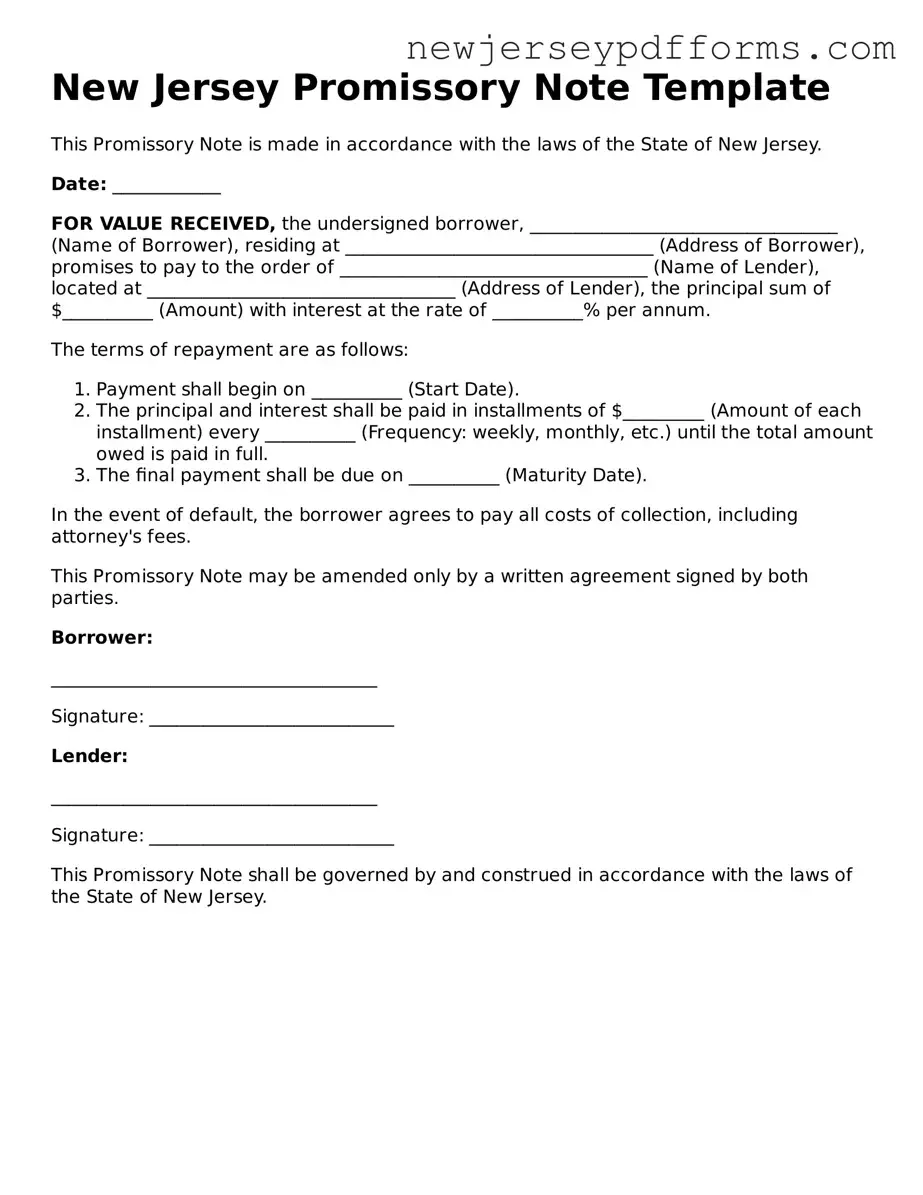

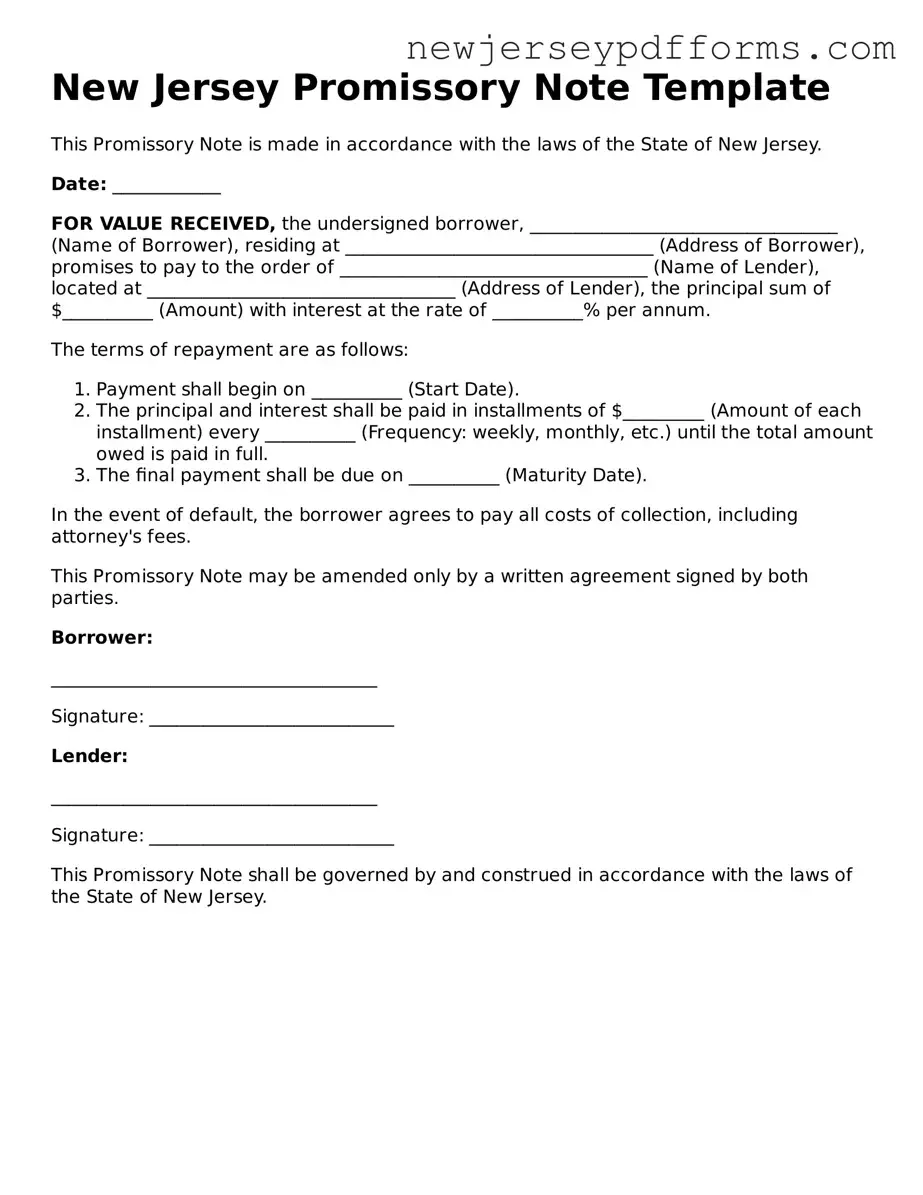

The New Jersey Promissory Note form shares similarities with the Loan Agreement. Both documents outline the terms under which money is borrowed and specify the repayment schedule. A Loan Agreement, however, tends to be more comprehensive, often including clauses related to default, collateral, and other conditions. In contrast, a Promissory Note is typically more straightforward, focusing on the borrower's promise to repay the loan amount with interest.

Another document akin to the New Jersey Promissory Note is the Mortgage. While a Promissory Note represents a promise to repay a loan, a Mortgage secures that promise with the property being financed. If the borrower defaults on the Promissory Note, the lender can initiate foreclosure on the property to recover the owed amount. Thus, the Mortgage adds an additional layer of security for the lender.

The New Jersey Promissory Note is also similar to a Personal Guarantee. In a Personal Guarantee, an individual agrees to be personally responsible for a debt or obligation incurred by another party. This document provides assurance to the lender that, should the primary borrower fail to repay, the individual will cover the debt. Both documents serve to protect the lender's interests, but a Personal Guarantee extends liability beyond the borrower.

A Business Loan Agreement is another document that resembles the New Jersey Promissory Note. Similar to a standard Loan Agreement, this document is specifically tailored for business transactions. It outlines the terms of the loan, including repayment schedules and interest rates. However, a Business Loan Agreement may also incorporate terms unique to business operations, such as performance covenants or financial reporting requirements.

When dealing with various financial documents, such as a Sample Tax Return Transcript, it's crucial to understand their importance in facilitating transactions and verifications. For instance, when you're preparing for a loan, having a clear overview of your financial situation through documents like the Sample Tax Return Transcript can be pivotal. To further assist with documentation needs, resources like PDF Document Service can provide templates and guidance.

The New Jersey Promissory Note can also be compared to an Installment Sale Agreement. In both cases, the buyer agrees to pay for a purchase over time, typically in regular installments. However, in an Installment Sale Agreement, the seller retains ownership of the property until the final payment is made. This contrasts with a Promissory Note, where ownership of the borrowed amount is transferred immediately upon receipt of funds.

Another document that bears similarities is the Secured Note. Like the New Jersey Promissory Note, a Secured Note includes a promise to repay a loan. However, a Secured Note is backed by collateral, which provides additional security to the lender. If the borrower defaults, the lender has the right to seize the collateral to satisfy the debt, whereas a standard Promissory Note may not offer such protections.

The New Jersey Promissory Note is also comparable to a Conditional Sales Agreement. In this agreement, the seller retains ownership of the goods until the buyer fulfills specific conditions, often related to payment. While both documents involve a promise to pay, a Conditional Sales Agreement typically relates to the sale of goods rather than a cash loan, making it a unique variant in the landscape of financial agreements.

Lastly, the New Jersey Promissory Note is similar to a Credit Agreement. A Credit Agreement outlines the terms under which a lender extends credit to a borrower. Like a Promissory Note, it specifies repayment terms and conditions. However, a Credit Agreement often encompasses a broader range of financial terms, including interest rates, fees, and conditions for drawing on the credit line, making it a more detailed document than a standard Promissory Note.