What is the NJ-630 form?

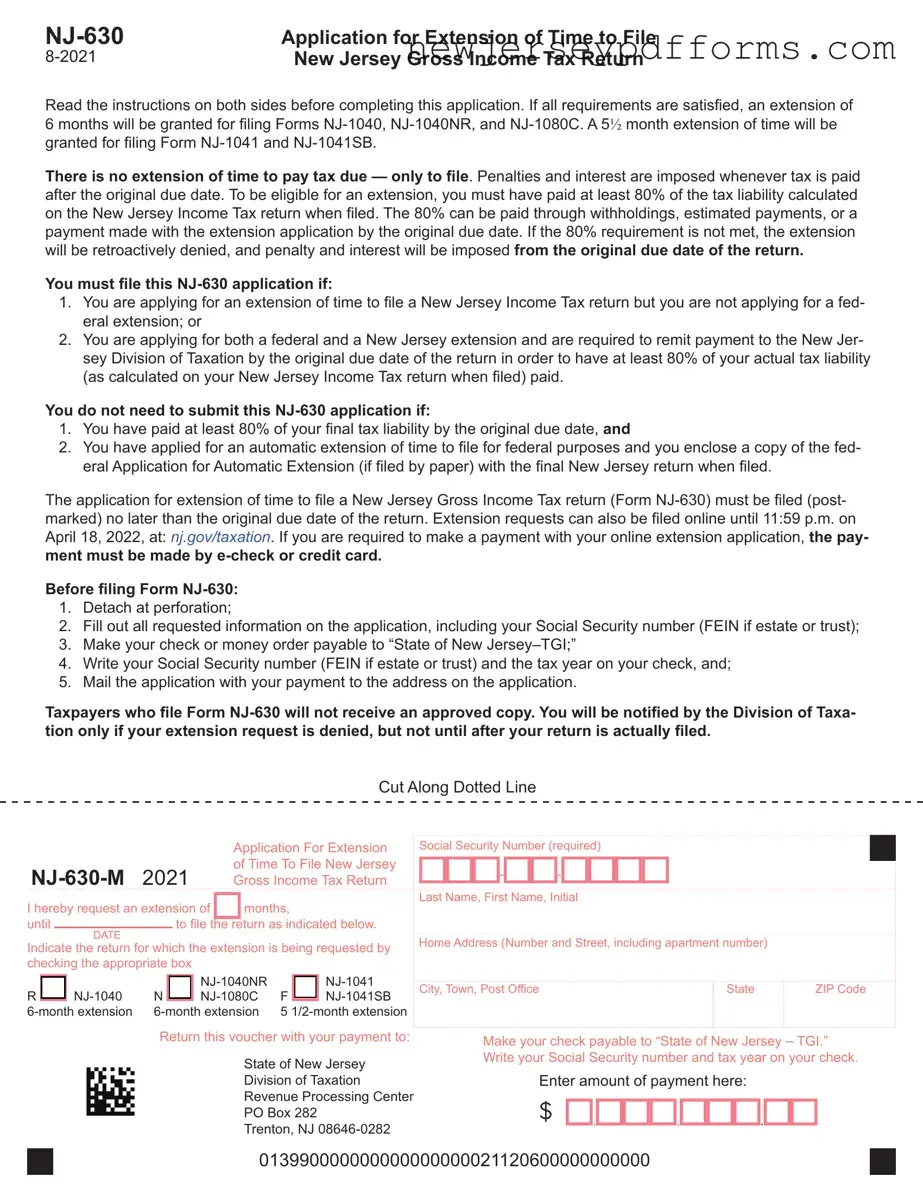

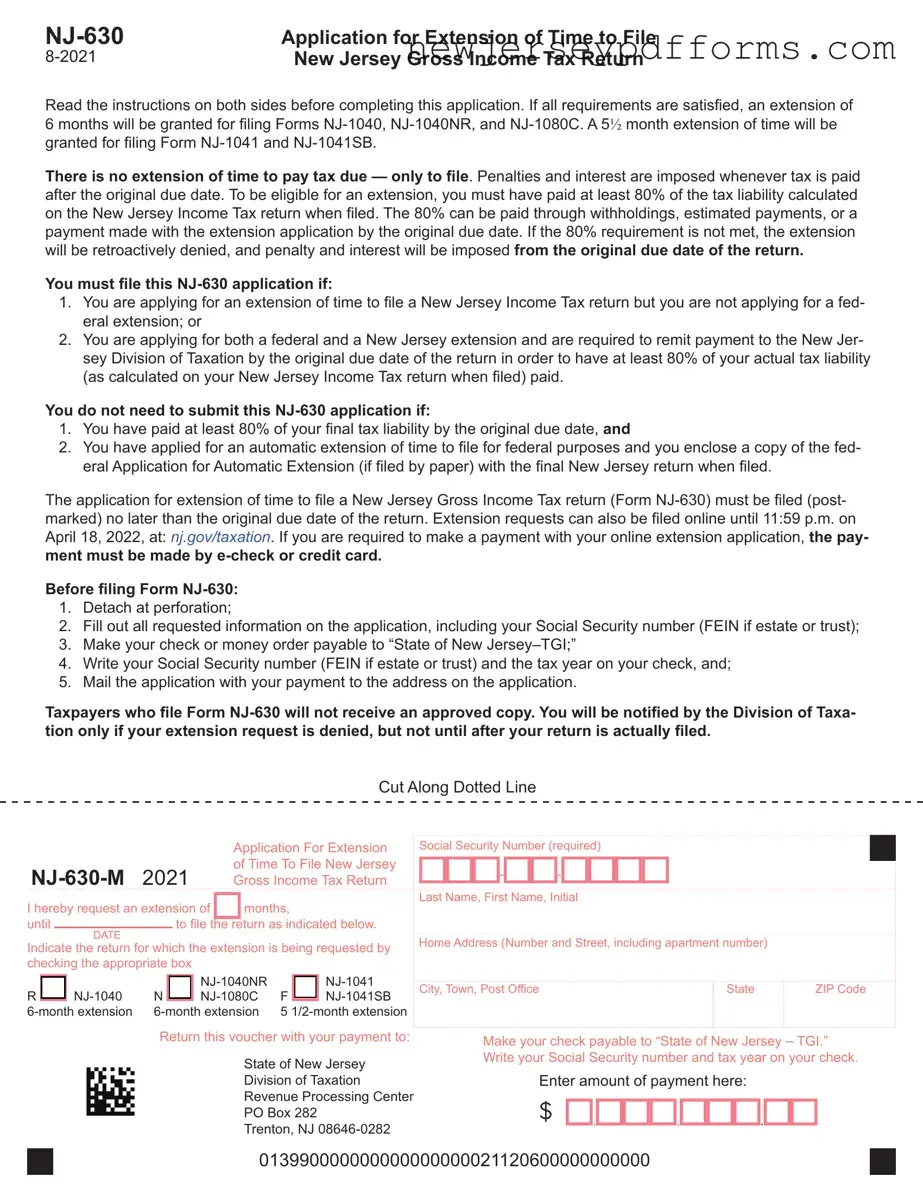

The NJ-630 form is an application for an extension of time to file a New Jersey Gross Income Tax Return. It allows taxpayers to request an extension of up to six months for certain tax forms, such as NJ-1040, NJ-1040NR, and NJ-1080C, and a 5½ month extension for Forms NJ-1041 and NJ-1041SB.

Who needs to file the NJ-630 form?

You need to file the NJ-630 form if you are applying for an extension to file a New Jersey Income Tax return without also applying for a federal extension. Additionally, if you are applying for both federal and New Jersey extensions, you must remit payment to the New Jersey Division of Taxation to ensure at least 80% of your tax liability is paid by the original due date.

What are the eligibility requirements for an extension?

To be eligible for an extension, you must pay at least 80% of your calculated tax liability by the original due date. This payment can be made through withholdings, estimated payments, or a payment included with your NJ-630 application. If you do not meet the 80% requirement, the extension will be denied retroactively, and penalties and interest will apply from the original due date.

When must the NJ-630 form be filed?

The NJ-630 form must be filed by the original due date of your New Jersey Income Tax return. This means it should be postmarked by that date. Alternatively, you can file online until 11:59 p.m. on the due date at www.njtaxation.org.

What payment methods are accepted with the NJ-630 form?

If you are submitting your NJ-630 application online, payments must be made via e-check or credit card. For paper submissions, you should include a check or money order made out to “State of New Jersey–TGI.” Ensure that your Social Security number and the tax year are written on the payment.

Will I receive confirmation of my extension request?

No, taxpayers who file the NJ-630 form will not receive an approved copy. The New Jersey Division of Taxation will only notify you if your extension request is denied, and this notification will occur after your return has been filed.

What happens if I do not file my return by the extended due date?

If your final return is not received by the extended due date, penalties and interest will be applied as if the extension had not been granted. Late filing penalties can reach up to 25% of the tax due, and interest will accrue at a rate of 3 percentage points above the prime rate for each month the tax remains unpaid.

Are there special provisions for military personnel regarding the NJ-630 form?

Yes, individuals in active service with the Armed Forces of the United States who are unable to file due to distance, injury, or hospitalization will automatically receive a six-month extension. They must include a statement explaining the reason for the extension with their return.