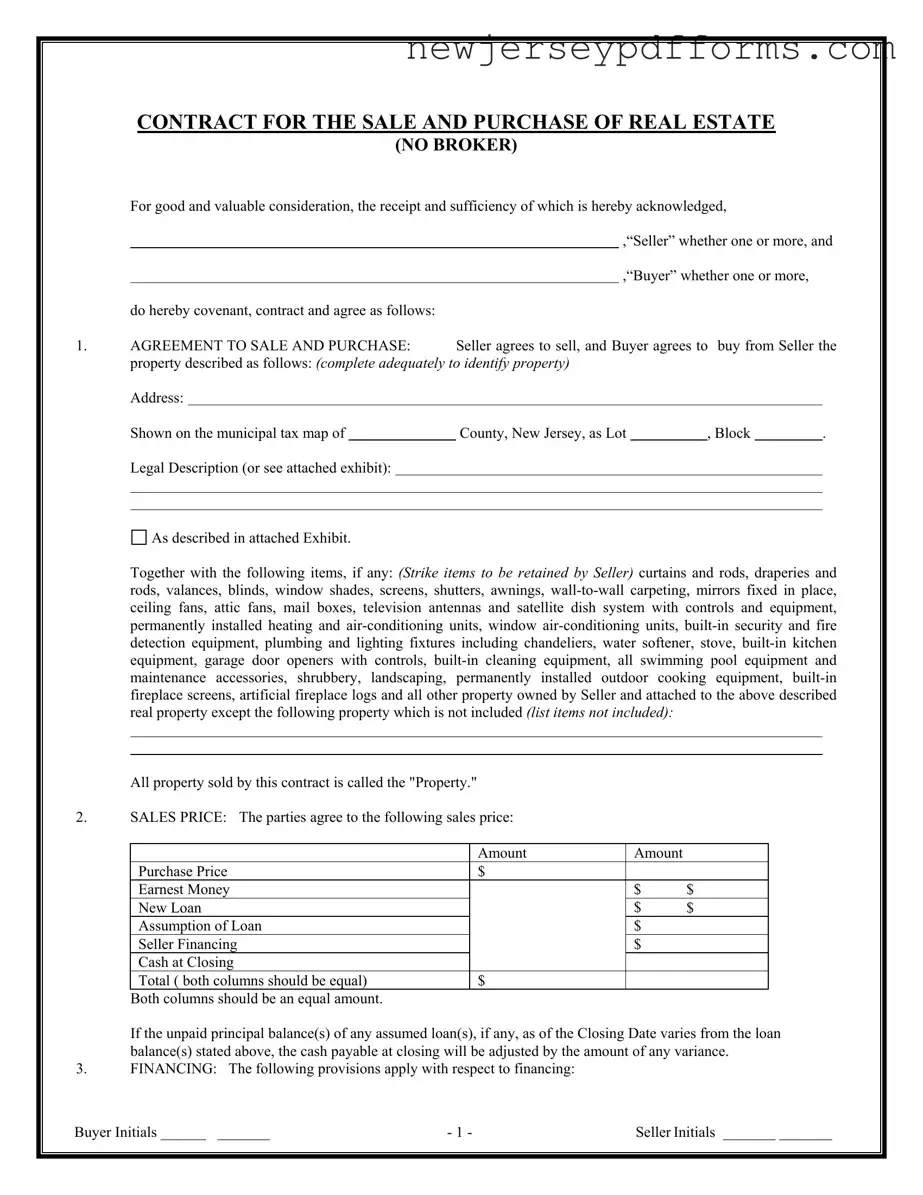

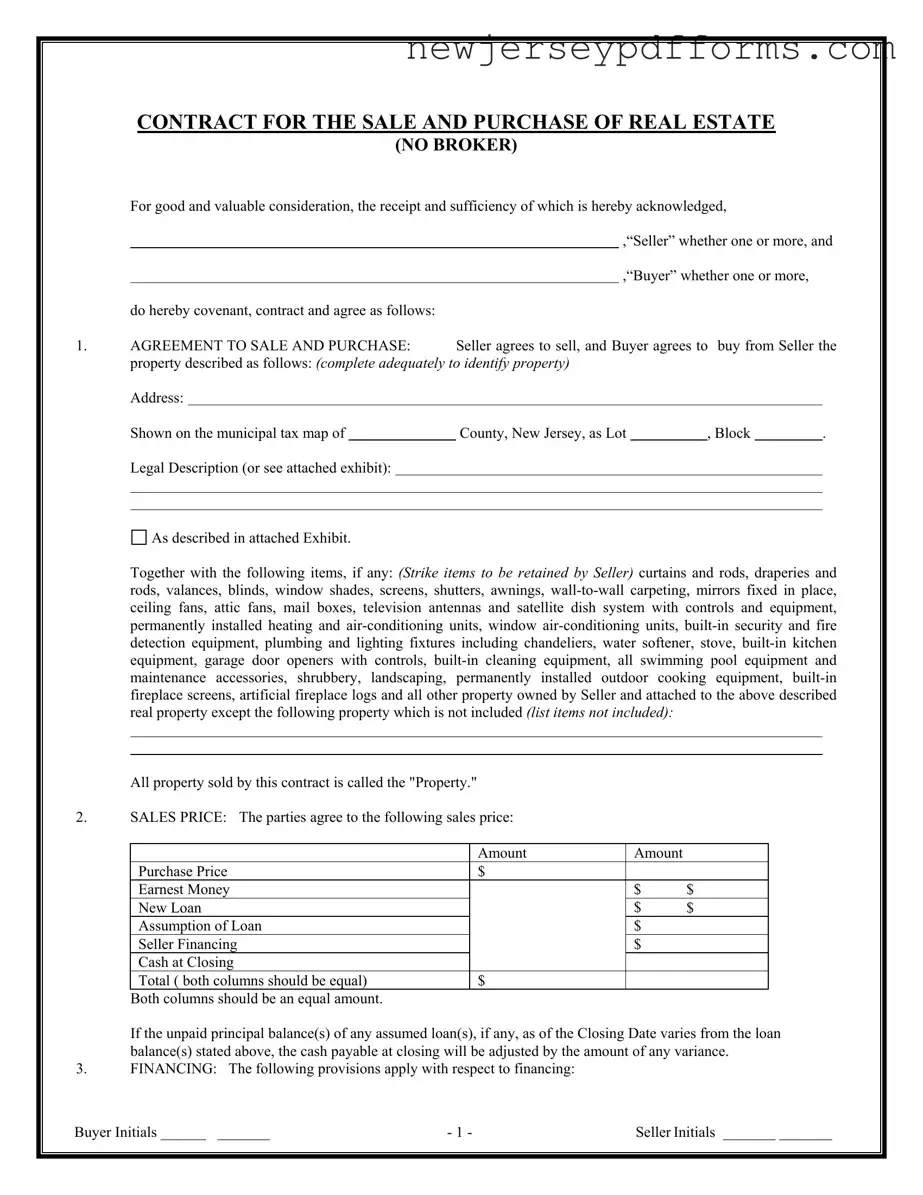

What is the NJ Contract Sale form?

The NJ Contract Sale form is a legal document used in New Jersey for the sale and purchase of real estate without the involvement of a broker. It outlines the terms of the sale, including the property description, sales price, financing details, and conditions regarding the property's condition. This contract serves as a binding agreement between the buyer and seller, ensuring both parties understand their rights and obligations in the transaction.

What should be included in the property description?

The property description must adequately identify the property being sold. This includes the address, lot number, and block number as shown on the municipal tax map. Additionally, any relevant legal descriptions should be attached as an exhibit. It is important to clearly state any items included in the sale, such as appliances or fixtures, and to specify any items that are excluded from the sale.

How is the sales price structured?

The sales price is detailed in the contract and includes several components: the purchase price, earnest money, any new loan amounts, assumptions of existing loans, seller financing, and cash at closing. Both columns of the sales price must equal the total amount. If there is a variance in the unpaid principal balance of any assumed loan at closing, the cash payable will be adjusted accordingly.

What happens if financing is not obtained?

If the contract is contingent on the buyer obtaining financing and the buyer fails to secure it within the specified timeframe, the contract will terminate. In this case, the earnest money will be refunded to the buyer. The buyer must apply for financing within a set number of days after the effective date of the contract and make every reasonable effort to obtain approval.

What are the buyer's responsibilities regarding property inspections?

The buyer has the right to inspect the property at their expense. If the inspection reveals defects, the buyer must notify the seller within five days of receiving the report. The buyer can choose to cancel the contract and receive a refund of the earnest money, proceed with the purchase despite the defects, or renegotiate the terms of the contract with the seller.

What are the closing costs associated with the sale?

Closing costs can include attorney fees, title insurance, property insurance, appraisal fees, survey costs, and recording fees. The contract allows for flexibility in how these costs are allocated between the buyer and seller. Specific terms regarding the payment of closing costs should be clearly outlined in the contract.

What should a buyer do if the property is damaged before closing?

If the property is damaged by fire or other casualty after the contract's effective date, the seller is responsible for restoring it to its previous condition. If the seller cannot do so due to factors beyond their control, the buyer has options: terminate the contract for a refund of the earnest money, extend the closing date, or accept the property in its damaged condition along with an assignment of any insurance proceeds.