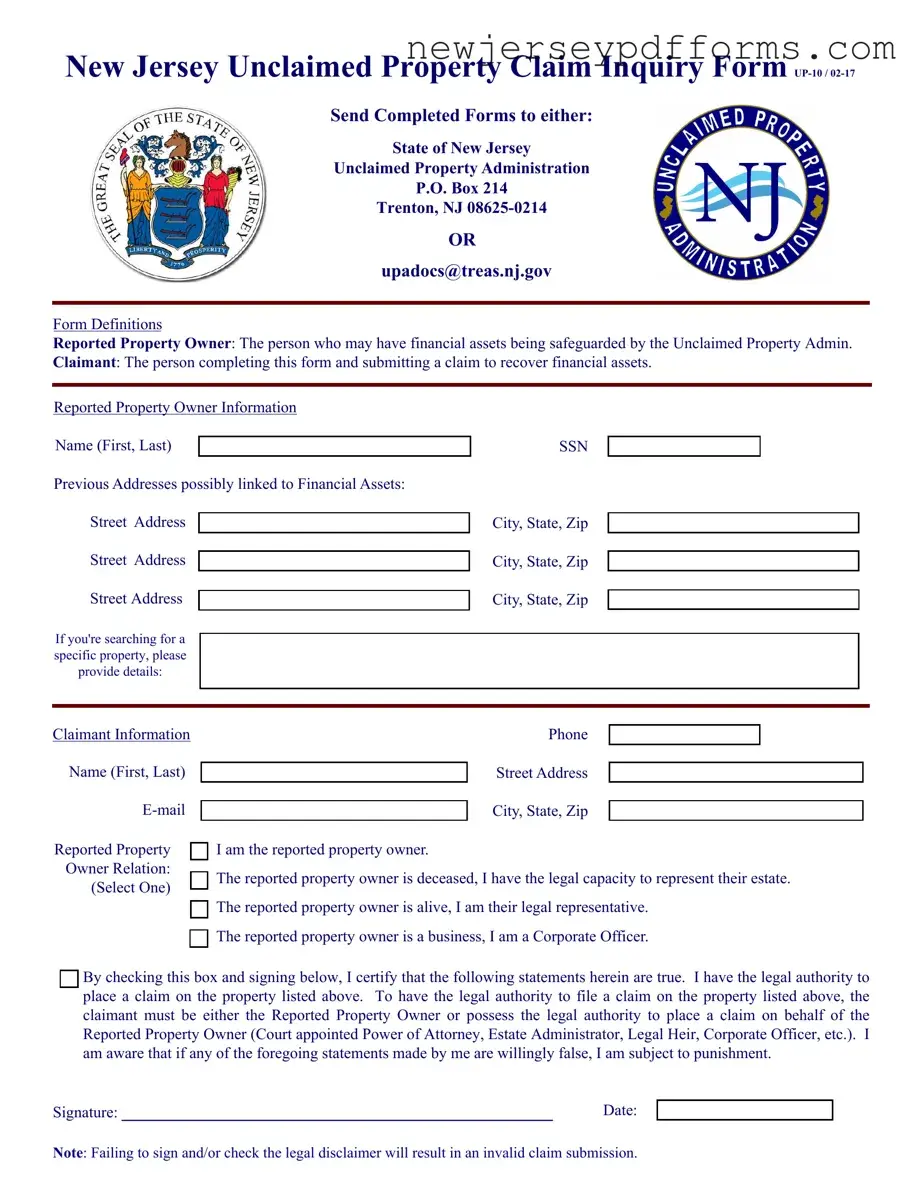

What is the New Jersey Unclaimed Property Claim Inquiry Form UP-10?

The New Jersey Unclaimed Property Claim Inquiry Form UP-10 is a document that individuals use to claim financial assets that have been reported as unclaimed by the state. This form helps the Unclaimed Property Administration identify the rightful owners of these assets so they can be returned.

Who is considered the "Reported Property Owner"?

The "Reported Property Owner" is the individual or entity that may have financial assets being safeguarded by the Unclaimed Property Administration. This can include people who have forgotten about old bank accounts, insurance policies, or other forms of financial property that have not been claimed for a certain period.

Who is the "Claimant"?

The "Claimant" is the person who fills out and submits the form to recover the financial assets. This individual may be the reported property owner themselves or someone who has the legal authority to act on behalf of the owner, such as a family member or legal representative.

What information do I need to provide about the reported property owner?

You will need to provide the full name of the reported property owner, along with any previous addresses that may be linked to their financial assets. Additionally, details such as the Social Security Number (SSN) and the city, state, and zip code of these addresses are also required to help locate the assets.

What information is required from the claimant?

The claimant must provide their full name, email address, phone number, and current address. They also need to indicate their relationship to the reported property owner, such as whether they are the owner themselves, a legal representative, or a corporate officer.

What legal authority is needed to file a claim?

To file a claim, the claimant must either be the reported property owner or have the legal authority to act on their behalf. This could include being a court-appointed power of attorney, an estate administrator, a legal heir, or a corporate officer representing a business.

What happens if I do not sign the form?

Failing to sign the form or check the legal disclaimer will result in an invalid claim submission. It is essential to certify that the statements made in the form are true and that the claimant has the legal authority to file the claim.

Where do I send the completed form?

You can send the completed form to the State of New Jersey Unclaimed Property Administration either by mailing it to P.O. Box 214, Trenton, NJ 08625-0214 or by emailing it to upadocs@treas.nj.gov.

What should I do if I have questions about the form?

If you have questions about the form or the claims process, it is advisable to contact the New Jersey Unclaimed Property Administration directly. They can provide guidance and assistance regarding your specific situation.

How long does it take to process a claim?

The processing time for a claim can vary based on several factors, including the complexity of the claim and the volume of claims being processed. Generally, it is recommended to allow several weeks for the claim to be reviewed and processed after submission.