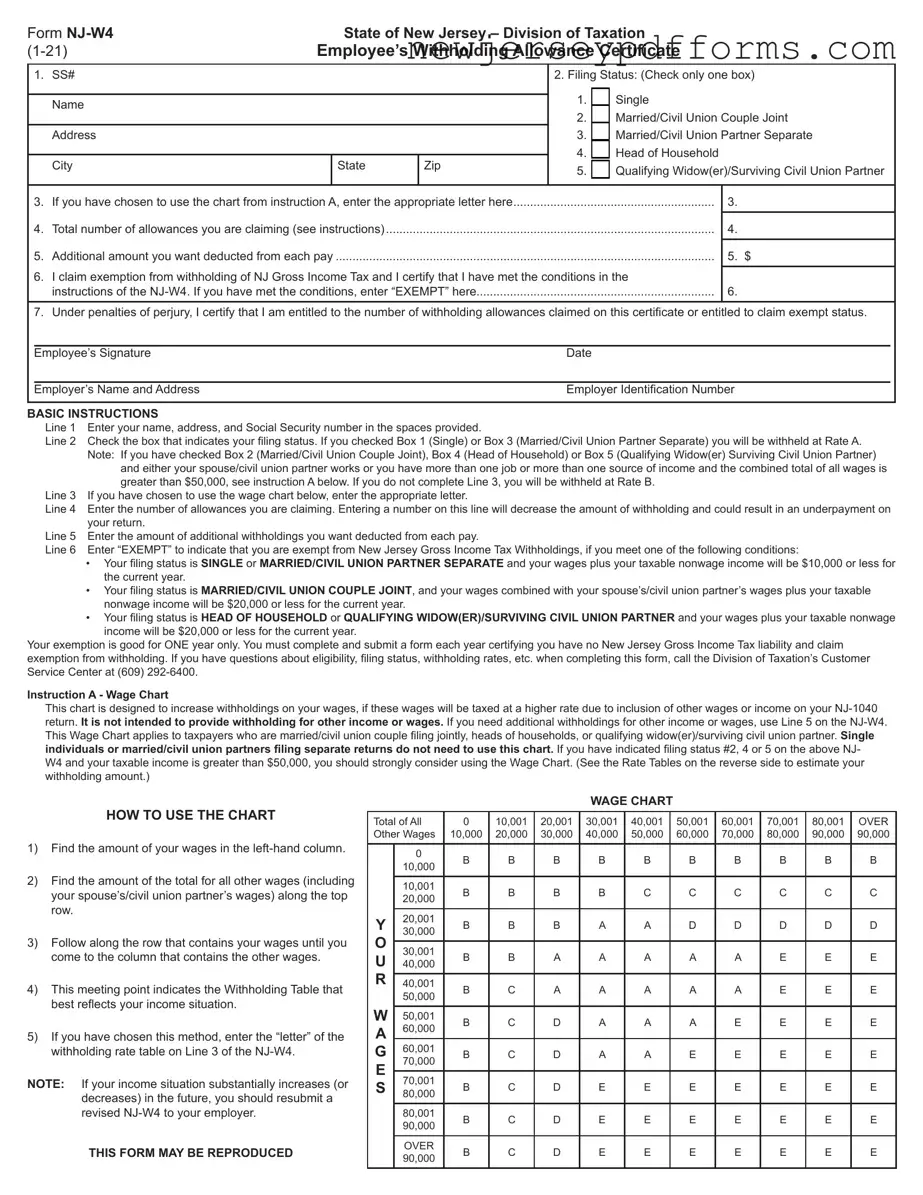

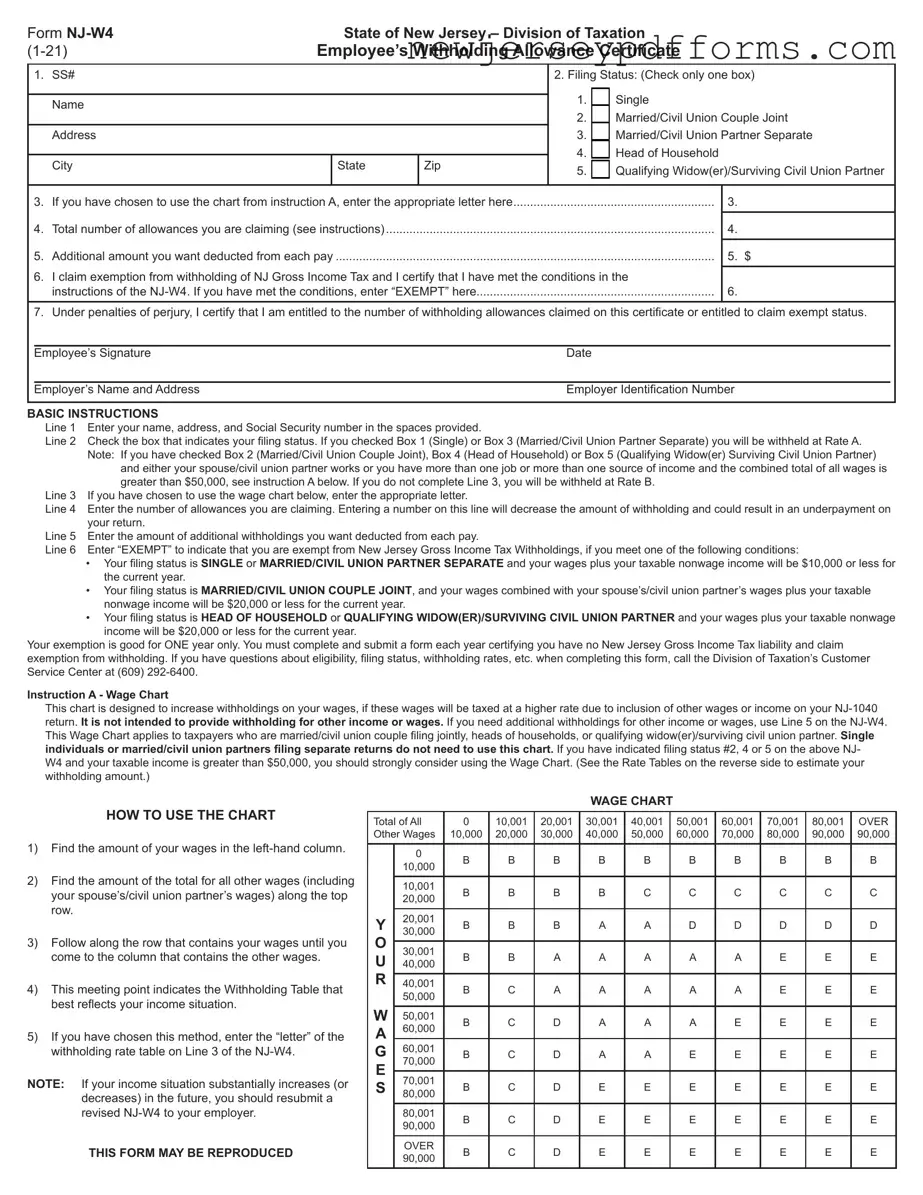

What is the NJ W4 form?

The NJ W4 form, officially known as the Employee’s Withholding Allowance Certificate, is a document used by employees in New Jersey to indicate their withholding preferences for state income tax. This form allows employees to claim allowances that can affect the amount of tax withheld from their paychecks. It is essential for accurate tax withholding and helps ensure that individuals do not overpay or underpay their state taxes throughout the year.

Who needs to fill out the NJ W4 form?

Any employee working in New Jersey who wants to adjust their state income tax withholding should complete the NJ W4 form. This includes new employees, individuals who have had changes in their personal circumstances (such as marriage or having a child), or those who want to change their withholding allowances. It is important to submit this form to your employer to ensure proper withholding from your paycheck.

How do I determine my filing status on the NJ W4 form?

On the NJ W4 form, you will find several options for filing status. You should check only one box that accurately reflects your situation: Single, Married/Civil Union Couple Joint, Married/Civil Union Partner Separate, Head of Household, or Qualifying Widow(er)/Surviving Civil Union Partner. Your filing status will impact the withholding rate applied to your income, so it is crucial to select the correct option based on your tax situation.

What are allowances, and how do they affect my withholding?

Allowances are a way to reduce the amount of state income tax withheld from your paycheck. The more allowances you claim, the less tax will be withheld. However, claiming too many allowances may lead to an underpayment of taxes, resulting in a tax bill when you file your return. It is essential to carefully consider how many allowances to claim based on your financial situation, including income, deductions, and credits.

What does it mean to claim exemption on the NJ W4 form?

Claiming exemption on the NJ W4 form indicates that you believe you will not owe any New Jersey Gross Income Tax for the current year. To qualify for exemption, your income must fall below certain thresholds based on your filing status. If you qualify, you can write "EXEMPT" on Line 6 of the form. Keep in mind that this exemption is valid for only one year, and you must submit a new form each year to maintain your exempt status.

What should I do if my income situation changes?

If your income situation changes significantly—whether it increases or decreases—you should submit a revised NJ W4 form to your employer. Changes in income can affect your tax liability, and adjusting your withholding accordingly can help prevent issues such as owing taxes at the end of the year or receiving a large refund. Regularly reviewing your withholding status is advisable, especially after major life events or changes in employment.

Where can I get assistance with filling out the NJ W4 form?

If you have questions or need assistance while completing the NJ W4 form, you can contact the New Jersey Division of Taxation’s Customer Service Center at (609) 292-6400. They can provide guidance on eligibility, filing status, withholding rates, and any other inquiries you may have regarding the form and its implications for your state income tax withholding.