What is the purpose of the NJ CBT 2553 R form?

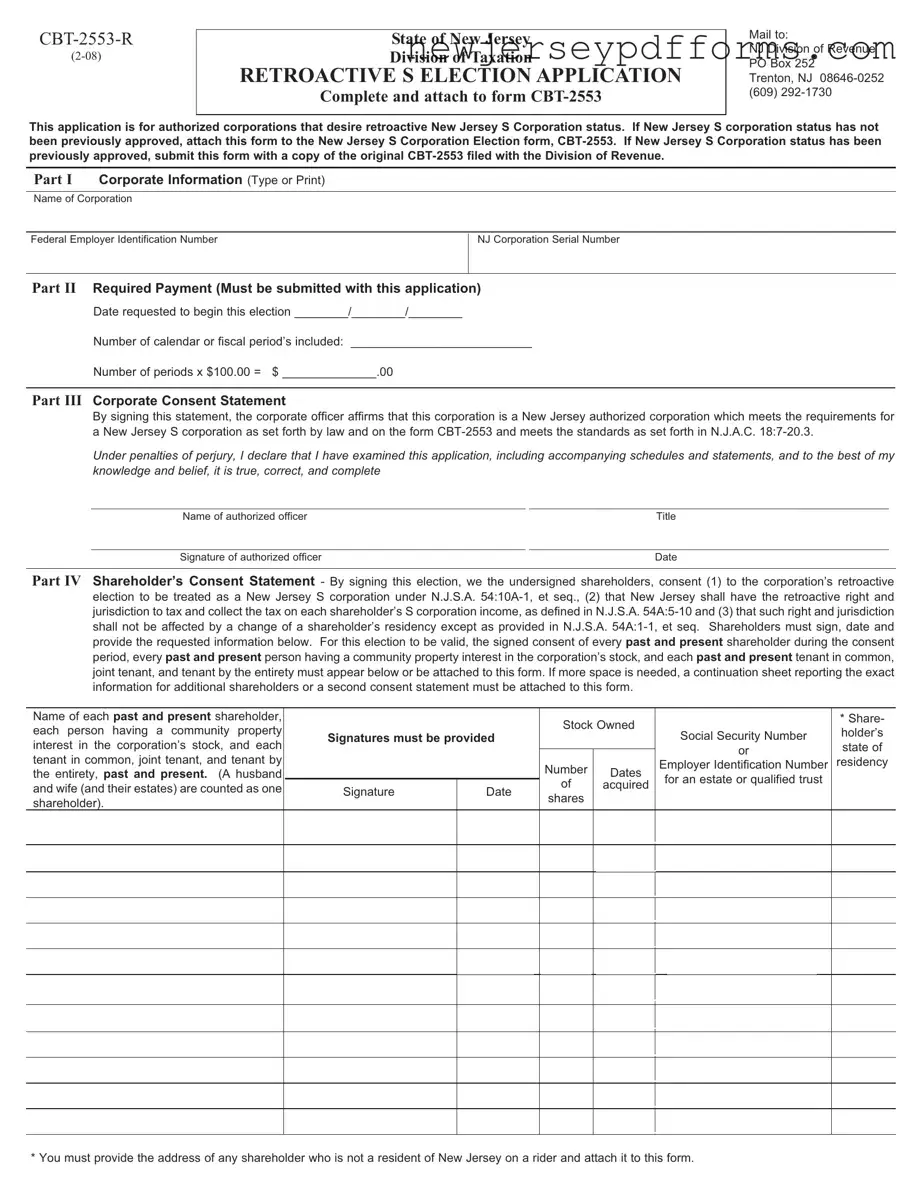

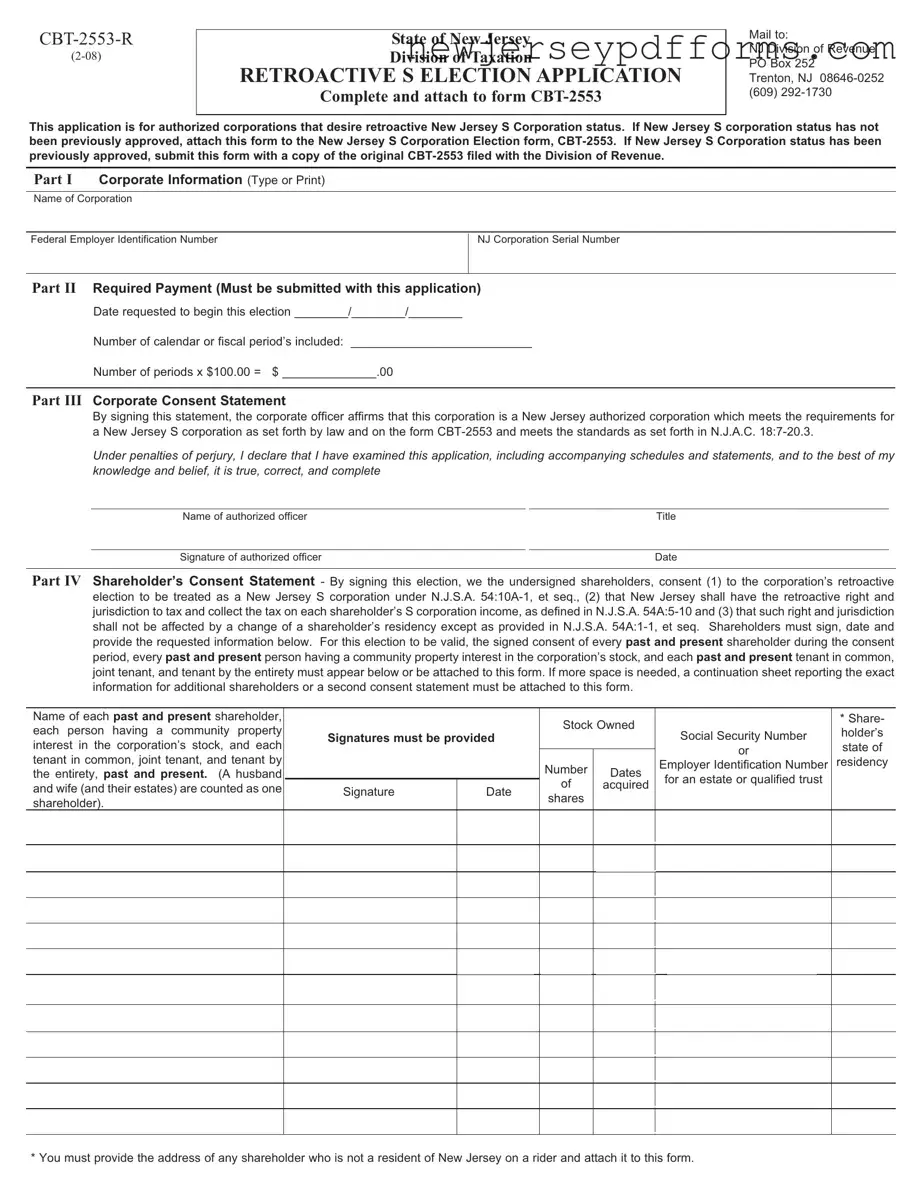

The NJ CBT 2553 R form is an application for corporations in New Jersey that wish to obtain retroactive S Corporation status. This form is essential for those corporations that either have not previously been approved for S Corporation status or need to amend their status retroactively. By completing this form, corporations can align their tax treatment with their intended classification, allowing them to benefit from the advantages associated with S Corporations in New Jersey.

Who is eligible to file the NJ CBT 2553 R form?

Only authorized corporations that are registered to do business in New Jersey can file this form. To qualify, the corporation must have filed New Jersey tax returns as an S Corporation in the past but failed to submit a timely election request. Additionally, all shareholders must consent to the retroactive election, which means that every past and present shareholder must sign the form or provide consent on an attached sheet.

What information is required on the NJ CBT 2553 R form?

The form requires several key pieces of information. Corporations must provide their name, Federal Employer Identification Number (FEIN), and New Jersey Corporation Serial Number. Additionally, they must indicate the desired effective date for the election and include the number of periods affected by the retroactive election, along with the appropriate payment. A corporate officer must also sign a consent statement affirming the corporation's eligibility for S Corporation status.

What is the payment requirement associated with the NJ CBT 2553 R form?

When submitting the NJ CBT 2553 R form, a non-refundable payment of $100 is required for each tax year or privilege period for which retroactive status is being requested. This payment must accompany the application to ensure that it is processed. Failure to include the payment may result in the application being deemed incomplete and not considered.

What happens after submitting the NJ CBT 2553 R form?

Once the completed form and payment are submitted to the New Jersey Division of Revenue, the application will be reviewed. The corporation will receive notification regarding the approval or denial of the retroactive election. If the election is granted, the corporation will be recognized as an S Corporation retroactively to the requested date, impacting the tax treatment of the corporation and its shareholders.

Are there any conditions that could prevent the approval of the NJ CBT 2553 R form?

Yes, several conditions could lead to the denial of the retroactive election. For example, if the corporation has not filed all required business tax returns on time or has not paid the appropriate taxes, the application may be rejected. Additionally, if an assessment against the corporation becomes final before the election request is received, it will not be granted. Shareholders must also have filed their tax returns correctly for the retroactive period; otherwise, the election may not be approved.

How can shareholders show their consent for the retroactive election?

Shareholders must sign the consent statement included in Part IV of the NJ CBT 2553 R form. This section requires the names, signatures, and other identifying information of all past and present shareholders, as well as those with community property interests in the corporation's stock. Each shareholder's consent is crucial for the application to be valid, and if more space is needed, a continuation sheet can be attached to provide the necessary information.