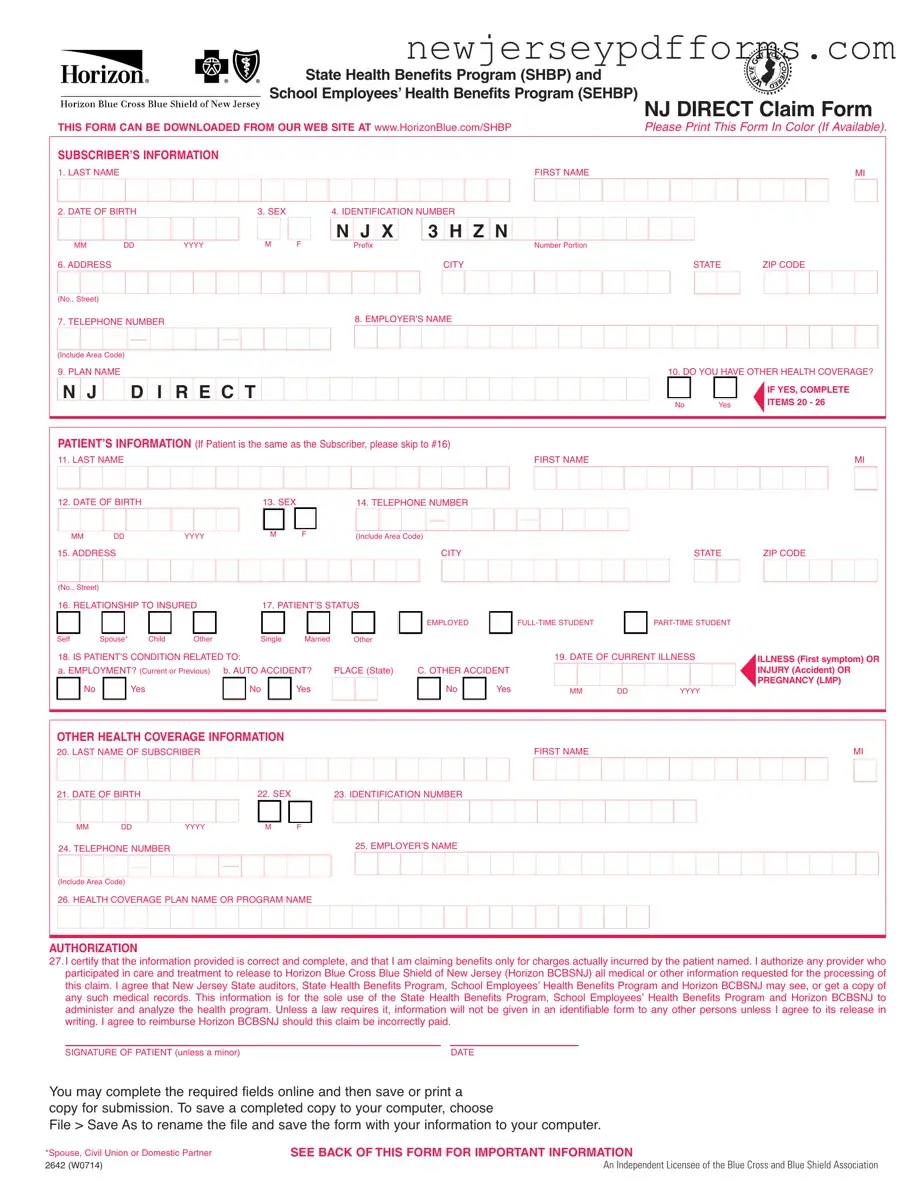

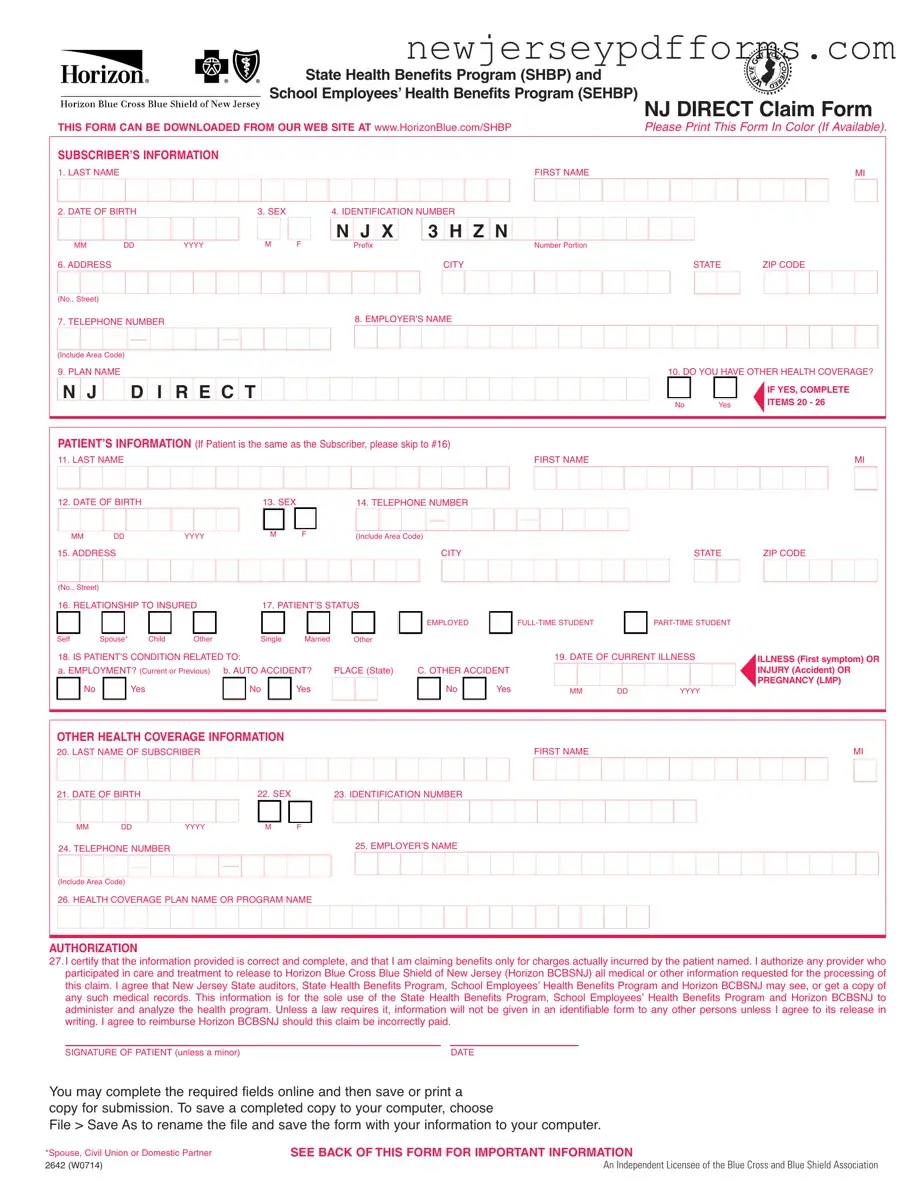

What is the NJ Direct Claim Form?

The NJ Direct Claim Form is a document used by members of the State Health Benefits Program (SHBP) and School Employees’ Health Benefits Program (SEHBP) to submit claims for medical expenses. It allows members to request reimbursement for healthcare services received.

How can I obtain the NJ Direct Claim Form?

You can download the NJ Direct Claim Form from the Horizon Blue Cross Blue Shield of New Jersey website at www.HorizonBlue.com/SHBP. It is recommended to print the form in color if possible for better clarity.

What information do I need to provide on the form?

The form requires personal information such as the subscriber's name, date of birth, identification number, and contact details. Additionally, details about the patient, the nature of the claim, and any other health coverage must be included. Ensure that all fields are completed accurately to avoid delays.

What should I attach to my claim form?

Attach itemized bills for covered services or supplies to the claim form. Each bill must include the provider's name and address, the patient's full name, the type of service rendered, the date of service, the amount charged, and the diagnosis. Non-itemized bills, such as cash register receipts, will not be accepted.

What if I have other health coverage?

If you or your dependents have other health insurance, you must complete the Other Health Coverage section of the form. Include any relevant documentation, such as a Notice of Payment or Explanation of Benefits from the other insurer, especially if the claim was partially paid or denied.

What if the patient is eligible for Medicare?

If the patient is eligible for Medicare benefits, include the Explanation of Medicare Benefits (EOMB) with your claim. This document outlines what Medicare paid or did not pay. Ensure that you write your NJ Direct identification number clearly on the first page of the EOMB.

Where do I submit my completed claim form?

Submit your completed claim form for medical claims to Horizon Blue Cross Blue Shield of New Jersey at P.O. Box 820, Newark, NJ 07101-0820. For mental health or substance abuse claims, send it to Horizon Behavioral Health at P.O. Box 10191, Newark, NJ 07101-3189.

What should I do if I have questions about the claim process?

If you have any questions regarding how to submit your claims, you can contact Customer Service at 1-800-414-SHBP (7427). They can provide assistance and clarify any uncertainties you may have.

What happens if I provide false information on the claim form?

Submitting a claim with false or misleading information can result in criminal and civil penalties. It is important to provide accurate and truthful information to avoid any legal consequences.