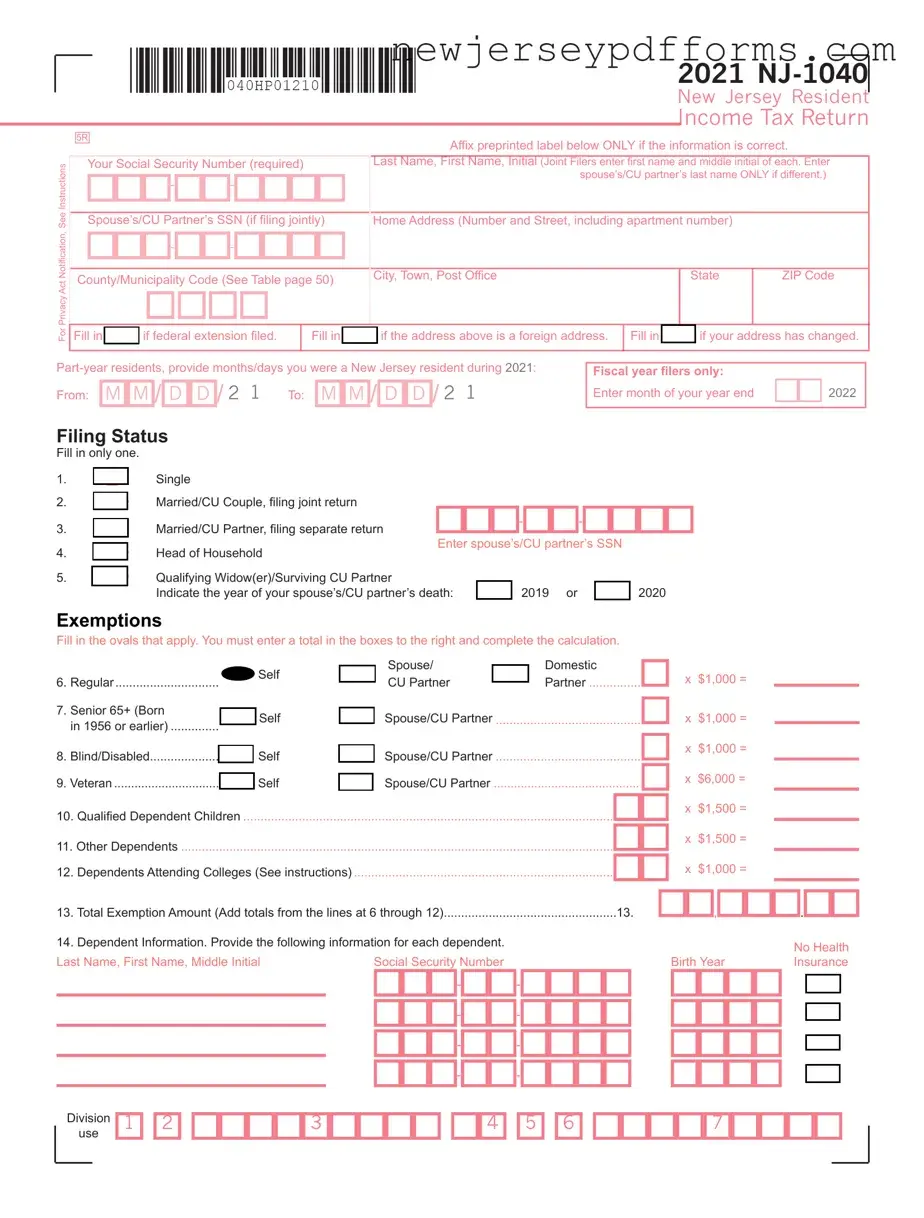

What is the NJ-1040 form?

The NJ-1040 form is the New Jersey Resident Income Tax Return. It is used by residents of New Jersey to report their income, calculate their tax liability, and claim any applicable credits or deductions. This form is essential for ensuring compliance with state tax laws and for determining whether you owe taxes or are eligible for a refund.

Who needs to file the NJ-1040 form?

Any resident of New Jersey who earns income during the tax year is generally required to file the NJ-1040 form. This includes full-year residents, part-year residents, and individuals who have a tax liability or wish to claim a refund. If you are unsure whether you need to file, consider your income level and residency status.

What information do I need to complete the NJ-1040 form?

To complete the NJ-1040 form, you will need personal information such as your Social Security number, your spouse's Social Security number (if filing jointly), and your home address. Additionally, you will need details about your income, including wages, interest, dividends, and any other sources of income. Documentation such as W-2 forms and 1099s will also be necessary.

What are the filing statuses available on the NJ-1040 form?

The NJ-1040 form allows you to select from several filing statuses: Single, Married/CU Couple filing jointly, Married/CU Partner filing separately, Head of Household, and Qualifying Widow(er)/Surviving CU Partner. Choose the status that best reflects your situation, as it can impact your tax rate and available deductions.

How do I calculate my taxable income on the NJ-1040 form?

To calculate your taxable income, start with your total income, which includes wages, interest, dividends, and other sources. Then, subtract any exclusions and deductions, such as retirement income exclusions and exemptions for dependents. The result will be your New Jersey taxable income, which is used to determine your tax liability.

What deductions and credits can I claim on the NJ-1040 form?

New Jersey offers various deductions and credits on the NJ-1040 form. Common deductions include medical expenses, alimony payments, and property tax deductions. Tax credits may include the Child and Dependent Care Credit and the New Jersey Earned Income Tax Credit. Review the instructions carefully to ensure you claim all eligible deductions and credits.

What should I do if I owe taxes?

If you find that you owe taxes after completing your NJ-1040 form, you can pay the amount due by mailing a check or money order along with the NJ-1040-V payment voucher. Alternatively, you can make a payment online through the New Jersey Division of Taxation's website. Ensure you pay by the deadline to avoid penalties and interest.

How can I check the status of my NJ-1040 refund?

To check the status of your NJ-1040 refund, visit the New Jersey Division of Taxation's website. You will need to provide your Social Security number and the amount of your refund. This online tool will give you real-time updates on the status of your refund and any processing issues.

Where do I mail my completed NJ-1040 form?

Where you mail your NJ-1040 form depends on whether you are expecting a refund or if you owe taxes. If you are due a refund, send your form to the Revenue Processing Center – Refunds. If you owe taxes, mail your form along with your payment to the Revenue Processing Center – Payments. Always ensure that you include your Social Security number on your payment.