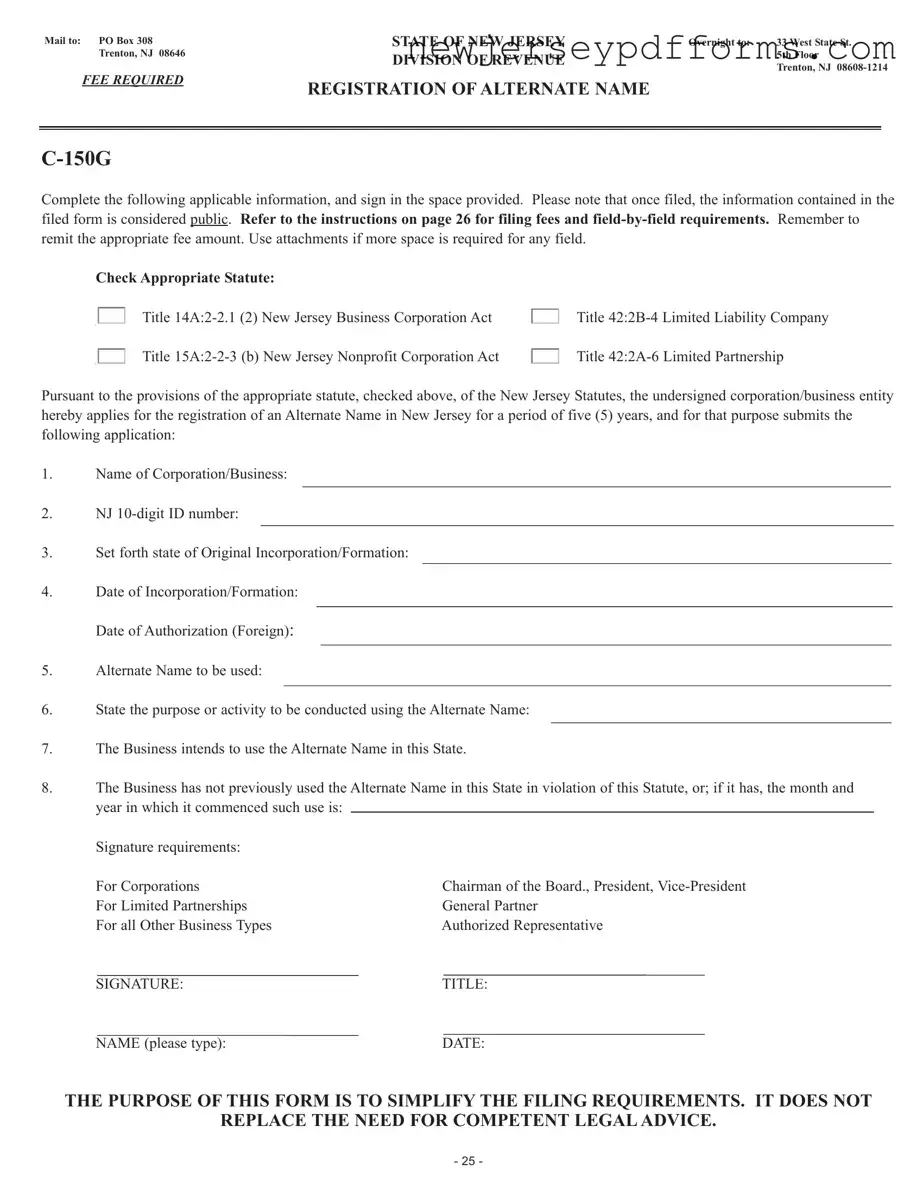

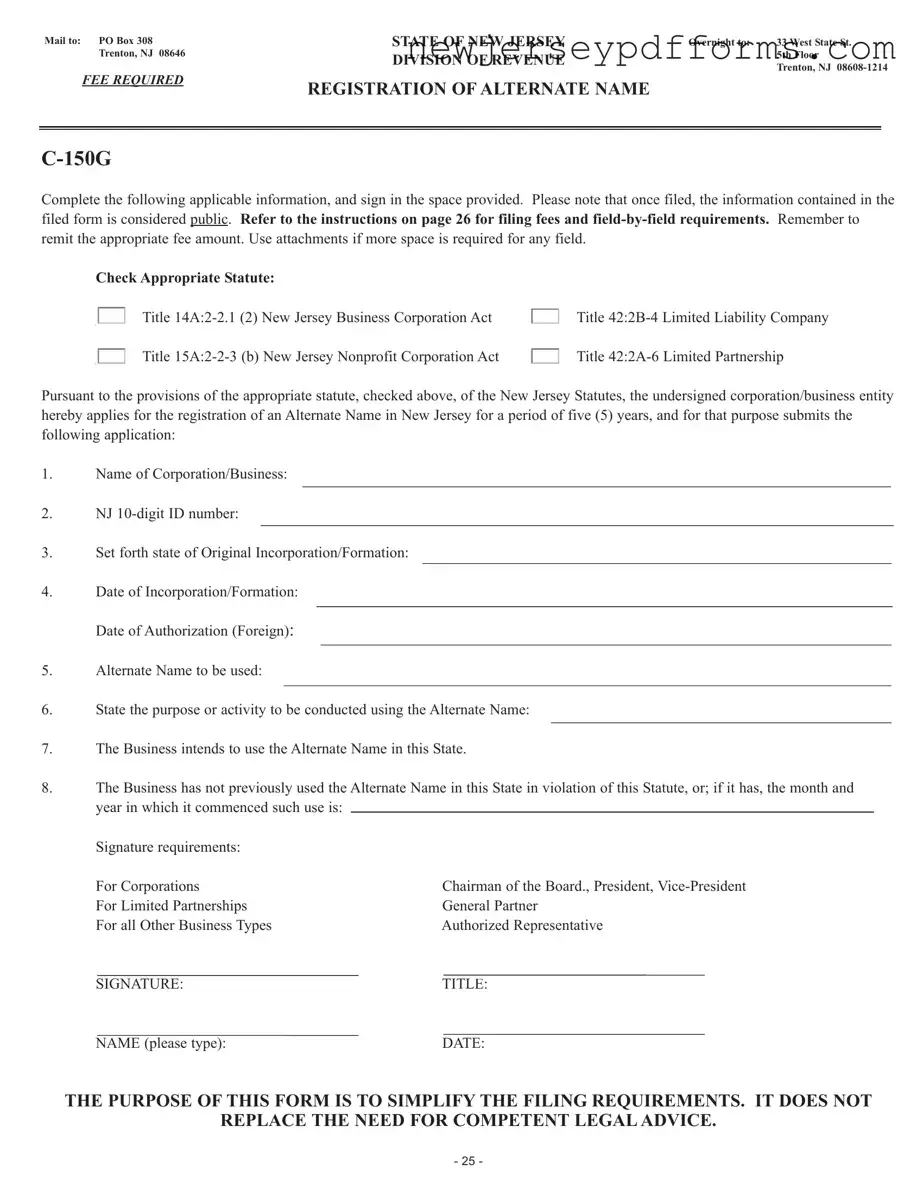

The NJ C 150G form, used for registering an alternate name for a business in New Jersey, shares similarities with the DBA (Doing Business As) registration. A DBA allows a business to operate under a name different from its legal name. Just like the NJ C 150G, a DBA registration requires that the business owner provide basic information about the business, including its legal name and the alternate name it wishes to use. Both forms aim to ensure transparency and public awareness of the names under which businesses operate, making it easier for customers and clients to identify and trust the entities they engage with.

Understanding the various forms utilized in business administration is crucial, particularly for those operating within specific jurisdictions such as New Jersey. One important resource for further information on these processes is available at https://formsgeorgia.com, which outlines essential documents such as the Georgia WC 102B form, aiding parties in navigating legal and procedural requirements effectively.

Another document akin to the NJ C 150G is the Certificate of Formation for LLCs. This document is essential for establishing a Limited Liability Company in New Jersey. Similar to the C 150G, the Certificate of Formation requires detailed information about the business, such as its name, address, and the names of its members. Both forms serve as official records that must be filed with the state, ensuring that the business is recognized legally. While the C 150G focuses on alternate naming, the Certificate of Formation lays the groundwork for the business's existence.

The Articles of Incorporation also bear a resemblance to the NJ C 150G form. This document is necessary for forming a corporation in New Jersey and outlines key details about the corporation, including its name, purpose, and registered agent. Like the C 150G, the Articles of Incorporation must be filed with the state to ensure legal recognition. Both documents are vital for establishing a business's identity and ensuring compliance with state regulations, although they serve different purposes within the business formation process.

The Business License Application is another document that parallels the NJ C 150G form. A business license is required for many types of businesses to operate legally within a municipality. Similar to the C 150G, the application for a business license requires information about the business's name and address. Both documents aim to protect consumers and ensure that businesses meet local regulations. While the NJ C 150G focuses on the registration of an alternate name, the Business License Application is about obtaining permission to conduct business activities.

Lastly, the Nonprofit Registration Form is similar to the NJ C 150G in that it is used to formally register a nonprofit organization with the state. This form requires information about the nonprofit's name, purpose, and structure, just like the C 150G requires details about the alternate name and business structure. Both forms are crucial for ensuring that the organizations are recognized legally and can operate within their respective frameworks. While the focus of the NJ C 150G is on alternate naming, the Nonprofit Registration Form emphasizes the establishment of nonprofit entities.