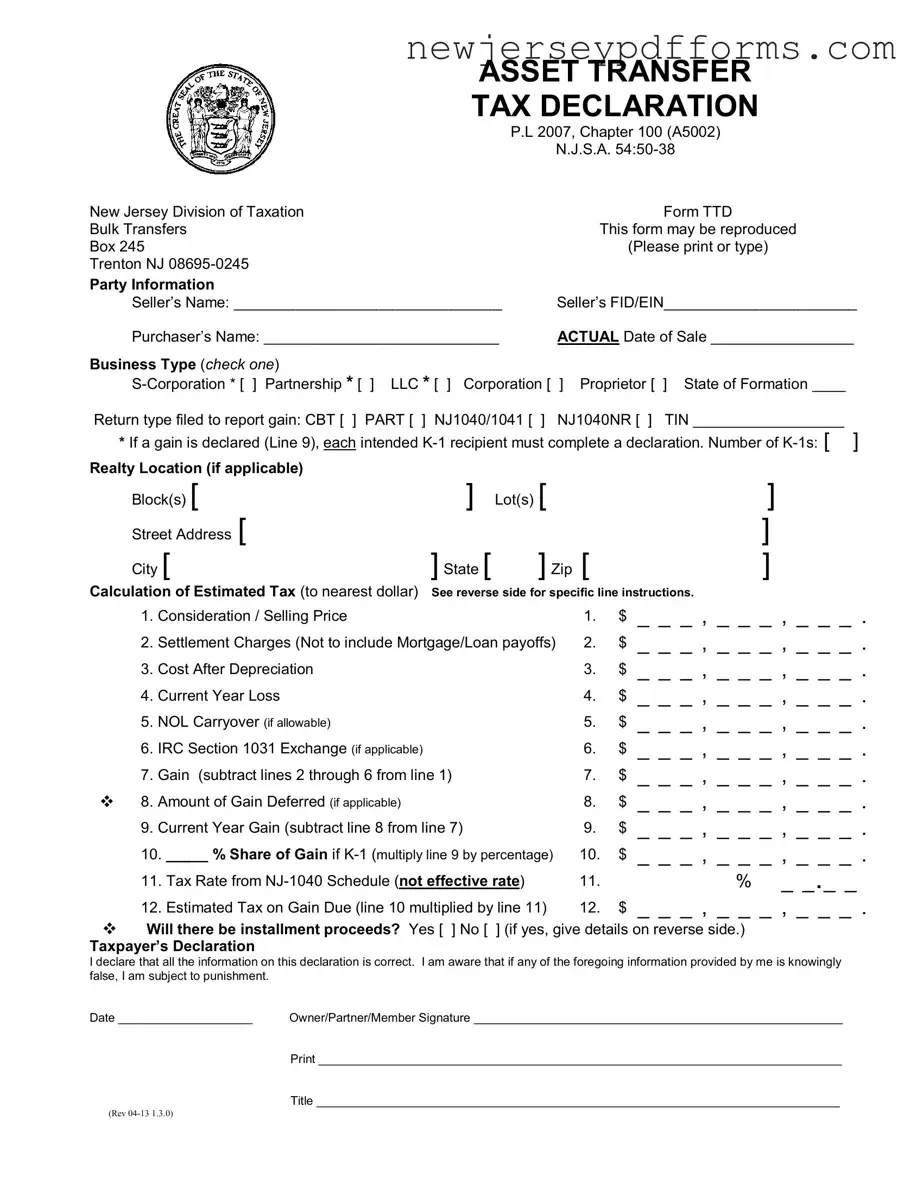

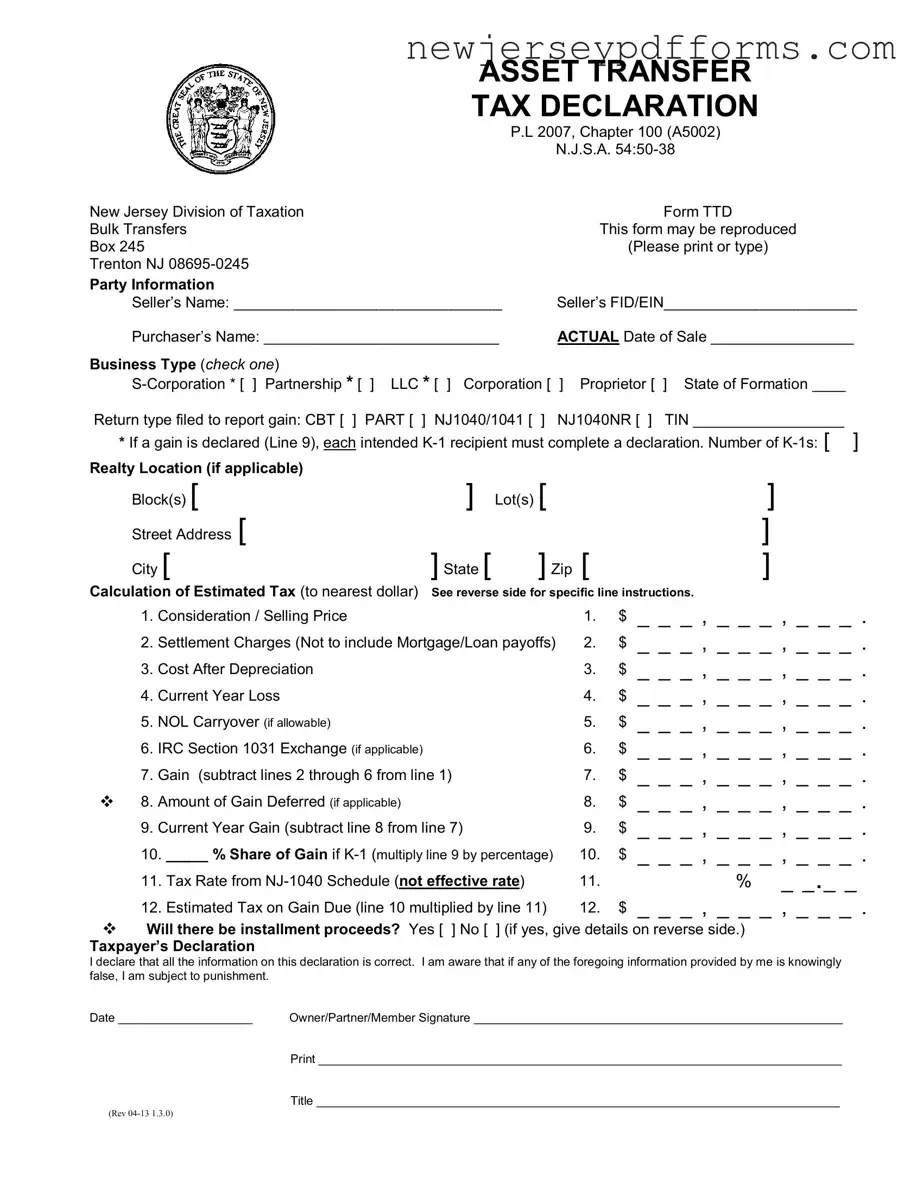

What is the NJ TTD form?

The NJ TTD form, or Asset Transfer Tax Declaration, is a document required by the New Jersey Division of Taxation. It is used to report the transfer of business assets and calculate any estimated tax due on the gain from the sale. This form ensures that the state is aware of potential tax liabilities associated with the transfer.

Who needs to fill out the NJ TTD form?

The seller of business assets must complete the NJ TTD form. This includes various business structures such as corporations, partnerships, LLCs, and sole proprietorships. If the seller is transferring assets, they are responsible for reporting the transaction using this form.

What information is required on the NJ TTD form?

The form requires details such as the seller's and purchaser's names, the date of sale, business type, and financial figures related to the transaction. This includes the selling price, settlement charges, cost after depreciation, and any losses or gains. Accurate information is crucial for calculating estimated taxes.

How is the estimated tax calculated on the NJ TTD form?

The estimated tax is calculated based on the gain from the sale of the assets. This involves subtracting certain costs, like settlement charges and depreciation, from the total selling price. The result determines the taxable gain, which is then multiplied by the applicable tax rate to find the estimated tax due.

What happens if the information on the NJ TTD form is incorrect?

If the information provided is incorrect, the seller may face penalties. The form includes a declaration stating that the information is accurate. Providing false information can lead to legal consequences, including fines or other penalties from the state.

Is there a deadline for submitting the NJ TTD form?

The NJ TTD form should be submitted at the time of the asset transfer, typically during the closing of the transaction. It is important to ensure that this form is filed promptly to avoid complications with tax liabilities.

What if there are installment proceeds involved in the asset transfer?

If the sale involves installment proceeds, the seller must indicate this on the form. Additional details about the installment terms should be provided. The estimated tax may be adjusted based on the specifics of the installment agreement.

Can the NJ TTD form be reproduced?

Yes, the NJ TTD form can be reproduced. It is important that all copies maintain the same format and clarity as the original to ensure proper processing by the New Jersey Division of Taxation.

What should be done after submitting the NJ TTD form?

After submitting the form, the estimated tax will be held in escrow until the transaction closes. The Division of Taxation will review the form and communicate any necessary adjustments. The seller will then file their year-end tax return, claiming credit for the estimated tax paid.

Where can I obtain the NJ TTD form?

The NJ TTD form can be obtained from the New Jersey Division of Taxation's website or by contacting their office directly. It is also available at various tax preparation offices and legal service providers.