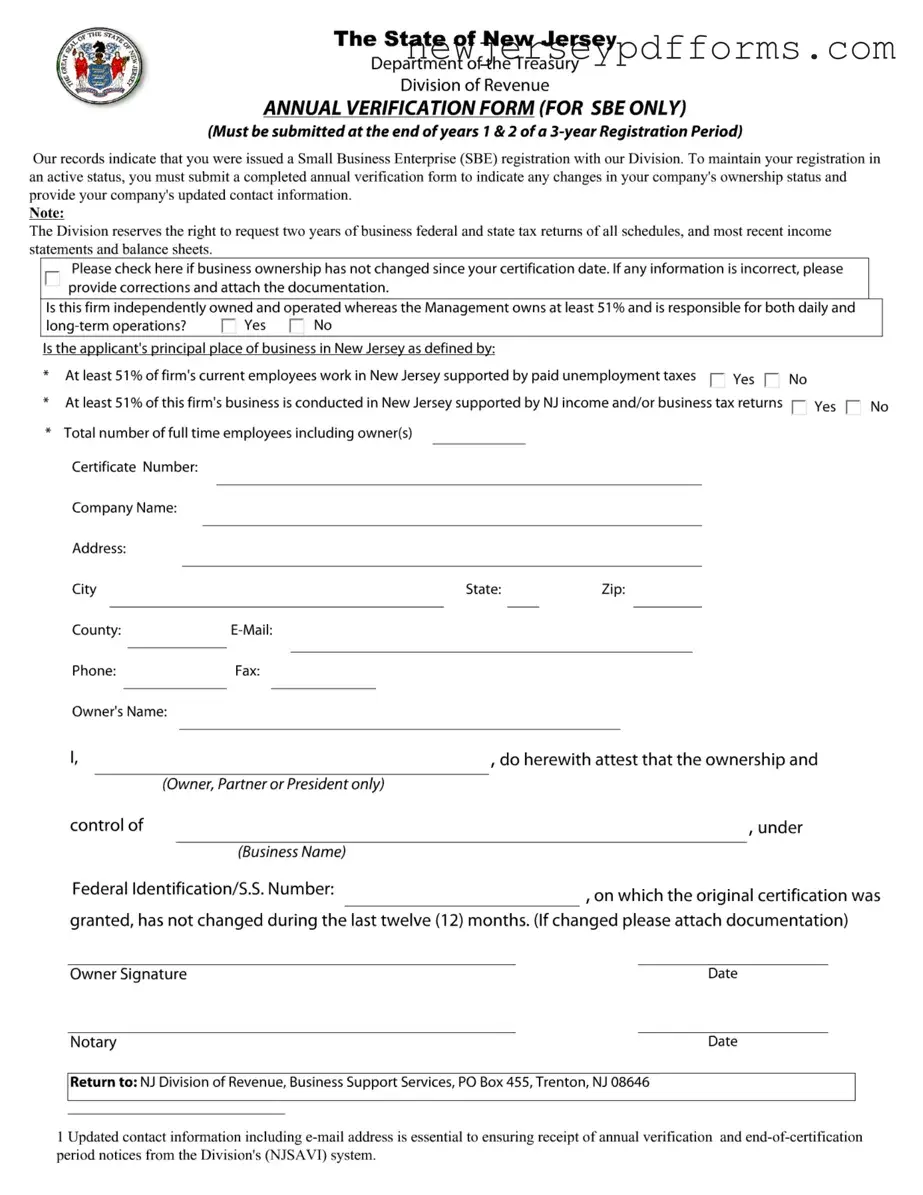

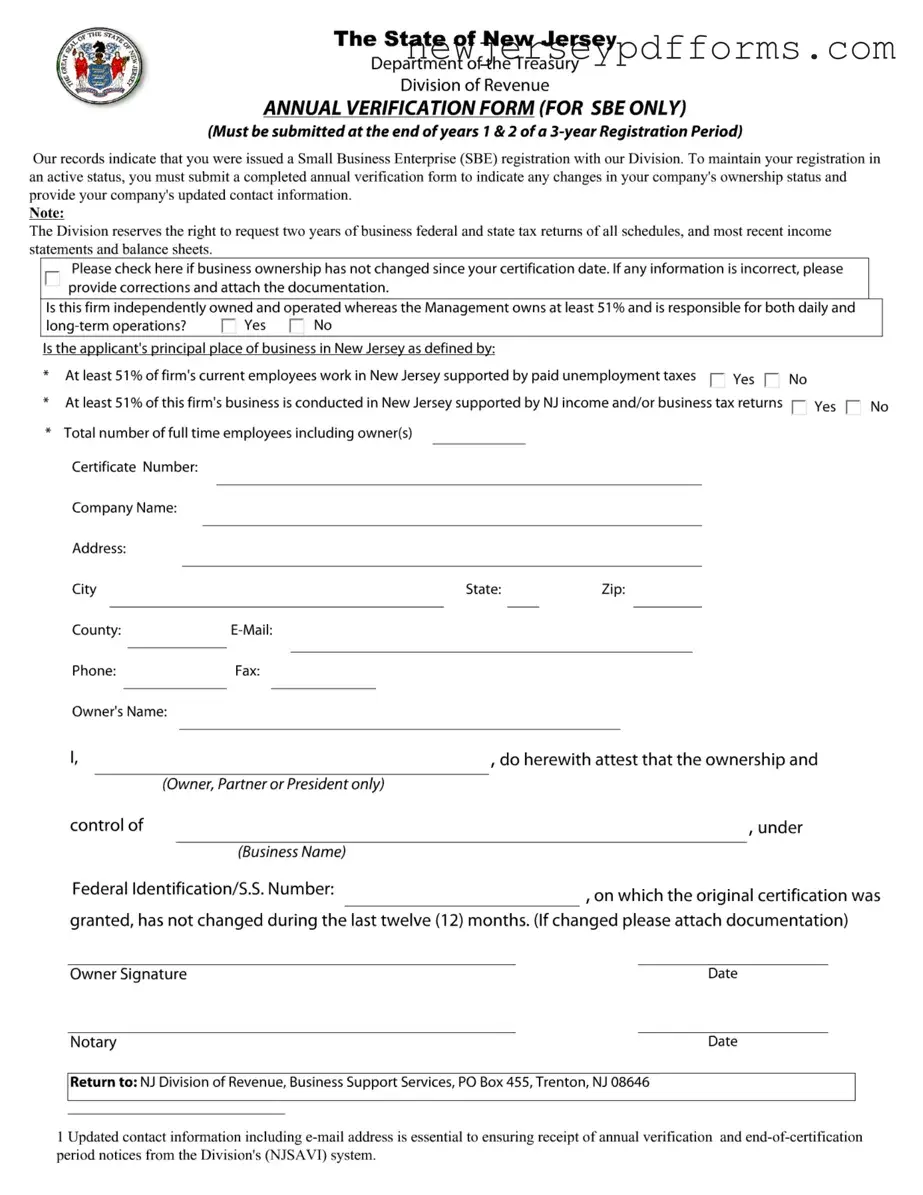

Printable Nj Verification Form

The New Jersey Verification Form is an essential document for Small Business Enterprises (SBE) to maintain their registration status with the State of New Jersey's Division of Revenue. This form must be submitted at the end of the first and second years of a three-year registration period to confirm any changes in ownership and to provide updated contact information. It is crucial for businesses to complete this form accurately to ensure compliance and avoid potential issues with their registration.

To fill out the form, click the button below.

Open Editor Here

Printable Nj Verification Form

Open Editor Here

Open Editor Here

or

Download Nj Verification PDF Form

Complete the form before time runs out

Edit your Nj Verification online and complete it quickly.