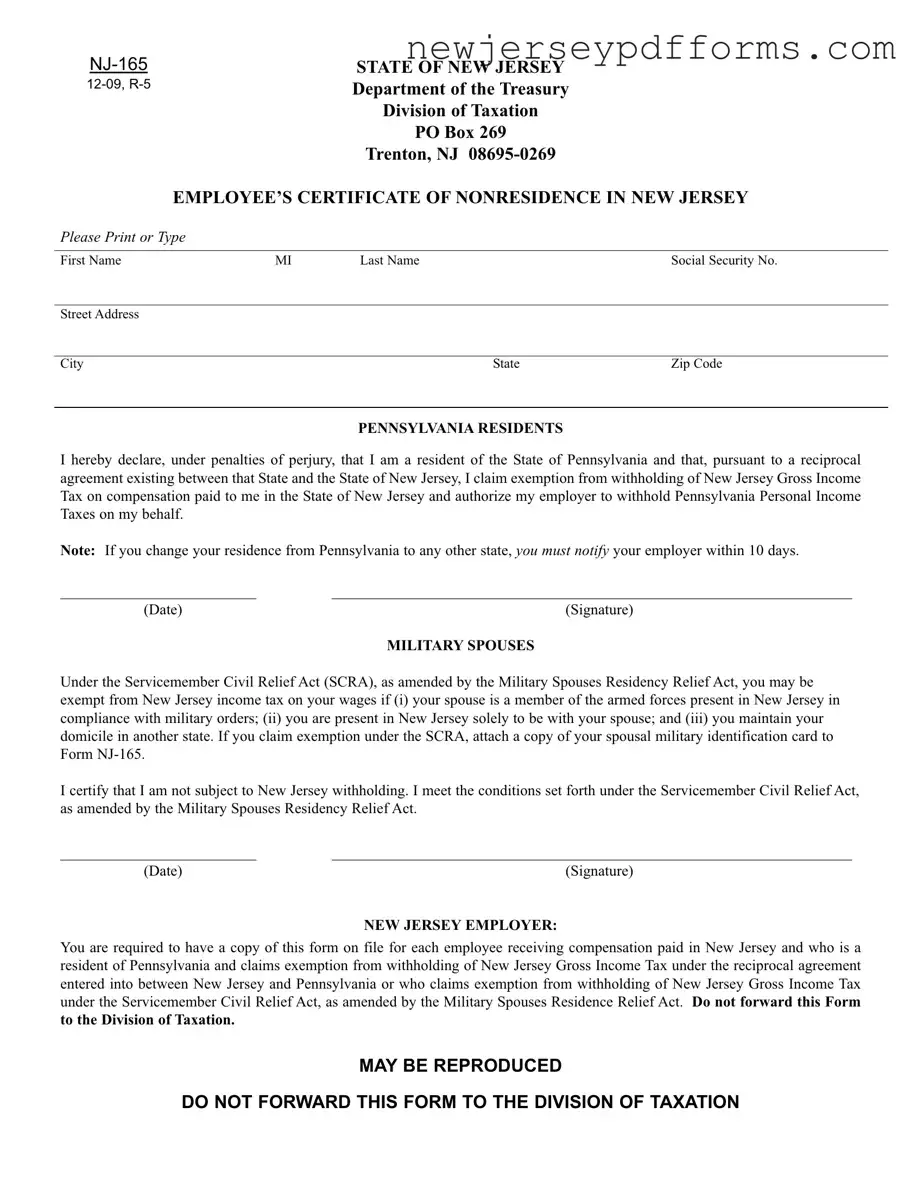

What is the NJ-165 form?

The NJ-165 form is an Employee’s Certificate of Nonresidence in New Jersey. It is used by individuals who are residents of Pennsylvania to claim exemption from New Jersey Gross Income Tax withholding. This form is particularly relevant for employees who work in New Jersey but reside in Pennsylvania due to a reciprocal tax agreement between the two states.

Who needs to fill out the NJ-165 form?

Individuals who are residents of Pennsylvania and work in New Jersey should complete the NJ-165 form. This includes employees who want to claim exemption from New Jersey's Gross Income Tax withholding. Additionally, military spouses who meet specific criteria under the Servicemember Civil Relief Act may also use this form to claim exemption.

What information is required on the NJ-165 form?

The form requires basic personal information, including your first name, middle initial, last name, Social Security number, street address, city, state, and zip code. If you are a military spouse claiming exemption, you will also need to provide a copy of your spousal military identification card.

How does the reciprocal agreement between New Jersey and Pennsylvania work?

The reciprocal agreement allows residents of Pennsylvania to work in New Jersey without having New Jersey Gross Income Tax withheld from their paychecks. Instead, employers will withhold Pennsylvania Personal Income Taxes. This agreement simplifies tax obligations for individuals who live in one state and work in another.

What should I do if I move from Pennsylvania to another state?

If you change your residence from Pennsylvania to another state, it is important to notify your employer within 10 days. This ensures that your tax withholding is adjusted according to your new residency status.

What are the criteria for military spouses to claim exemption?

Military spouses can claim exemption from New Jersey income tax if three conditions are met: their spouse must be a member of the armed forces stationed in New Jersey, they must be in New Jersey solely to be with their spouse, and they must maintain their domicile in another state. Proof of military status is required when claiming this exemption.

Do I need to submit the NJ-165 form to the Division of Taxation?

No, you do not need to send the NJ-165 form to the Division of Taxation. Instead, your employer is required to keep a copy of the form on file for each employee who claims exemption from New Jersey Gross Income Tax under the applicable provisions.

What happens if I do not submit the NJ-165 form?

If you do not submit the NJ-165 form and you are eligible for the exemption, your employer may withhold New Jersey Gross Income Tax from your paycheck. This could lead to unnecessary tax payments that you may need to reclaim later.

Can the NJ-165 form be reproduced?

Yes, the NJ-165 form may be reproduced for your use. However, it should not be forwarded to the Division of Taxation. Keep the completed form with your employer's records.