The IRS Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, is similar to the NJ ST-5 form in that both documents are used by organizations seeking tax-exempt status. Form 1023 is specifically for organizations that qualify under section 501(c)(3), which includes charitable, religious, educational, and scientific organizations. Like the NJ ST-5, the IRS form requires detailed information about the organization’s structure, purpose, and activities, as well as supporting documentation to substantiate the claims made in the application.

The IRS Form 990, Return of Organization Exempt from Income Tax, shares similarities with the NJ ST-5 form as both serve to provide transparency and accountability for tax-exempt organizations. While the NJ ST-5 is an application for exemption, Form 990 is an annual reporting return that provides information on the organization’s financial status, governance, and compliance with tax regulations. Both forms require organizations to disclose financial information, including revenue and expenses, which helps the state and federal authorities monitor compliance with tax laws.

The IRS Form 1024, Application for Recognition of Exemption Under Section 501(a), is another document akin to the NJ ST-5. This form is utilized by organizations seeking exemption under various sections of the Internal Revenue Code, not just 501(c)(3). Similar to the NJ ST-5, Form 1024 requires the organization to provide a description of its activities and purposes, along with supporting documentation to justify its request for tax-exempt status.

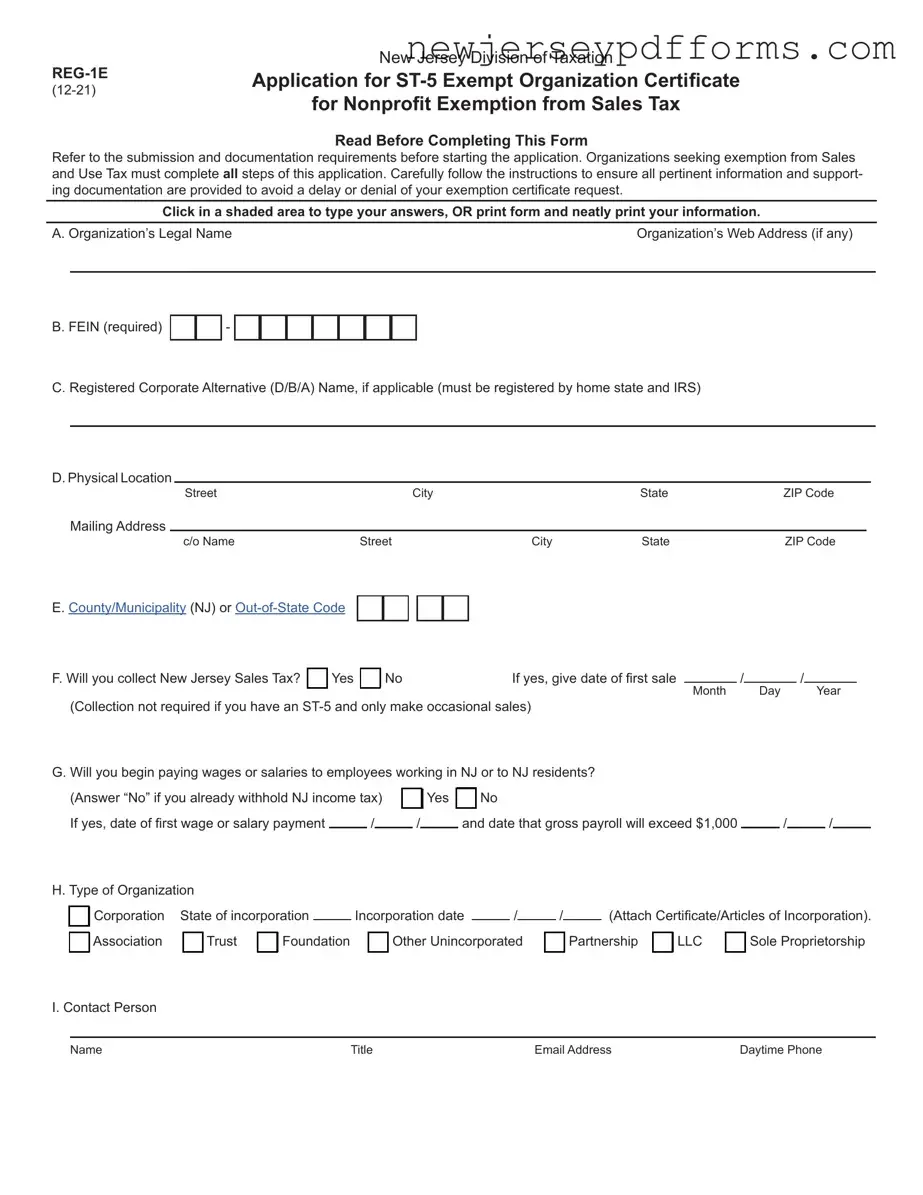

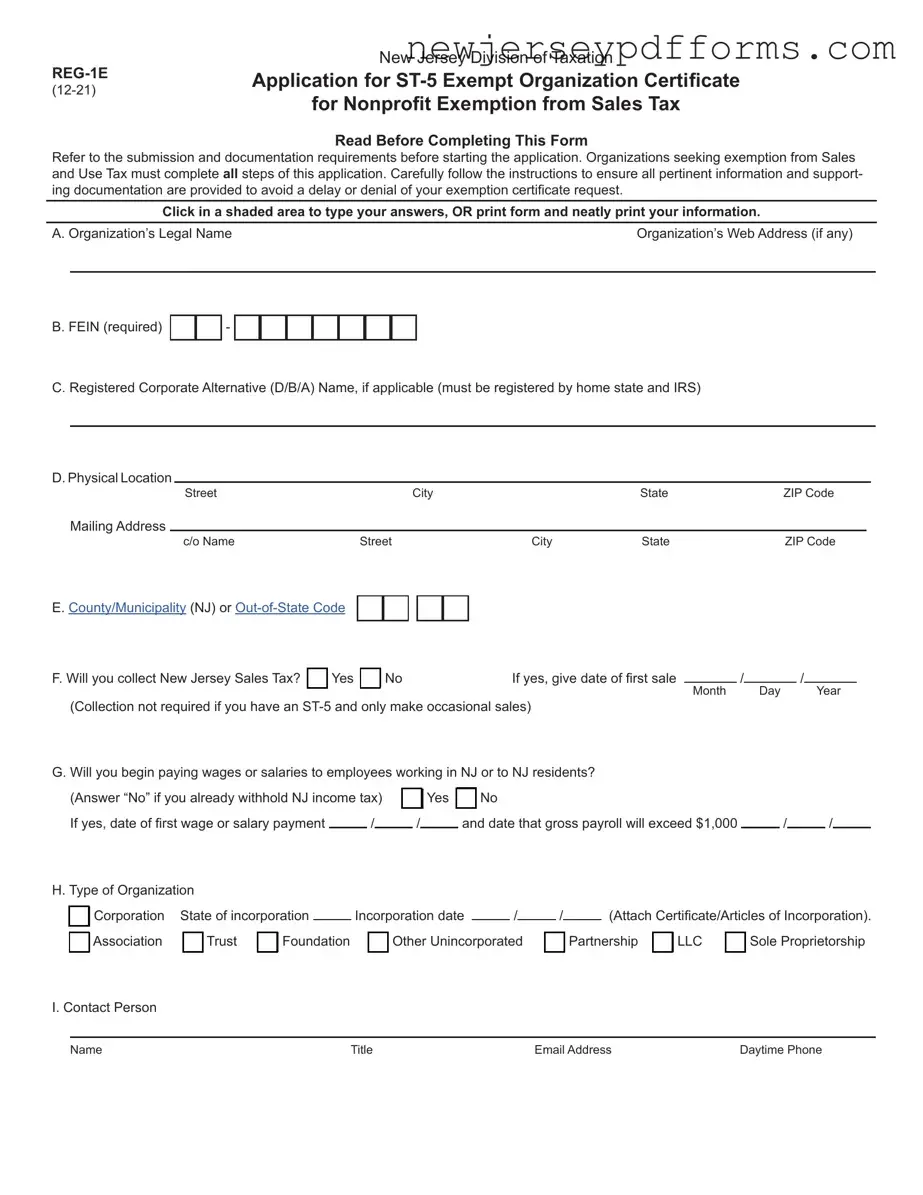

The New Jersey Division of Taxation’s REG-1E form is closely related to the NJ ST-5. The REG-1E is the application for a sales tax exemption certificate for nonprofit organizations. Both forms require organizations to demonstrate their eligibility for tax exemptions, and the REG-1E must be submitted along with the NJ ST-5 to initiate the exemption process. The documentation required for both forms ensures that the organization meets the necessary criteria for tax-exempt status.

The Form 990-N, e-Postcard, is a simplified version of the Form 990, designed for small tax-exempt organizations with gross receipts of $50,000 or less. While it is not directly comparable to the NJ ST-5, both documents serve to maintain the tax-exempt status of organizations by requiring them to report their financial activities. The Form 990-N is an easy way for small organizations to comply with federal reporting requirements, similar to how the NJ ST-5 facilitates state-level compliance.

The New Jersey Nonprofit Corporation Annual Report is another document similar to the NJ ST-5. This report must be filed annually by nonprofit organizations registered in New Jersey. Like the NJ ST-5, it requires organizations to provide information about their activities, governance, and financial status. Both forms are essential for maintaining compliance with state regulations and ensuring that organizations remain in good standing.

For anyone navigating the complexities of divorce in California, the key Divorce Settlement Agreement details can provide crucial guidance. This document outlines the necessary terms and helps ensure a smoother process by addressing important aspects like property division and spousal support. Having a clear understanding of these elements is vital for both parties involved.

The IRS Form 990-T, Exempt Organization Business Income Tax Return, is relevant as it addresses the taxation of unrelated business income for tax-exempt organizations. While the NJ ST-5 focuses on obtaining tax-exempt status, the 990-T ensures that organizations report and pay taxes on income generated from activities not substantially related to their exempt purpose. Both forms reflect the broader regulatory framework governing tax-exempt organizations.

The New Jersey Charitable Registration and Investigation Act registration form is similar to the NJ ST-5 in that it requires charitable organizations to register with the state before soliciting donations. Both documents aim to ensure that organizations operate transparently and in compliance with state laws. The registration form requires organizations to provide information about their mission, governance, and financial practices, similar to the information required in the NJ ST-5.

The New Jersey Division of Taxation’s ST-4 Exempt Use Certificate is akin to the NJ ST-5 as both relate to tax exemptions. The ST-4 is used by organizations to claim exemption from sales tax on purchases made for exempt purposes. Like the NJ ST-5, the ST-4 requires organizations to provide evidence of their tax-exempt status and ensure compliance with state tax regulations.

Lastly, the New Jersey Sales Tax Exempt Organization Certificate (ST-5) is similar to the ST-5 form in that it is issued to organizations that qualify for sales tax exemption. Both forms require organizations to provide documentation proving their eligibility for tax-exempt status. The ST-5 serves as a certificate that organizations can present to vendors to make tax-exempt purchases, reinforcing the relationship between the two documents.