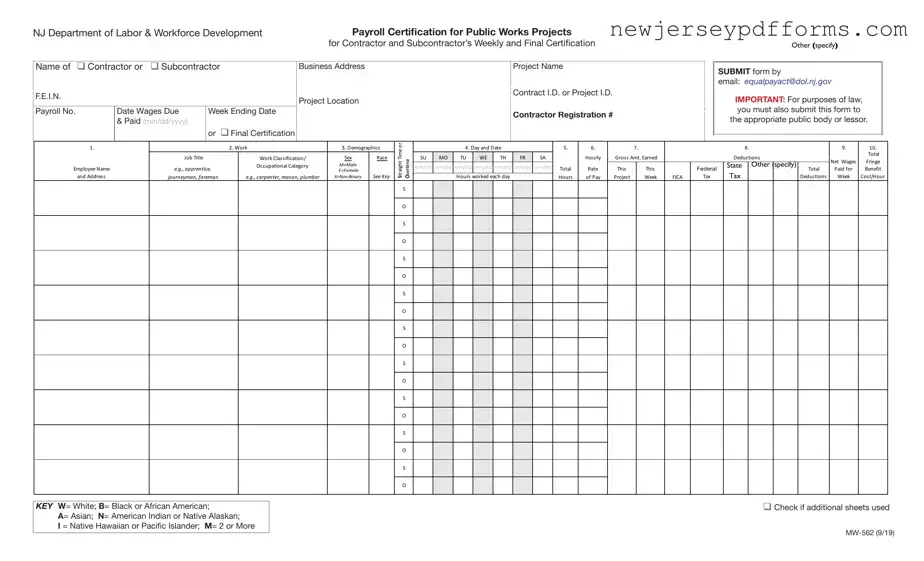

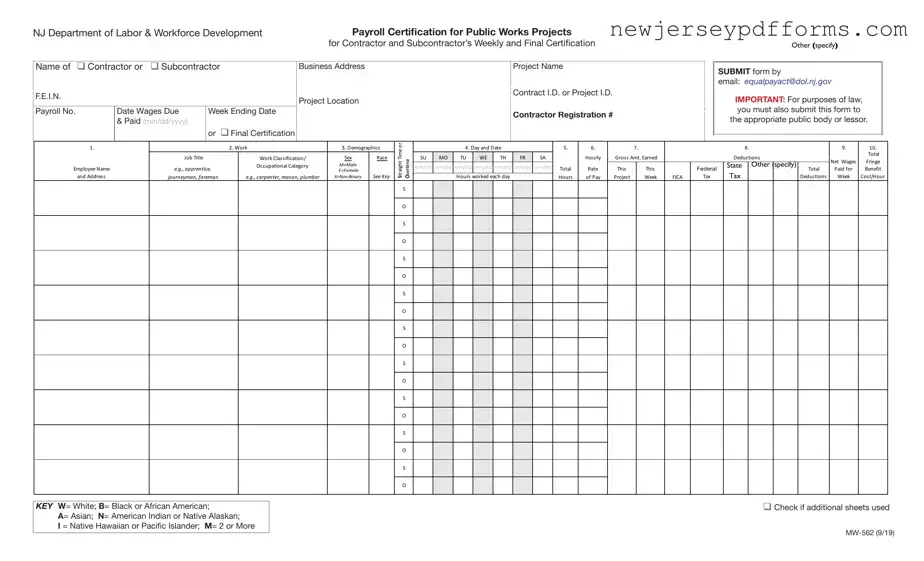

The Davis-Bacon Act Wage Determination form is similar to the NJ Payroll Certification form in that both documents are used to ensure compliance with prevailing wage laws on public works projects. The Davis-Bacon Act requires contractors and subcontractors to pay laborers and mechanics employed on federal government contracts at least the locally prevailing wages and benefits. Like the NJ Payroll Certification, the Davis-Bacon form includes information about the project, the workers, their classifications, and the wages paid. Both forms aim to protect workers' rights and ensure fair compensation for labor performed on public projects.

The Certified Payroll Report is another document that shares similarities with the NJ Payroll Certification form. This report is typically required for federal and state-funded projects to demonstrate compliance with wage laws. It includes details about the project, employee classifications, hours worked, and wages paid, much like the NJ form. The Certified Payroll Report serves as a verification tool for government agencies to ensure that contractors are adhering to wage regulations and that employees are receiving proper compensation for their work.

The Employee Earnings Record is also akin to the NJ Payroll Certification form, as it tracks the wages and deductions for individual employees over a specific period. This record includes information such as hours worked, pay rates, and total earnings, similar to the detailed wage information required in the NJ form. While the Employee Earnings Record is more focused on individual employees, both documents serve the purpose of ensuring accurate wage reporting and compliance with labor laws.

The Wage Rate Schedule is another document that parallels the NJ Payroll Certification. This schedule outlines the minimum wage rates for various classifications of laborers and mechanics on public works projects. It serves as a reference for contractors to ensure that they are paying their workers in accordance with state and federal wage laws. Both the Wage Rate Schedule and the NJ Payroll Certification emphasize the importance of adhering to established wage standards to protect workers' rights.

The Labor Compliance Checklist is similar to the NJ Payroll Certification form in that it is used by contractors to ensure compliance with labor laws on public works projects. This checklist includes various requirements, such as wage determinations, certified payroll submissions, and proper classification of workers. By completing this checklist, contractors can verify that they are meeting all necessary legal obligations, just as the NJ Payroll Certification requires them to certify their compliance with wage laws.

The New Jersey Prevailing Wage Act Compliance form is closely related to the NJ Payroll Certification. This form is specifically designed to ensure that contractors and subcontractors are aware of and compliant with the state's prevailing wage requirements. It includes similar information regarding employee classifications, wages, and hours worked, reinforcing the need for accurate reporting and adherence to wage laws, much like the NJ Payroll Certification.

The Form WH-347, which is a federal certified payroll form, shares similarities with the NJ Payroll Certification form. It is used by contractors on federally funded projects to report wages paid to employees. The WH-347 includes detailed information about the project, employee classifications, hours worked, and wages, paralleling the information required in the NJ form. Both forms serve as tools for ensuring compliance with wage laws and protecting workers' rights.

Understanding the various forms related to payroll certification is crucial for contractors, and another essential document to consider is the Pennsylvania Motor Vehicle Bill of Sale form. This form is a legal document that facilitates the transfer of ownership of a vehicle, serving as proof of purchase and including essential information about the vehicle and the involved parties. For those looking for guidance or templates, resources such as PDF Document Service can be invaluable, ensuring that all necessary details are correctly captured to enable a smooth transaction.

The Fringe Benefits Certification form is another document that resembles the NJ Payroll Certification. This form is used to report the fringe benefits provided to employees, such as health insurance and retirement contributions. It complements the NJ Payroll Certification by ensuring that contractors are not only paying the minimum wage but also providing the required benefits. Both documents emphasize the importance of fair compensation and compliance with labor regulations.

Finally, the Labor Standards Enforcement form is similar to the NJ Payroll Certification in that it is used to monitor compliance with labor laws. This form is typically used by government agencies to track contractors' adherence to wage and hour regulations. It includes information about wages, hours worked, and employee classifications, reinforcing the need for accurate reporting and compliance, just like the NJ Payroll Certification form does.