The NJ W3 form shares similarities with the IRS Form W-2, which is used by employers to report wages paid to employees and the taxes withheld from those wages. Both forms serve the purpose of reconciling income and tax withholdings for a specific tax year. The W-2 is submitted to both the employee and the IRS, while the NJ W3 is specifically tailored for reporting payments made to unregistered contractors in New Jersey. Both forms require detailed information about the taxpayer, including identification numbers and total amounts withheld, ensuring accurate reporting for tax purposes.

Another related document is the IRS Form 1099-MISC, which reports miscellaneous income, including payments made to independent contractors. Like the NJ W3, the 1099-MISC is used to report tax withheld on payments made throughout the year. The NJ W3 requires the attachment of 1099-MISC forms when reporting payments to unregistered contractors, illustrating the interconnectedness of these forms in the tax reporting process. Both documents aim to ensure that income is accurately reported and taxes are appropriately withheld.

If you're in the process of transferring ownership, understanding the details of a horse transaction is critical. For this, consider utilizing a "thorough guide to the Horse Bill of Sale" found at https://californiapdfforms.com/horse-bill-of-sale-form/.

The NJ-500 form is also similar, as it is used by employers to report withholding payments made to unregistered unincorporated contractors on a monthly basis. While the NJ W3 serves as an annual reconciliation, the NJ-500 provides a more frequent reporting mechanism. Employers must compile the information from the NJ-500 when completing the NJ W3, making the two forms complementary in nature. Both documents require accurate reporting of payments and withholdings to ensure compliance with state tax laws.

In addition, the NJ-927 form functions similarly as a quarterly report of employee and contractor withholdings. Employers use the NJ-927 to summarize their withholding obligations throughout the year, which then informs the annual reporting on the NJ W3. The information contained in the NJ-927 is crucial for the accurate completion of the NJ W3, as it provides a detailed account of the amounts withheld from contractors. Both forms aim to ensure transparency and compliance in tax reporting.

The IRS Form 941 is another document that bears resemblance to the NJ W3. This form is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. While the NJ W3 focuses specifically on unregistered contractors, both forms require similar information regarding the taxpayer and the amounts withheld. They both serve as reconciliation tools, ensuring that the taxes reported and paid align with the amounts withheld throughout the year.

Additionally, the IRS Form 945 is relevant, as it is used to report federal income tax withheld from non-payroll payments, including payments to independent contractors. Like the NJ W3, the Form 945 serves as a reconciliation tool, summarizing the total amounts withheld for a tax year. Both forms require detailed reporting of payments made and taxes withheld, reinforcing the importance of accurate reporting in compliance with tax regulations.

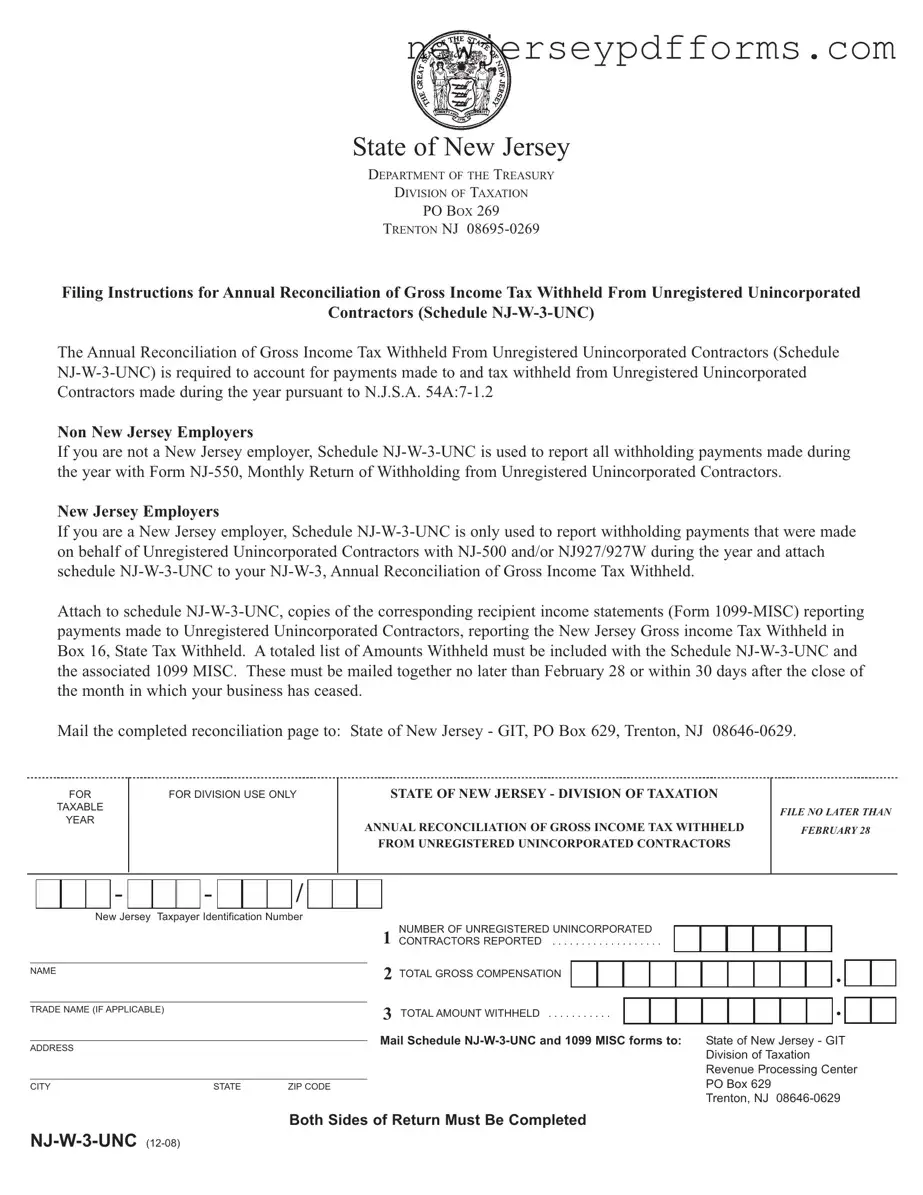

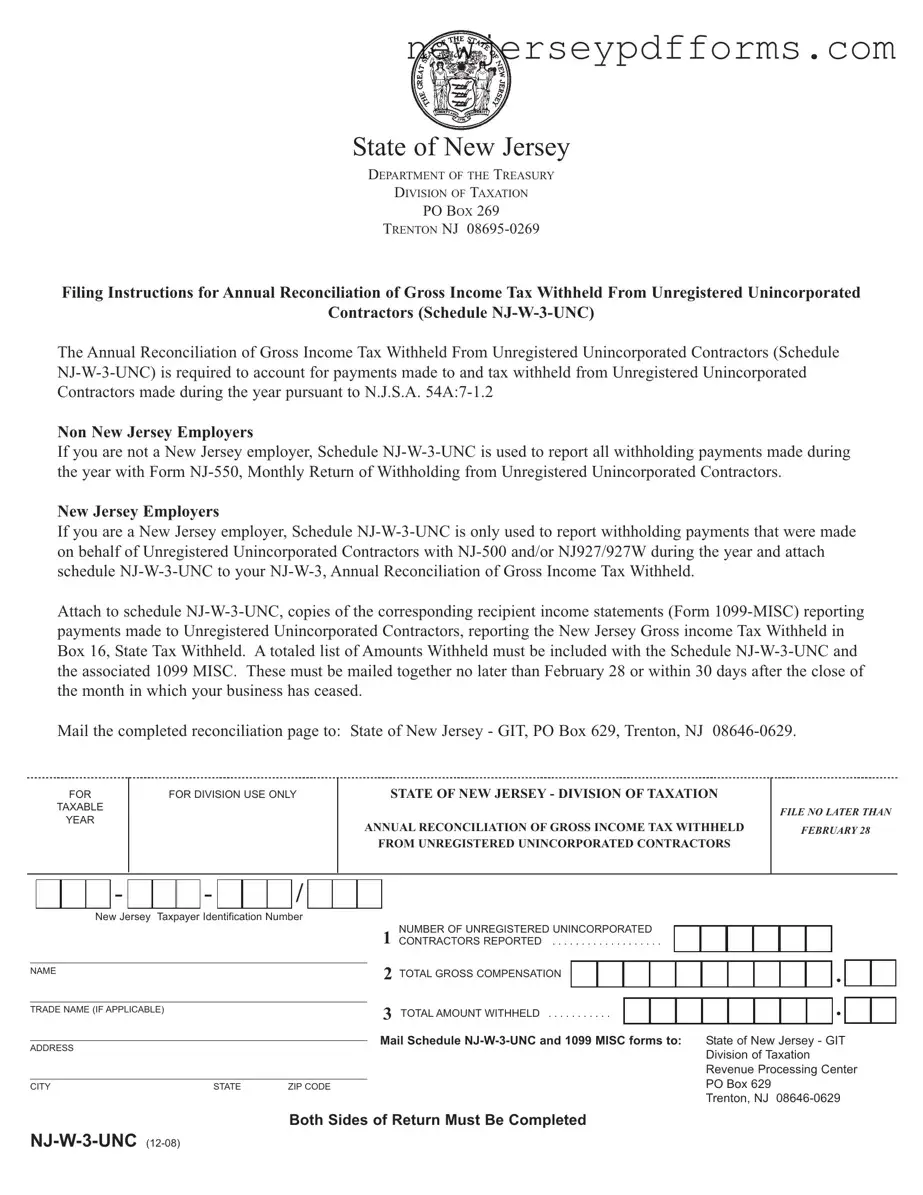

Finally, the New Jersey Division of Taxation's Annual Reconciliation of Withholding (Form NJ-W-3) is comparable to other state-specific reconciliation forms used across the United States. These forms serve a similar purpose in providing a summary of withholding for various types of income, ensuring that taxpayers report their income accurately and comply with state tax laws. Each state may have its own specific requirements, but the overarching goal remains consistent: to provide a clear accounting of income and taxes withheld throughout the year.