What is the NJ L-9 form used for?

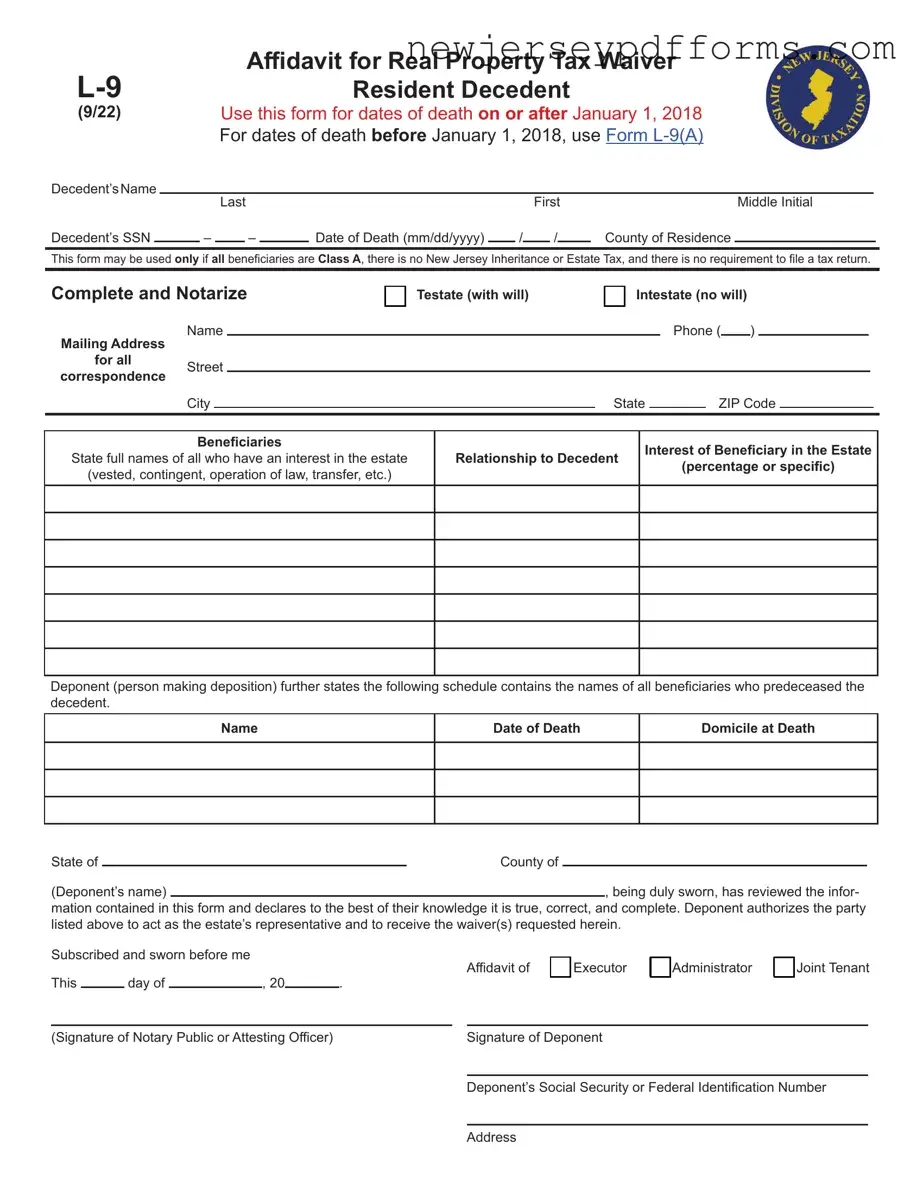

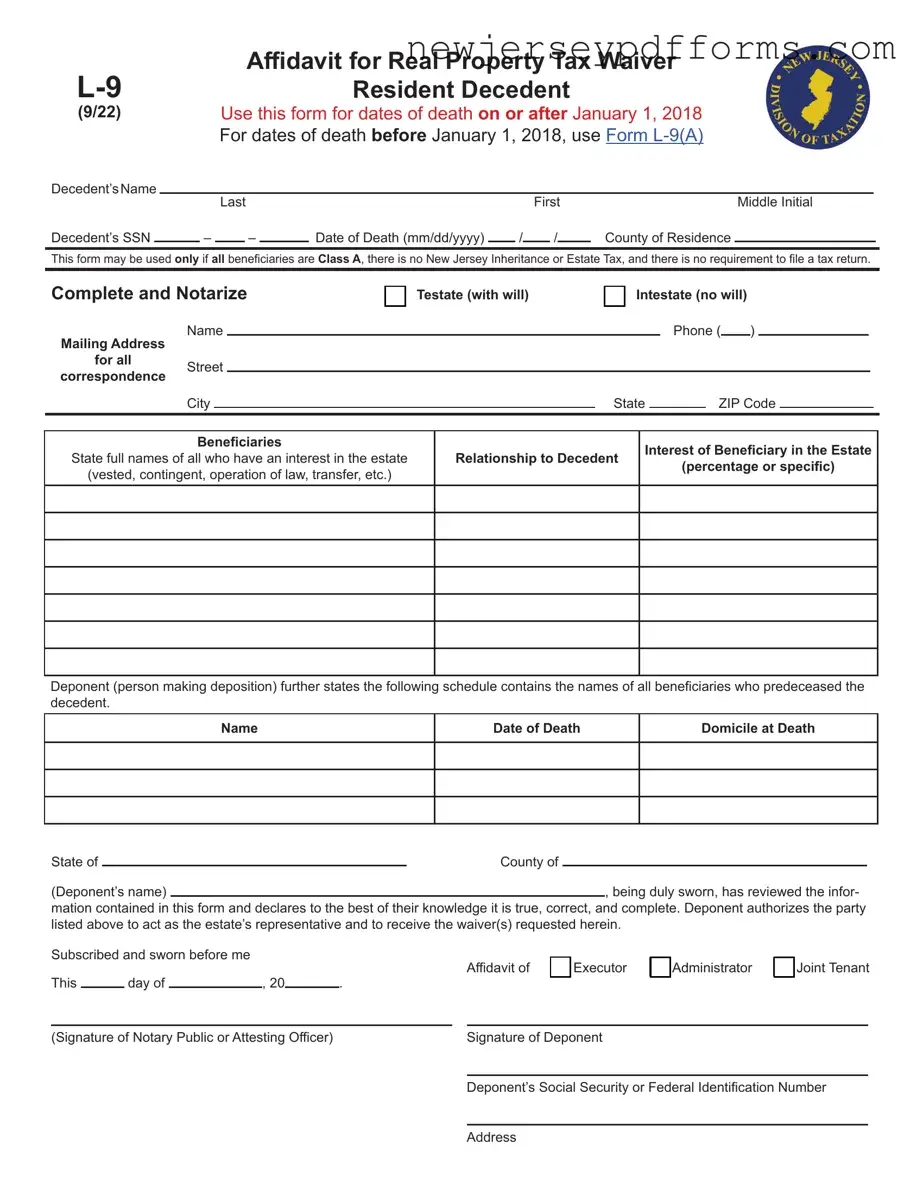

The NJ L-9 form, also known as the Affidavit for Real Property Tax Waiver, is used to request a waiver of real property taxes for a decedent's estate. It applies specifically to individuals who passed away on or after January 1, 2018. This form is essential for beneficiaries seeking to manage the estate's tax obligations efficiently.

Who can complete the NJ L-9 form?

The form can be completed by the executor, administrator, or joint tenant of the property for which the waiver is requested. This flexibility allows those directly involved in the estate's management to handle the necessary paperwork without undue complications.

Who qualifies as a Class A beneficiary?

To qualify as a Class A beneficiary, individuals must be one of the following: a spouse or civil union partner, a child (including legally adopted children), a grandchild, a great-grandchild, a parent, a grandparent, a step-child, or a domestic partner (as recognized since July 10, 2004). This classification is crucial because only Class A beneficiaries can use the NJ L-9 form for tax waivers.

What conditions disqualify the use of the NJ L-9 form?

The NJ L-9 form cannot be used if certain conditions exist. These include if the real estate was held as “tenants by the entirety” and a surviving spouse or civil union partner is involved, if any asset valued at $500 or more passes to beneficiaries outside of the Class A list, if a mutually acknowledged child relationship is claimed, or if there are any New Jersey Inheritance or Estate Taxes due. Understanding these disqualifications is essential for proper form usage.

What documents are required to submit with the NJ L-9 form?

When submitting the NJ L-9 form, several documents must accompany it. These include a copy of the decedent’s will and any codicils, a copy of the deed for the property, a copy of the executor’s or administrator’s certificate, and a copy of the decedent’s death certificate. Providing these documents ensures the form is processed smoothly.

Where should the completed NJ L-9 form be mailed?

The completed NJ L-9 form should be mailed to the NJ Division of Taxation, specifically to the Inheritance and Estate Tax Branch. The address is 50 Barrack Street, 3rd Floor, PO Box 249, Trenton, NJ 08695-0249. It is important not to file this form with the County Clerk.

Is the NJ L-9 form a tax waiver?

No, the NJ L-9 form is not a tax waiver itself. Instead, it serves as a request for a waiver of real property taxes related to the estate of the decedent. Therefore, it should not be confused with an actual tax waiver document.

How can I get more information about the NJ L-9 form?

For additional information regarding the NJ L-9 form, individuals can call the Inheritance and Estate Tax Branch at (609) 292-5033. Alternatively, visiting the Division of Taxation's website at www.njtaxation.org can provide further guidance and resources related to the form.