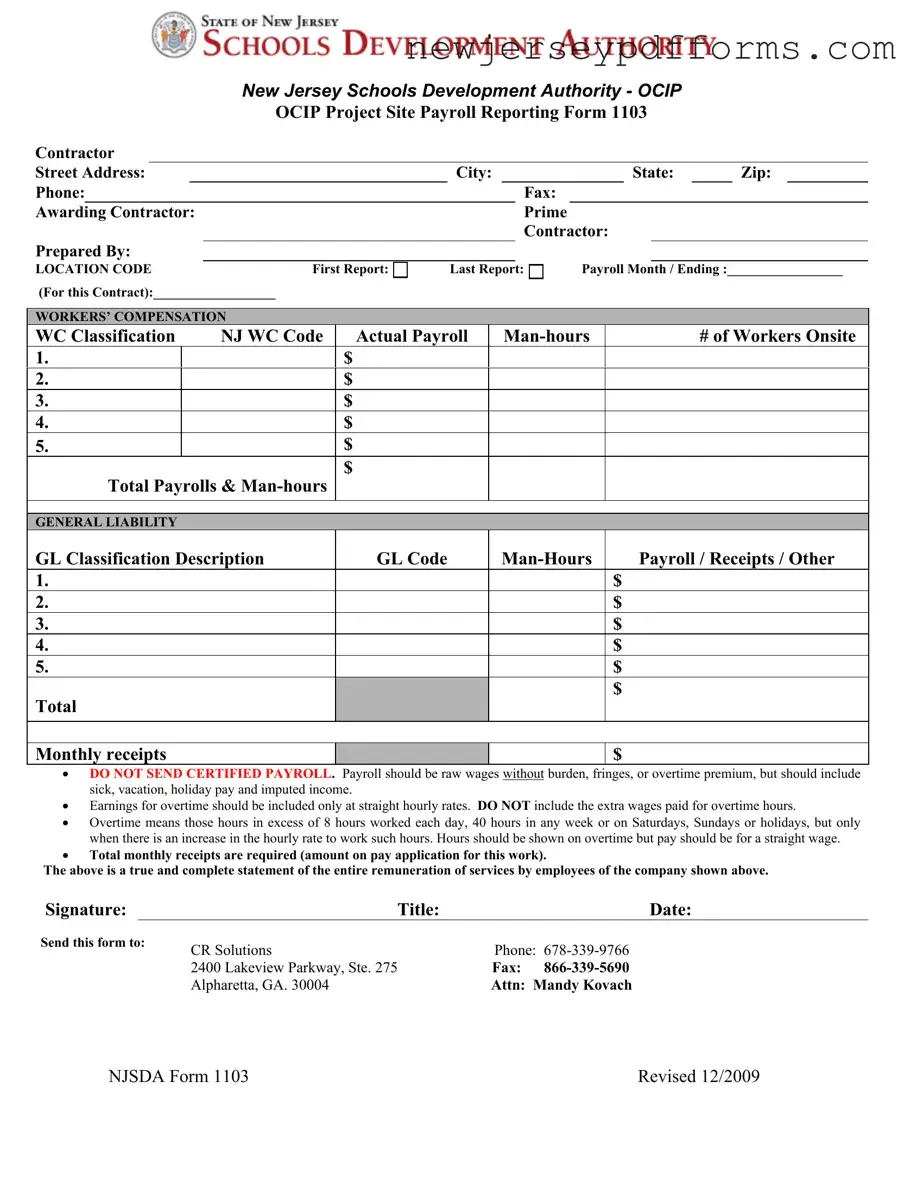

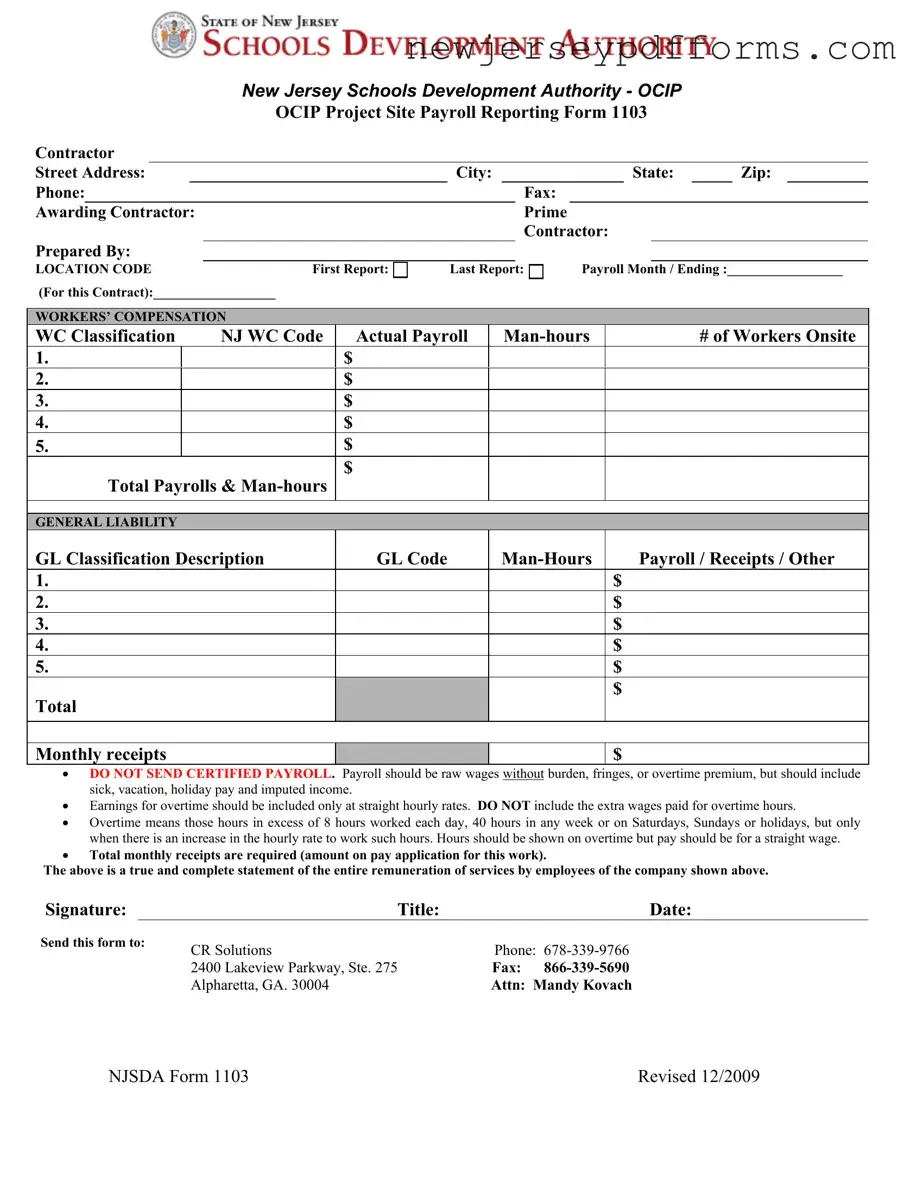

The NJSDA 1103 form is similar to the Certified Payroll Report (CPR), which is commonly used in various construction projects. Like the NJSDA 1103, the CPR requires detailed reporting of employee wages, hours worked, and classifications. Both forms aim to ensure compliance with labor laws and regulations, particularly concerning the payment of prevailing wages. The CPR also emphasizes the need for accurate reporting of payroll without including additional burdens, which aligns with the requirements outlined in the NJSDA 1103.

Another document comparable to the NJSDA 1103 is the Payroll Summary Report. This report provides a comprehensive overview of payroll data for a specific period, including total hours worked and gross wages. Similar to the NJSDA 1103, the Payroll Summary Report must be submitted regularly, often on a monthly basis. Both documents require a breakdown of wages by classification, ensuring that employers track labor costs accurately and comply with applicable regulations.

The Employee Time Sheet is also akin to the NJSDA 1103 form. Time sheets record the hours worked by employees on a daily basis, capturing the necessary details for payroll processing. Both documents serve to verify the hours worked and ensure that payroll calculations are accurate. While the NJSDA 1103 aggregates this information for reporting, the time sheet is typically used for internal tracking purposes.

Understanding the various compliance documents required in New Jersey's construction landscape, including the NJSDA 1103 form, is crucial for contractors. One essential resource that can assist in navigating these requirements is the PDF Document Service, which offers templates and guidance on legal documents, ensuring that contractors are well-prepared for all regulatory obligations.

The Labor Compliance Report shares similarities with the NJSDA 1103 in its focus on compliance with labor standards. This report often includes information about worker classifications, wages, and hours worked. Both forms are essential for demonstrating adherence to labor laws and ensuring that workers receive fair compensation. The Labor Compliance Report, like the NJSDA 1103, is often submitted to regulatory agencies for review.

The Weekly Payroll Report is another document that parallels the NJSDA 1103. This report is submitted weekly and details employee hours, classifications, and wages. While the NJSDA 1103 is a monthly report, both documents aim to provide transparency regarding payroll practices. They both require accurate reporting of wages without additional burdens, ensuring compliance with labor regulations.

Similar to the NJSDA 1103 is the Job Cost Report, which is used to track the costs associated with a specific project. This report includes labor costs, materials, and other expenses. Both the Job Cost Report and the NJSDA 1103 require detailed tracking of payroll data, although the Job Cost Report encompasses a broader range of project expenses. Accurate reporting in both cases is crucial for effective project management and financial oversight.

Finally, the Insurance Certificate serves as a relevant document alongside the NJSDA 1103. While it primarily focuses on verifying insurance coverage, it often includes information about employee classifications and payroll estimates. Both documents are essential for contractors participating in construction projects, ensuring that they meet insurance requirements while accurately reporting payroll data for compliance purposes.