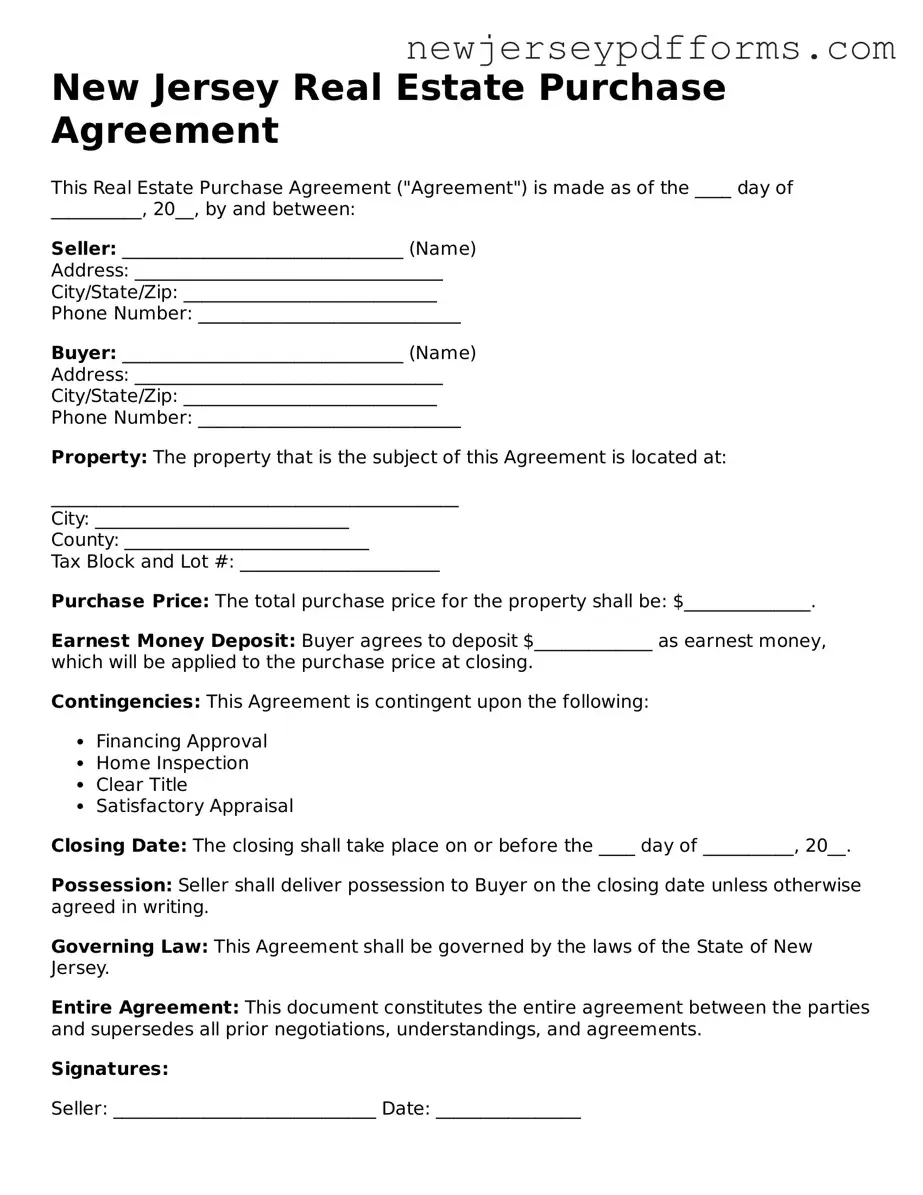

Valid Real Estate Purchase Agreement Document for the State of New Jersey

The New Jersey Real Estate Purchase Agreement form is a legal document that outlines the terms and conditions for buying and selling real estate in New Jersey. This form serves as a crucial tool for both buyers and sellers, ensuring that all parties understand their rights and obligations throughout the transaction. To get started on your real estate journey, fill out the form by clicking the button below.

Open Editor Here

Valid Real Estate Purchase Agreement Document for the State of New Jersey

Open Editor Here

Open Editor Here

or

Download Real Estate Purchase Agreement PDF Form

Complete the form before time runs out

Edit your Real Estate Purchase Agreement online and complete it quickly.