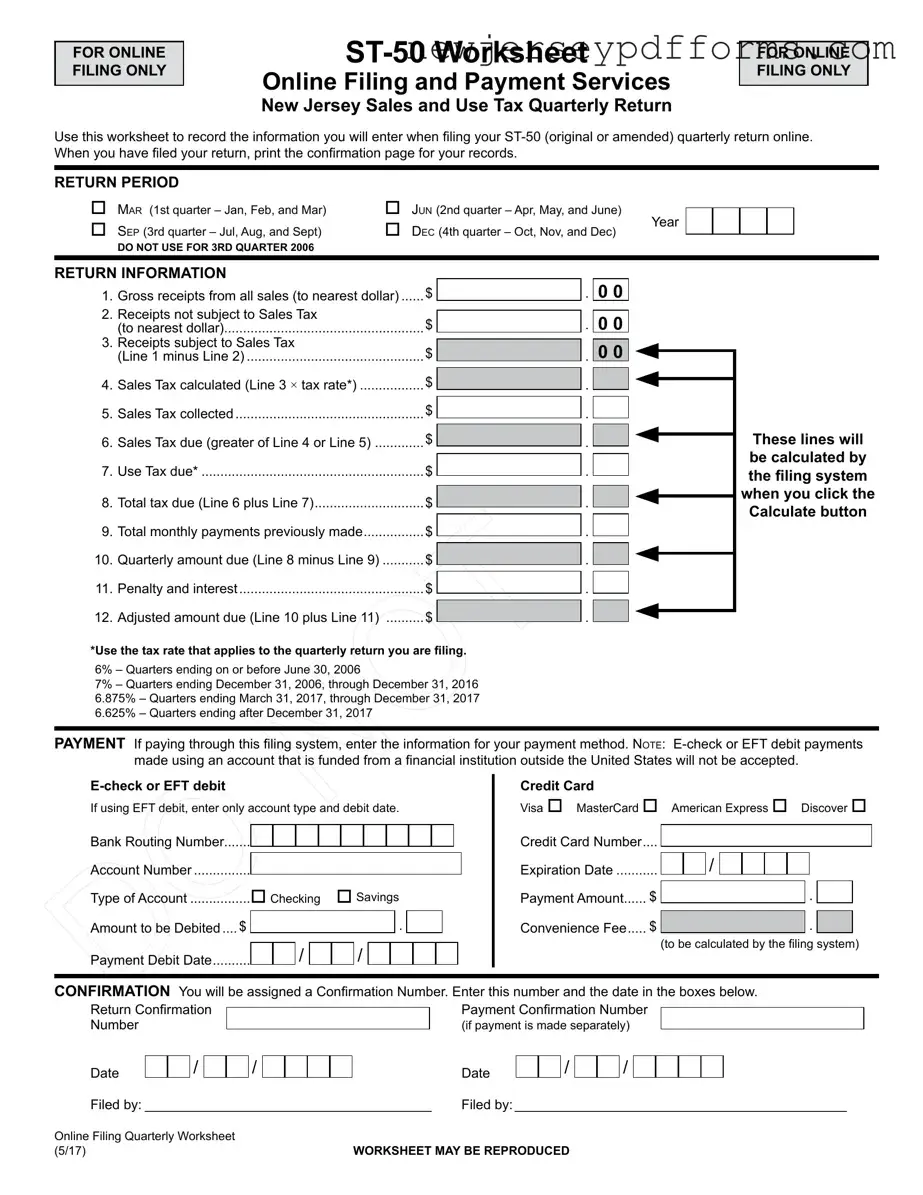

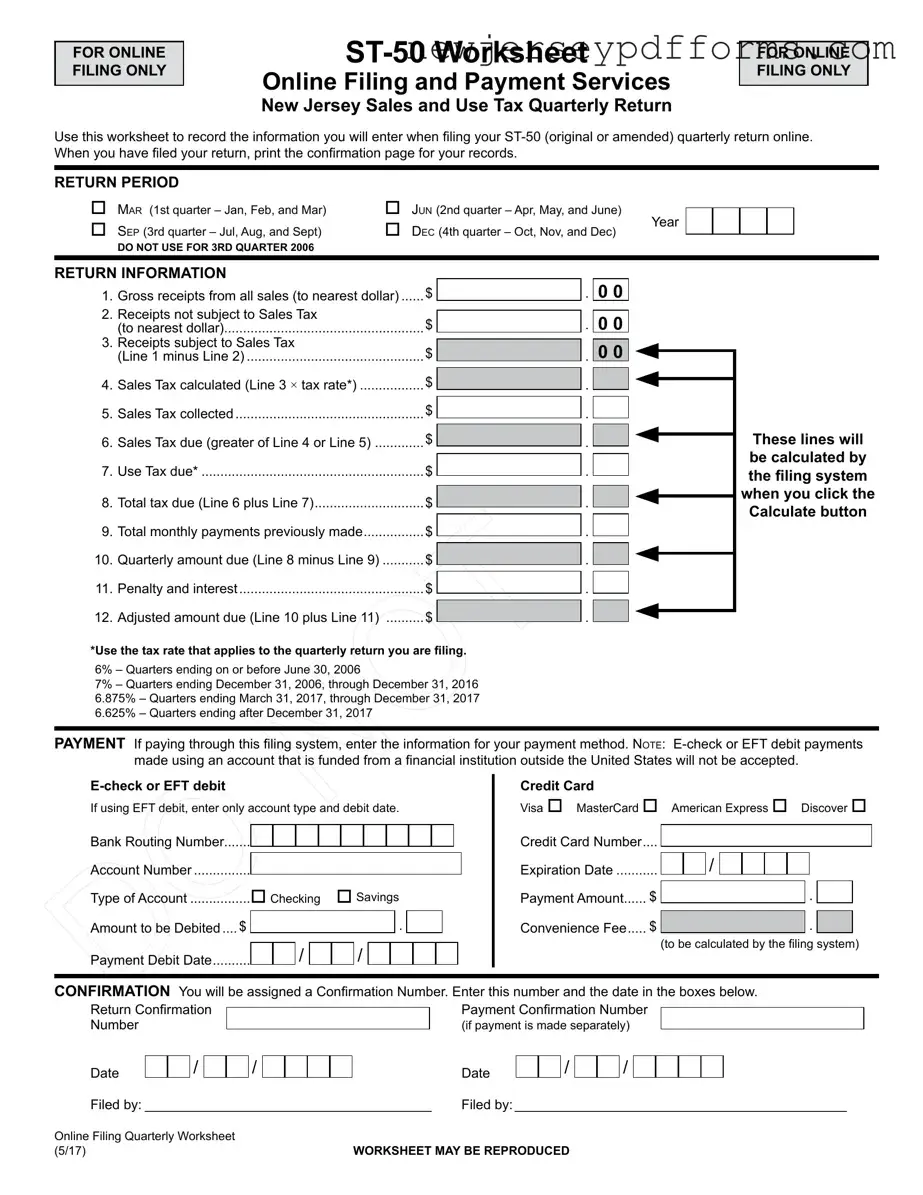

Printable Nj Sales Tax St 50 Form

The NJ Sales Tax ST-50 form is a crucial document used for filing quarterly sales and use tax returns in New Jersey. This form allows businesses to report their gross receipts, calculate the sales tax due, and make necessary payments online. Understanding how to accurately complete the ST-50 is essential for compliance and avoiding penalties.

Ready to fill out the form? Click the button below to get started!

Open Editor Here

Printable Nj Sales Tax St 50 Form

Open Editor Here

Open Editor Here

or

Download Nj Sales Tax St 50 PDF Form

Complete the form before time runs out

Edit your Nj Sales Tax St 50 online and complete it quickly.