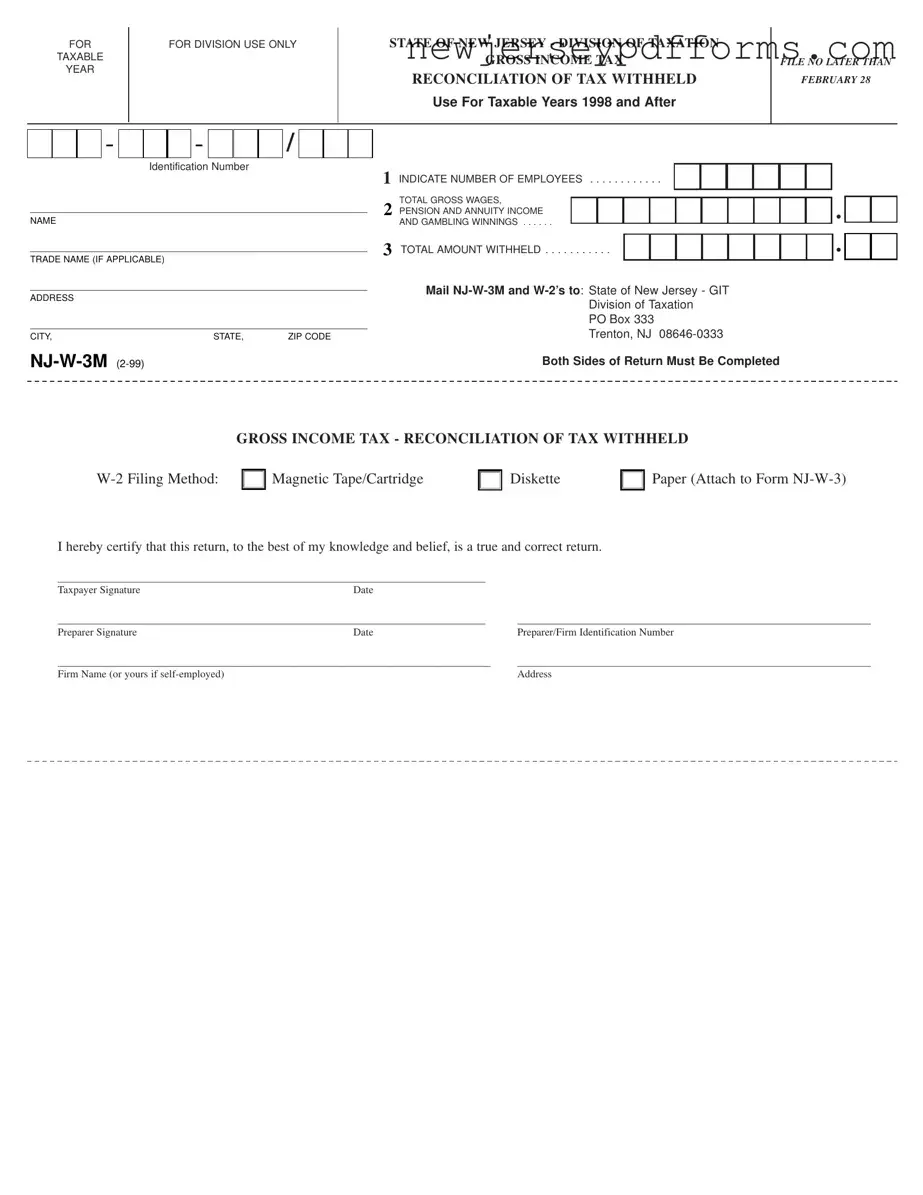

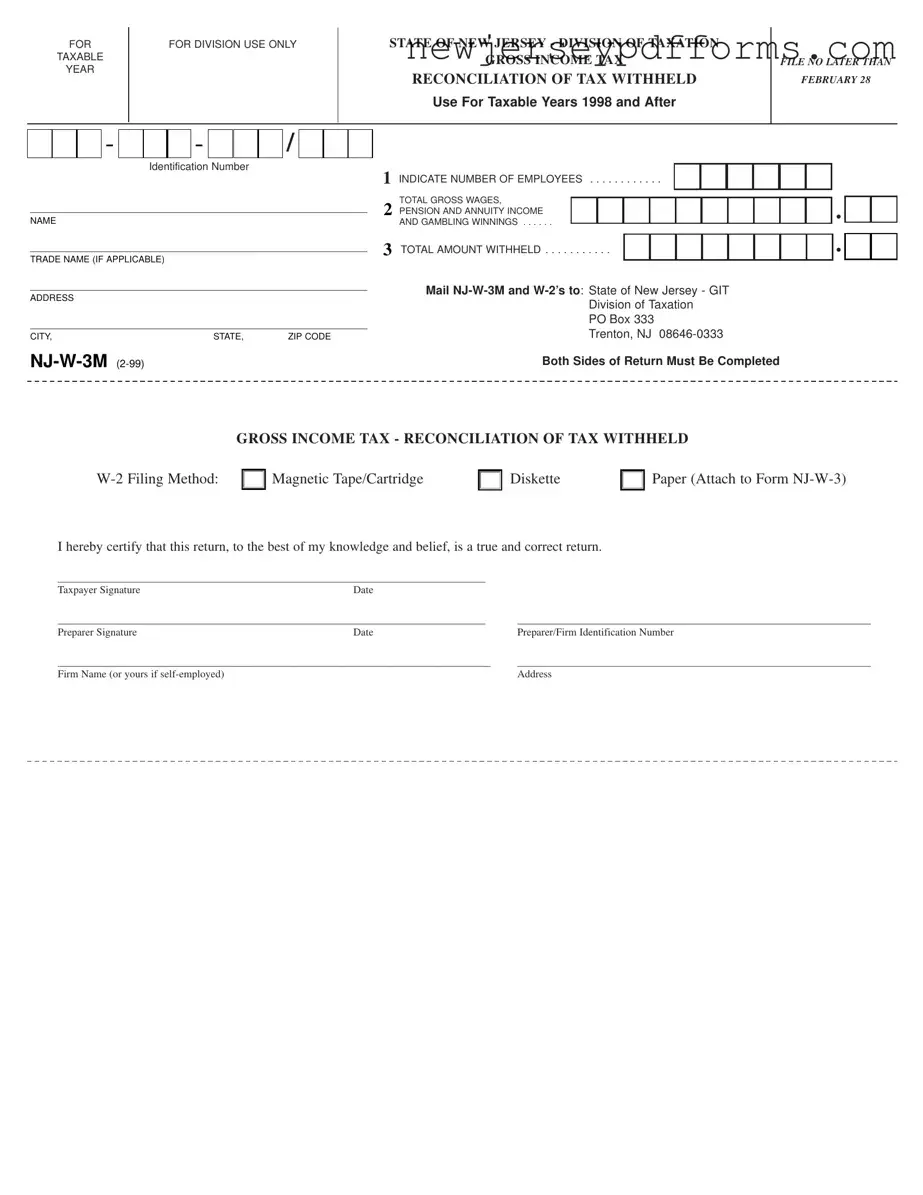

What is the NJ W-3M form?

The NJ W-3M form is used for the reconciliation of tax withheld for gross income tax in New Jersey. It is required for taxable years 1998 and later. Employers must file this form along with their W-2s to report the total wages paid and the taxes withheld from employees.

Who needs to file the NJ W-3M form?

Employers who have employees in New Jersey and withhold state income tax from their wages must file the NJ W-3M form. This includes businesses of all sizes, from small companies to large corporations.

When is the NJ W-3M form due?

The NJ W-3M form must be filed no later than February 28 of the year following the tax year for which the wages and withholding are reported. For example, for the 2023 tax year, the form is due by February 28, 2024.

What information is required on the NJ W-3M form?

The form requires several key pieces of information, including the employer's identification number, name, trade name (if applicable), address, total number of employees, total gross wages, pension and annuity income, gambling winnings, and the total amount withheld for taxes.

How do I submit the NJ W-3M form?

The completed NJ W-3M form, along with all W-2 forms, should be mailed to the State of New Jersey, Division of Taxation, at the specified address: PO Box 333, Trenton, NJ 08646-0333. Ensure that both sides of the return are completed before submission.

Can I file the NJ W-3M form electronically?

Yes, employers can file the NJ W-3M form electronically if they choose to use magnetic tape, cartridge, or diskette filing methods. However, if filing on paper, the form must be attached to the W-2 forms.

What happens if I miss the filing deadline?

Failing to file the NJ W-3M form by the deadline may result in penalties and interest on any taxes owed. It's important to file on time to avoid these additional costs and complications.

Is there a penalty for incorrect information on the NJ W-3M form?

Yes, providing incorrect information on the NJ W-3M form can lead to penalties. It's crucial to ensure that all information is accurate and complete to avoid any issues with the New Jersey Division of Taxation.

Can I amend the NJ W-3M form after filing?

If you discover an error after submitting the NJ W-3M form, you can amend it. You will need to file a corrected NJ W-3M form along with corrected W-2 forms to rectify any inaccuracies.

Where can I find more information about the NJ W-3M form?

For more detailed information, you can visit the New Jersey Division of Taxation's website or contact their office directly. They provide resources and guidance to help employers comply with filing requirements.