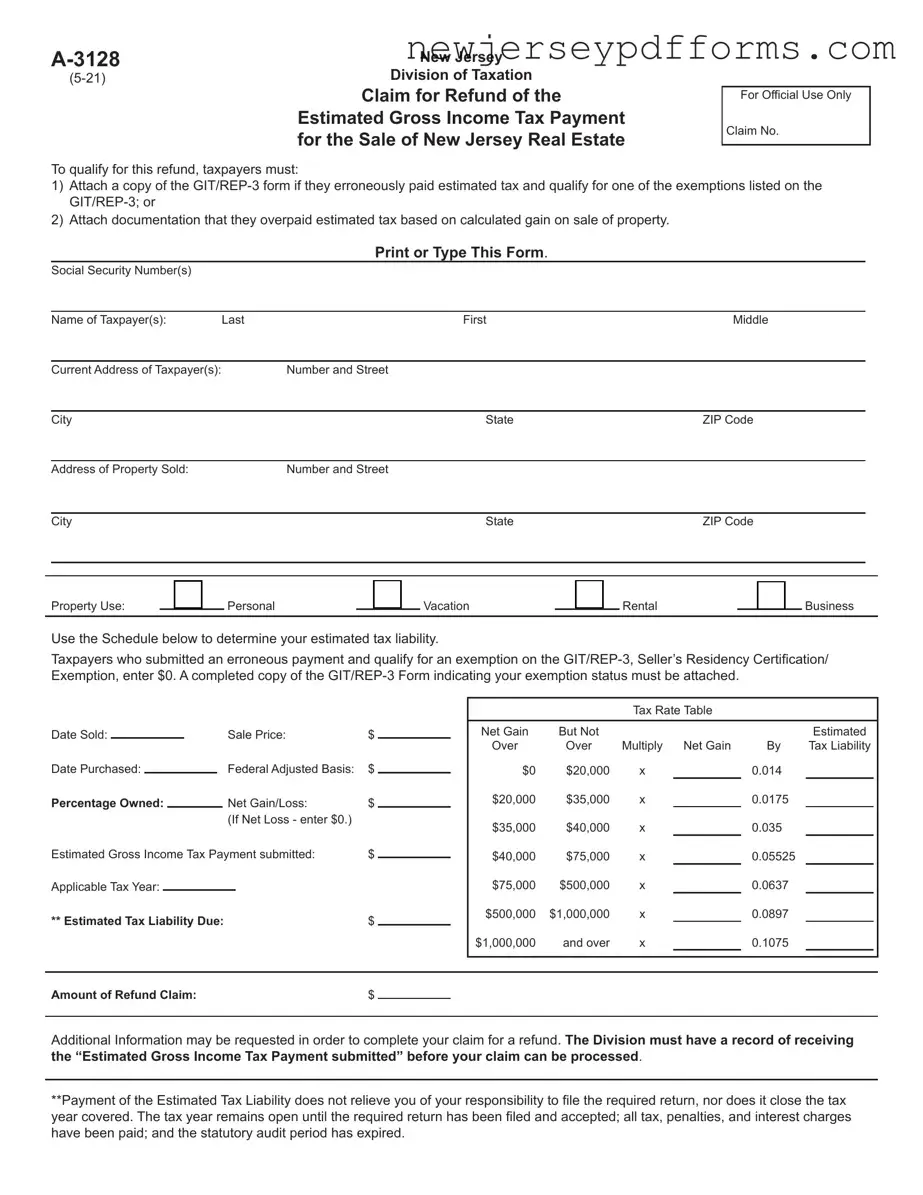

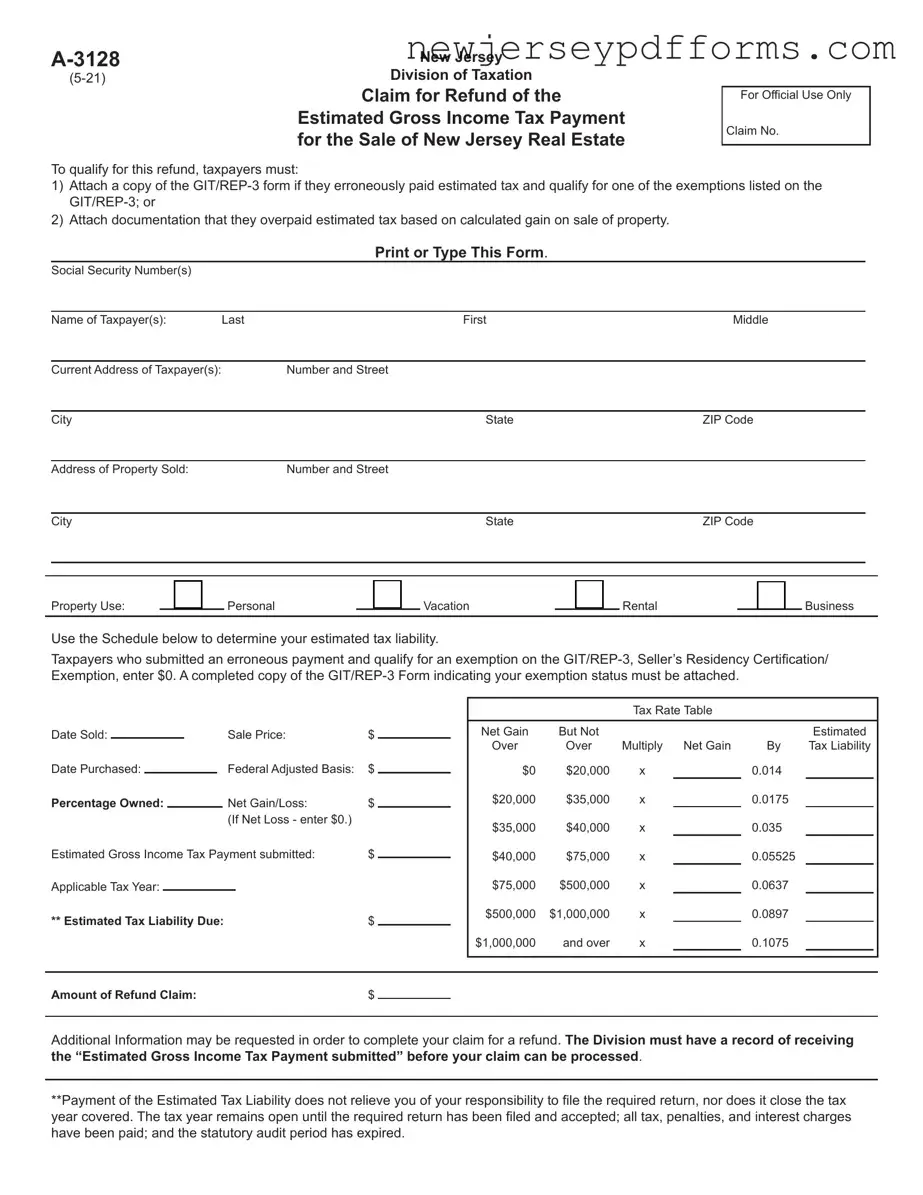

What is the NJ A-3128 form used for?

The NJ A-3128 form is used to claim a refund of the estimated Gross Income Tax payment made for the sale of New Jersey real estate. Taxpayers, including nonresident individuals, estates, or trusts, can use this form to request a refund if they have overpaid their estimated tax based on the gain from the sale of property.

Who is eligible to file the NJ A-3128 form?

Eligibility to file the NJ A-3128 form includes nonresident individuals, estates, or trusts that have made an estimated Gross Income Tax payment when selling New Jersey real estate. To qualify for a refund, taxpayers must either attach a GIT/REP-3 form showing an exemption or provide documentation that demonstrates an overpayment based on the calculated gain from the sale.

What documentation must be submitted with the NJ A-3128 form?

When submitting the NJ A-3128 form, taxpayers must include a copy of the GIT/REP-3 form if they qualify for an exemption. Alternatively, they must provide documentation that supports their claim of overpayment based on the gain from the property sale. Additionally, a Settlement Statement (HUD-1) or Closing Disclosure form must be attached.

How is the estimated tax liability calculated on the NJ A-3128 form?

Taxpayers must use the tax rate table provided on the form to calculate their estimated tax liability. This involves determining the net gain or loss from the sale of the property and applying the appropriate tax rate based on the amount of gain. Taxpayers who qualify for an exemption should enter $0 for their estimated tax liability.

What should be done if the form is prepared by someone other than the taxpayer?

If the NJ A-3128 form is prepared by an individual other than the taxpayer, an Appointment of Taxpayer Representative must be included. This document authorizes the representative to act on behalf of the taxpayer in matters related to the claim for a refund.

What happens if the form is incomplete or lacks required documentation?

Incomplete claims or those lacking required documentation will be rejected. The New Jersey Division of Taxation will return such claims. It is crucial to ensure that all required lines on the form are filled out and that necessary documentation is attached to avoid delays in processing the refund.

Where should the completed NJ A-3128 form be mailed?

The completed NJ A-3128 form, along with the required attachments, should be mailed to the New Jersey Division of Taxation, Taxpayer Accounting Branch, P.O. Box 046, Trenton, NJ 08646-0046. Timely submission is important to ensure the claim is processed efficiently.

Does submitting the NJ A-3128 form eliminate the need to file a tax return?

No, submitting the NJ A-3128 form does not eliminate the requirement to file the necessary tax return. Taxpayers remain responsible for filing the required return, and the tax year will remain open until the return is filed and accepted, all taxes and penalties are paid, and the statutory audit period has expired.