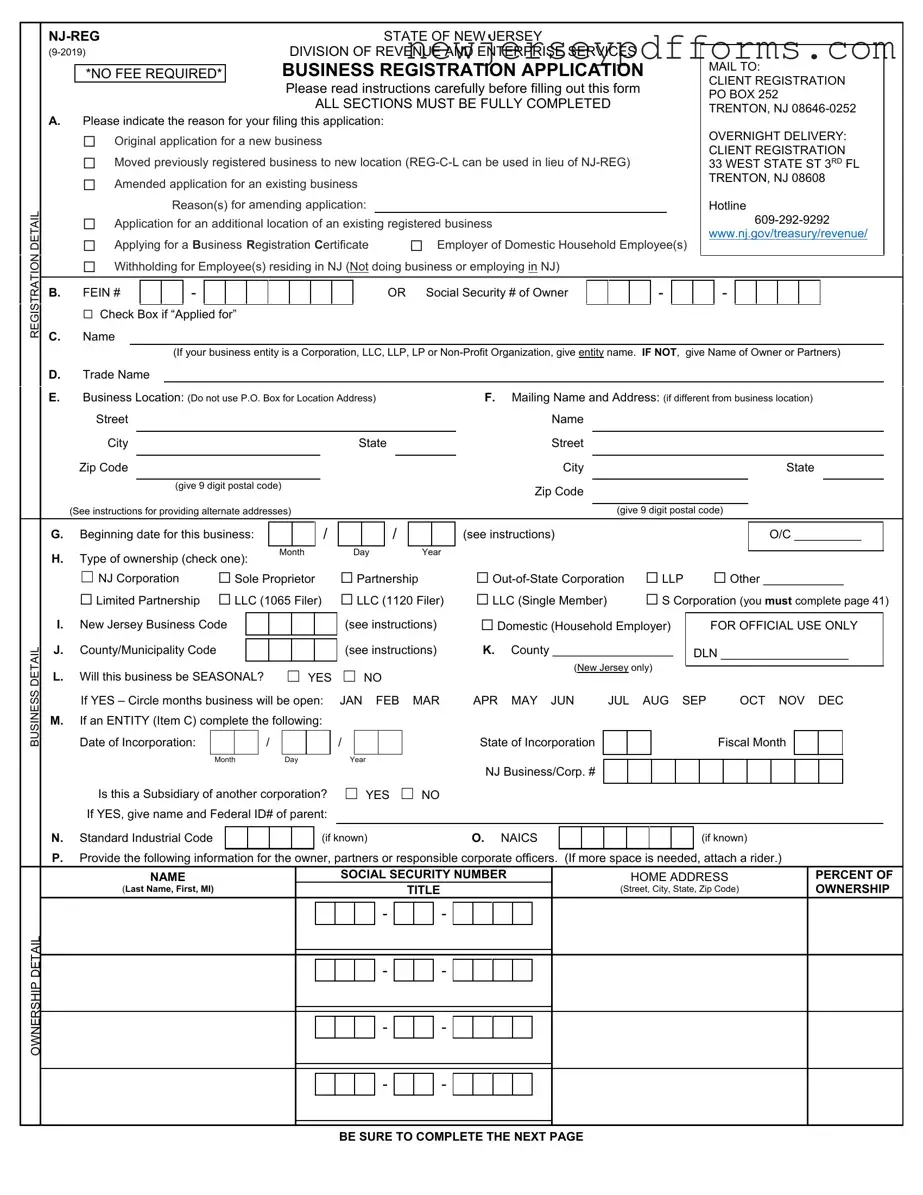

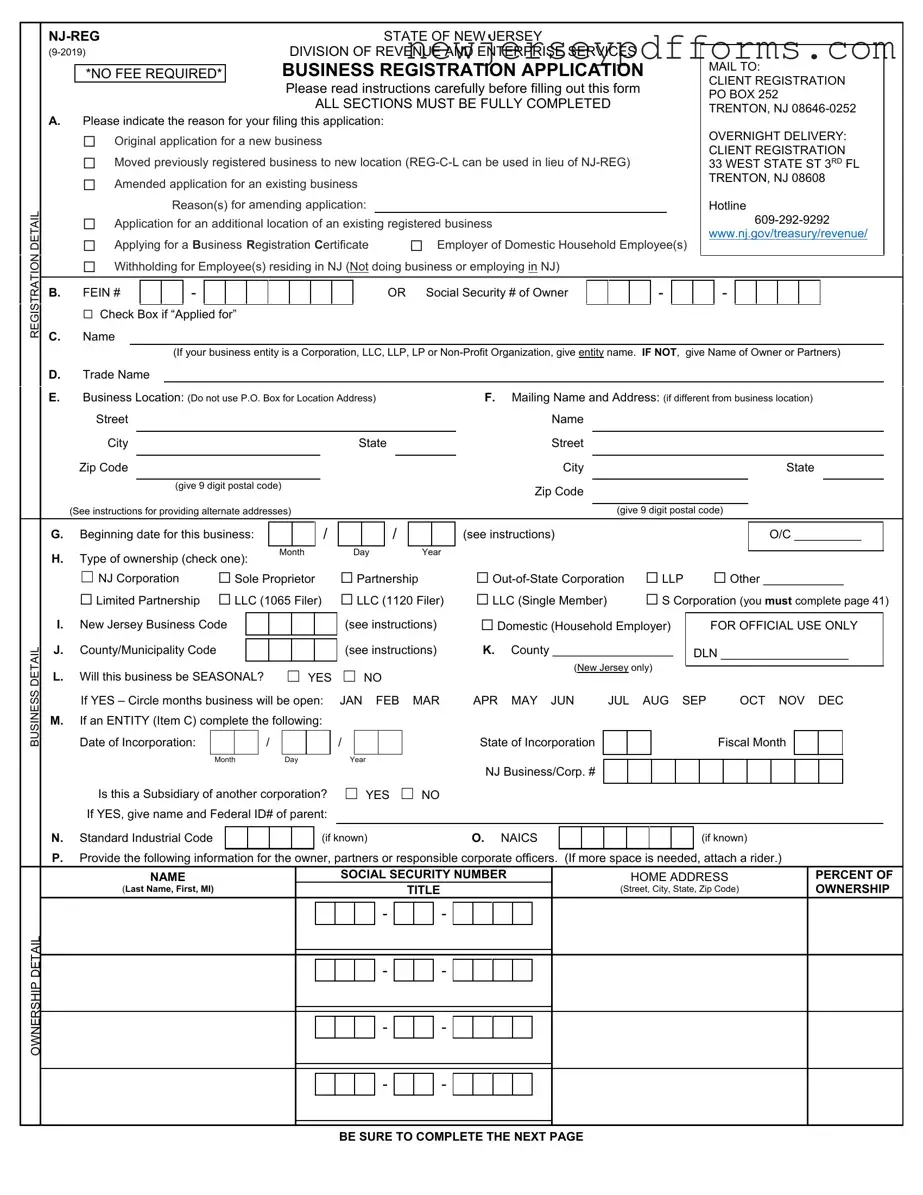

The NJ-REG form shares similarities with the IRS Form SS-4, which is used to apply for an Employer Identification Number (EIN). Both documents require information about the business structure, ownership, and location. While the NJ-REG focuses on state-specific registration, the SS-4 is primarily concerned with federal tax identification. Completing either form is crucial for compliance with tax obligations, and both forms ask for similar owner identification details, including Social Security numbers and business names.

Another document comparable to the NJ-REG is the New Jersey Business Registration Certificate application. This certificate is essential for businesses operating in New Jersey, as it serves as proof of registration with the state. Like the NJ-REG, this application requires details about the business type, ownership, and location. Both documents aim to ensure that businesses comply with state regulations and tax laws, making them vital for any new venture in New Jersey.

The NJ-REG form is also similar to the IRS Form 1065, which is used by partnerships to report income, deductions, and other tax information. Both forms require detailed information about ownership and the distribution of profits among partners. While the NJ-REG focuses on state registration, the Form 1065 is geared toward federal tax reporting. Completing both forms is essential for partnerships to maintain compliance with both state and federal laws.

Understanding the various business registration forms is essential for compliance, and the Pennsylvania Motor Vehicle Bill of Sale form serves as a prime example within legal transactions. This document is crucial for the transfer of vehicle ownership and contains detailed information about the parties involved and the vehicle itself. To assist with these processes, you may find templates helpful, such as the one provided by PDF Document Service, which ensures proper documentation is maintained.

Additionally, the NJ-REG form resembles the New Jersey Sales Tax Registration application. This document is necessary for businesses that will collect sales tax in New Jersey. Both forms require information about the business structure and location. They also ensure that businesses understand their tax obligations. Completing the Sales Tax Registration is critical for any business planning to sell taxable goods or services in the state.

The New Jersey Certificate of Incorporation is another document that shares similarities with the NJ-REG form. This certificate is required for corporations and LLCs and establishes the legal existence of the business. Both documents collect information about the business's name, structure, and ownership. While the NJ-REG focuses on registration for tax purposes, the Certificate of Incorporation is essential for legal recognition and compliance with state laws.

Moreover, the NJ-REG form is akin to the New Jersey Partnership Registration form. This form is specifically for partnerships and requires similar information regarding ownership and business location. Both documents are crucial for partnerships to register with the state and fulfill their tax obligations. Completing either form ensures that partnerships are recognized by the state and can operate legally.

The NJ-REG form is also similar to the New Jersey Non-Profit Registration form. Non-profit organizations must complete this form to operate legally in the state. Both documents require information about the organization’s purpose, structure, and ownership. While the NJ-REG is broader in scope, the Non-Profit Registration focuses specifically on non-profit entities, ensuring they comply with state regulations.

Furthermore, the NJ-REG bears resemblance to the New Jersey Business Entity Annual Report. This report is filed annually and provides updated information about the business's structure and ownership. Both documents require detailed information about the business and serve to keep the state informed about active businesses. Completing the Annual Report is essential for maintaining good standing in New Jersey.

Lastly, the NJ-REG form is similar to the New Jersey Domestic Partnership Registration form. This form is specifically for domestic partnerships and requires details about the partners and their relationship. Both forms share a focus on the legal recognition of the entity and the need for proper registration with the state. Completing either form is crucial for ensuring compliance with New Jersey laws regarding partnerships.