The NJ Estate form shares similarities with the IRS Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return. Both forms are used to report the value of a decedent's estate and calculate any taxes owed. While the NJ form focuses on state-specific inheritance and estate taxes, Form 706 serves a federal purpose. The deadlines for filing and extensions differ, with the IRS allowing for a longer initial extension period compared to New Jersey. However, both forms require detailed information about the decedent's assets and liabilities, ensuring that all taxable elements are accounted for.

Another comparable document is the IRS Form 1041, the U.S. Income Tax Return for Estates and Trusts. This form is filed by the estate to report income generated during the period of administration. Like the NJ Estate form, it requires specific information about the decedent and the estate's financial activities. While the NJ form addresses tax obligations at the time of death, Form 1041 focuses on ongoing income tax responsibilities. Both documents are essential for ensuring compliance with tax laws, albeit at different stages of the estate's lifecycle.

The NJ Estate form also bears resemblance to the probate court petition for letters testamentary or letters of administration. This document initiates the legal process of administering an estate. Both forms require identification of the decedent and the appointed executor or administrator. While the NJ form is concerned with tax extensions, the probate petition is about granting authority to manage the estate. Each document plays a crucial role in the overall estate administration process, ensuring that the decedent's wishes are honored and legal obligations met.

A Pennsylvania Bill of Sale form is crucial in documenting the sale and transfer of personal property, clearly listing the involved parties, item specifics, and sale amount. This ensures clarity and legal protection for both buyer and seller, helping to avert future disagreements. For detailed guidance on obtaining this essential document, visit topformsonline.com/pennsylvania-bill-of-sale.

Additionally, the NJ Estate form is similar to the IRS Form 8822, which is used to notify the IRS of a change of address. Although it serves a different purpose, both documents require accurate identification of the decedent or the estate representative. Keeping the IRS informed of address changes is essential for ensuring that tax correspondence reaches the appropriate parties. Similarly, the NJ Estate form ensures that the state is aware of the executor's contact information for tax-related communications.

The NJ Estate form is also akin to the final income tax return for the decedent, often filed using IRS Form 1040. This return accounts for the decedent's income up to the date of death. Both documents require comprehensive financial information and must be filed within specific timeframes. While the NJ Estate form deals with estate taxes, the final income tax return focuses on income tax obligations. Each form is vital in ensuring that all tax liabilities are settled appropriately.

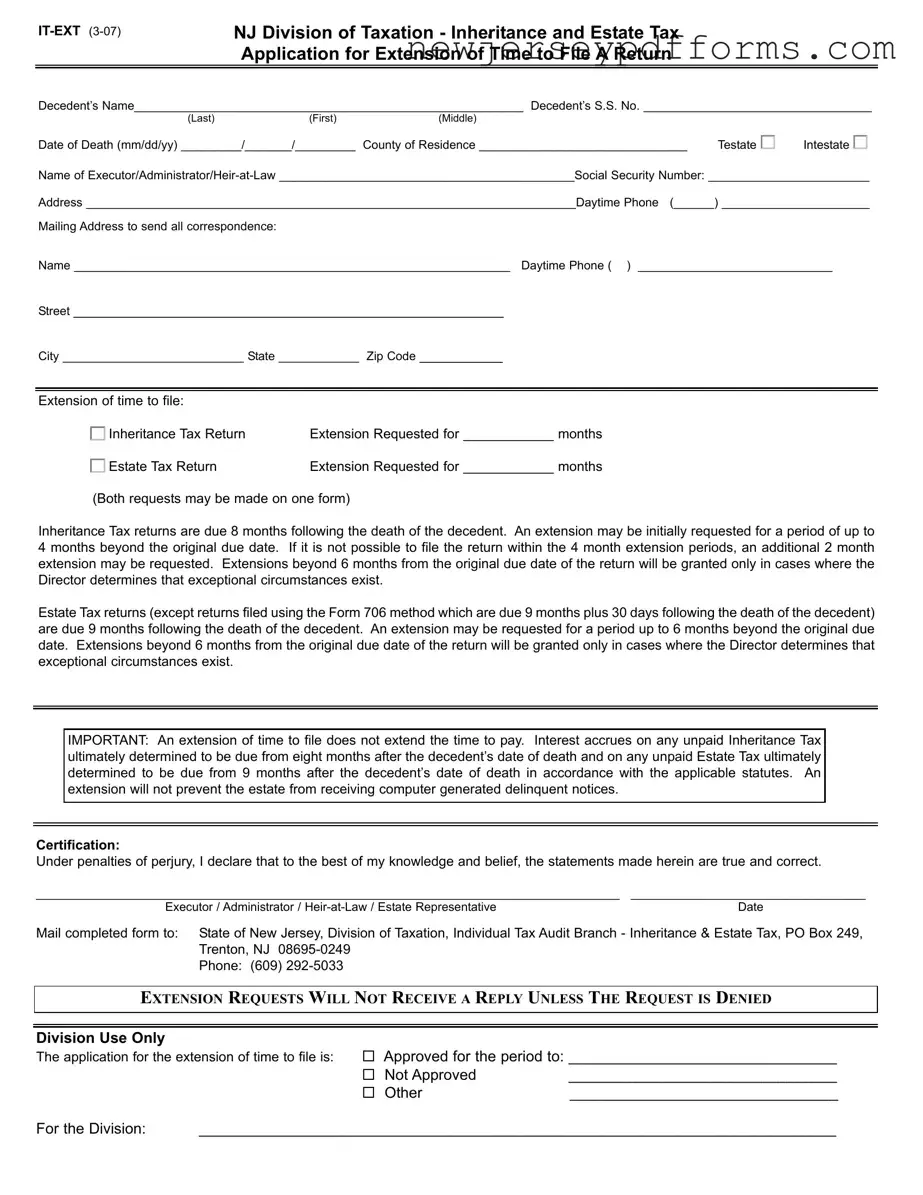

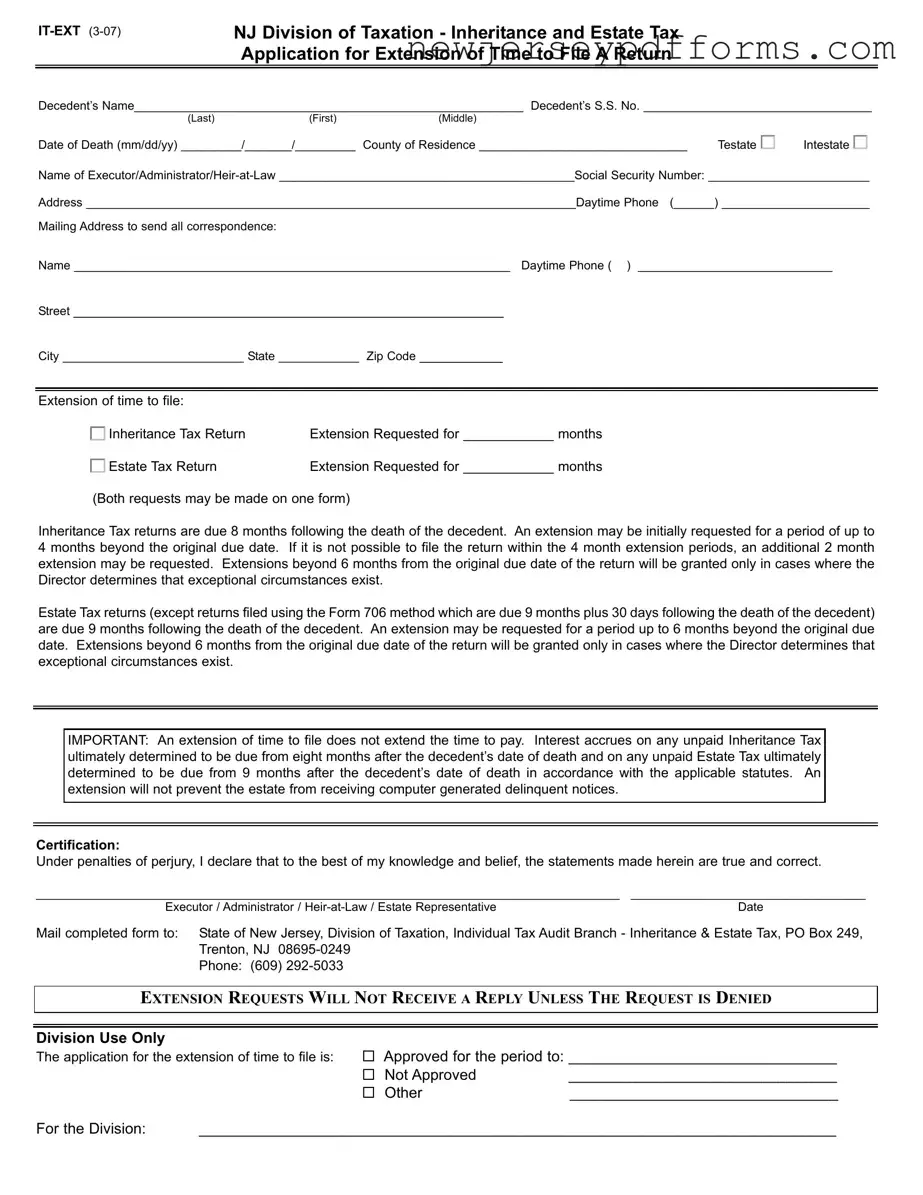

Another related document is the NJ Inheritance Tax Return, which is specifically designed to report and calculate the inheritance tax owed by beneficiaries. Similar to the NJ Estate form, this document requires detailed information about the decedent's estate and the beneficiaries. Both forms are interconnected, as the inheritance tax return is often filed in conjunction with the estate tax return. They ensure that the state collects the appropriate taxes based on the decedent's assets and the beneficiaries' inheritances.

The NJ Estate form is also comparable to the Certificate of Death, which serves as official documentation of the decedent's passing. While the NJ form focuses on tax obligations, the Certificate of Death is crucial for initiating various legal processes, including probate. Both documents require accurate identification of the decedent and play significant roles in the administration of the estate. The Certificate of Death is often a prerequisite for filing the NJ Estate form, linking the two processes.

Moreover, the NJ Estate form is similar to a trust accounting document, which details the income and expenses of a trust during its administration. Both documents require transparency and accuracy in reporting financial information. While the NJ Estate form is concerned with tax obligations following a death, trust accounting focuses on the ongoing management of trust assets. Each document serves to protect the interests of beneficiaries and ensure compliance with legal standards.

Finally, the NJ Estate form can be compared to a property transfer deed, which is used to transfer ownership of real estate following a decedent's death. Both documents require detailed information about the property and the decedent. While the NJ form addresses tax obligations, the property transfer deed facilitates the actual transfer of assets to heirs or beneficiaries. Each document is essential in the overall process of settling an estate and ensuring that the decedent's wishes are fulfilled.