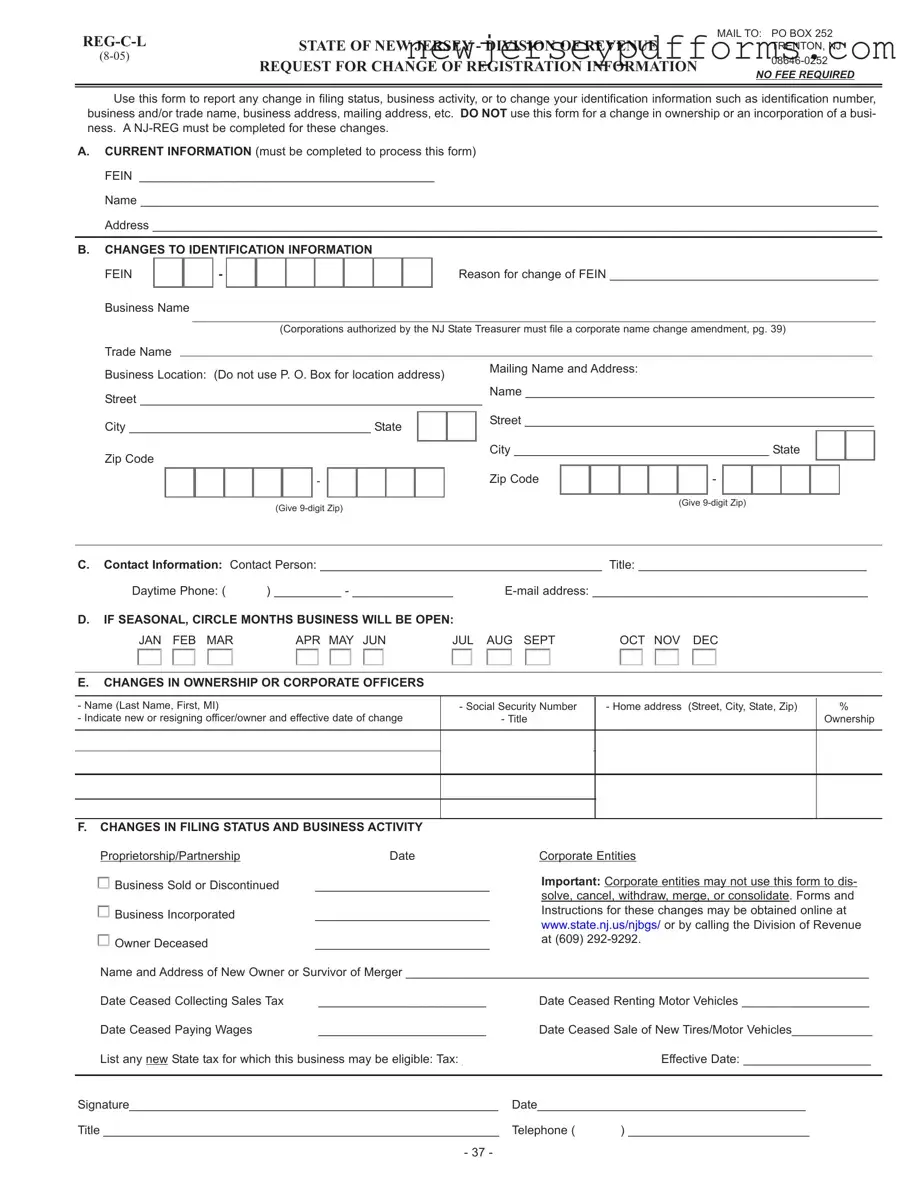

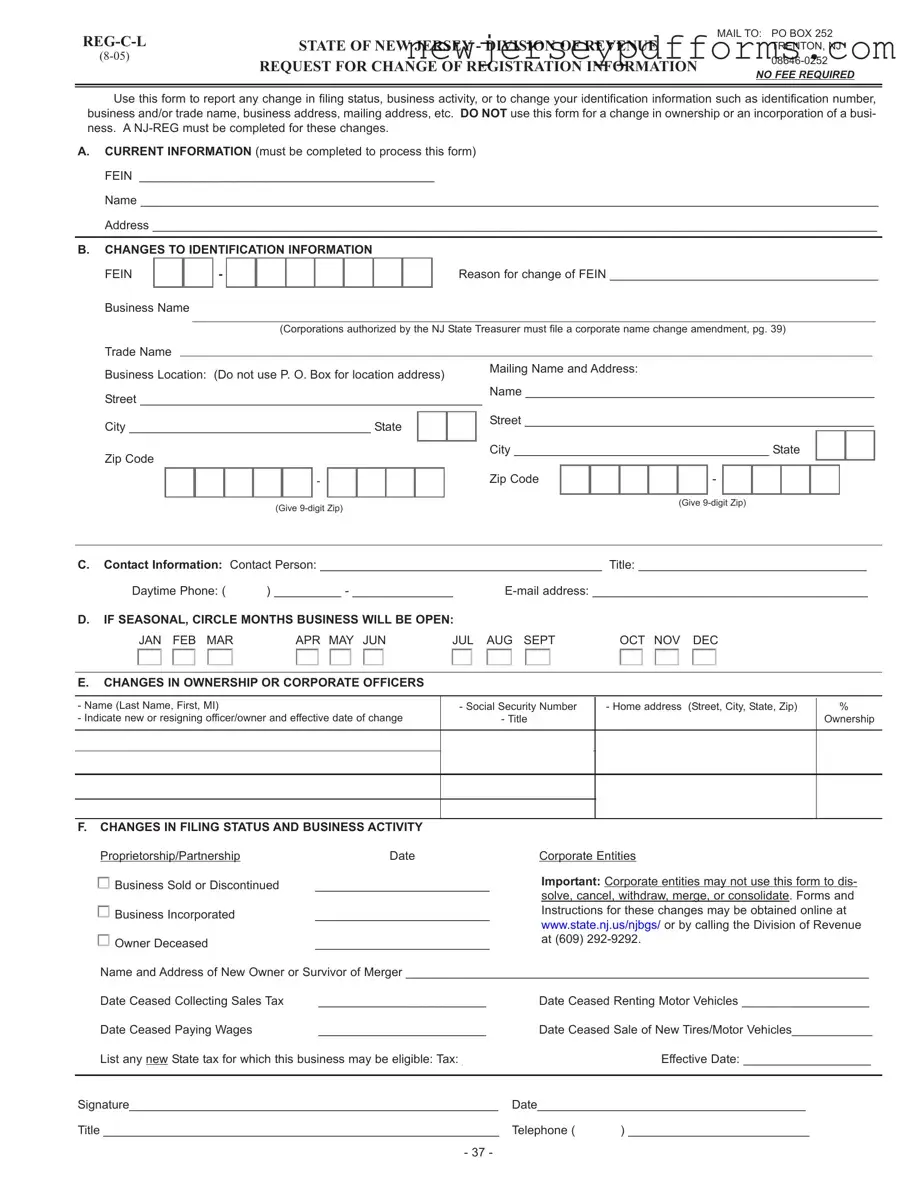

What is the purpose of the NJ Reg C L form?

The NJ Reg C L form is used to report changes in registration information for businesses in New Jersey. This includes changes in filing status, business activity, or identification information such as your business name, address, or identification number. It is important to note that this form should not be used for changes in ownership or incorporation of a business.

Who should use the NJ Reg C L form?

Sole proprietorships and partnerships should use this form to report changes related to tax and wage registration. Additionally, corporations and other business entities can use it to update their address or seasonal business cycles. However, if a business needs to make changes to its ownership or incorporate, they must use a different form.

What information is required to complete the NJ Reg C L form?

The form requires current information, including your Federal Employer Identification Number (FEIN), business name, and addresses. You must also provide details about the changes you are reporting, such as the reason for a change in FEIN or business name. Additionally, contact information for a representative of the business is needed.

Is there a fee associated with filing the NJ Reg C L form?

No fee is required to file the NJ Reg C L form. This makes it accessible for businesses to update their information without incurring additional costs.

How should the NJ Reg C L form be submitted?

Once completed, the form should be mailed to the Division of Revenue at PO Box 252, Trenton, NJ 08646-0252. Ensure that the form is filled out completely and accurately to avoid processing delays.

What happens if I need to change ownership or incorporate my business?

If you need to change ownership or incorporate your business, you cannot use the NJ Reg C L form. Instead, you must complete a NJ-REG form. This is specifically designed for ownership changes and incorporation processes.

Can I change my business address using the NJ Reg C L form?

Yes, you can change your business address using the NJ Reg C L form. Just ensure that you provide the new street address, city, state, and zip code. Remember, a P.O. Box cannot be used as the location address.

What should I do if I have questions about filling out the form?

If you have questions or need assistance while filling out the NJ Reg C L form, you can contact the Division of Revenue at (609) 292-9292. They can provide guidance and answer any specific questions you may have about the process.