The Form REG-C-L is used by sole proprietorships and partnerships in New Jersey to report changes in tax or wage registration. Similar to the REG-C-EA, it requires detailed information about the business entity, including the business name and identification number. Both forms necessitate the payment of a filing fee and are considered public records once submitted. However, REG-C-L is specifically tailored for simpler amendments, such as address changes, rather than more complex alterations to articles of incorporation.

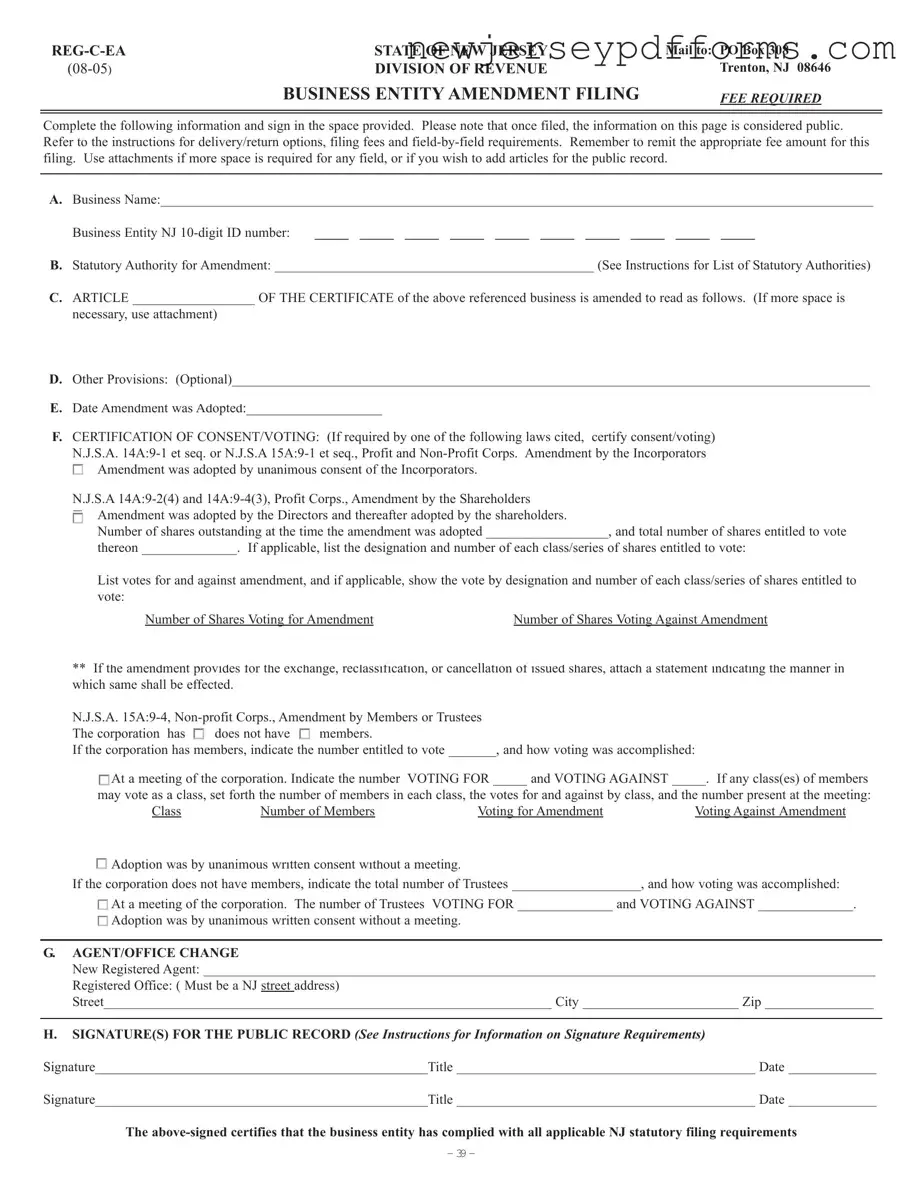

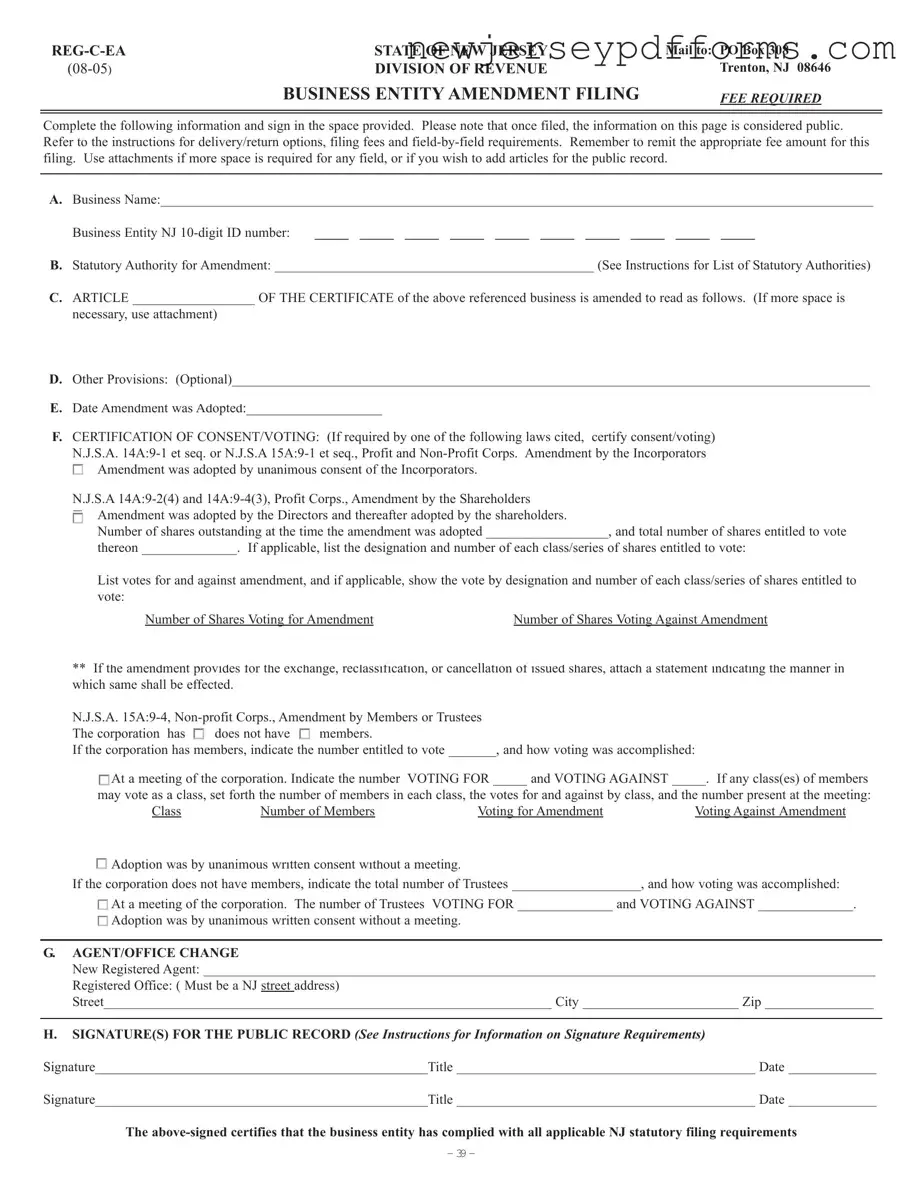

The Certificate of Incorporation is another document that shares similarities with the REG-C-EA. This certificate is foundational for forming a corporation in New Jersey and outlines essential details such as the business name, purpose, and registered agent. Like the REG-C-EA, it must be filed with the state and becomes a public document. Amendments to the Certificate of Incorporation, such as name changes or changes in the number of authorized shares, are reported using the REG-C-EA form.

The Articles of Organization serve as the foundational document for limited liability companies (LLCs) in New Jersey. Similar to the REG-C-EA, the Articles of Organization must be filed with the state and include critical information about the LLC, including its name and registered agent. When changes need to be made to the articles, such as a change in the business name or management structure, the REG-C-EA is the appropriate form to use for those amendments.

The Non-Profit Corporation Certificate is akin to the REG-C-EA for non-profit entities. This document establishes a non-profit organization and includes details such as its purpose and governance structure. When a non-profit needs to amend its certificate, whether to change its name or purpose, it must use the REG-C-EA to file those amendments, ensuring that the updated information is publicly accessible.

The Statement of Information is a document often required by various states, including New Jersey, for business entities to report basic information. Like the REG-C-EA, it requires accurate details about the business and is used to keep state records current. While the Statement of Information may be less formal than the REG-C-EA, both documents aim to maintain transparency and provide the state with essential business information.

The Business License Application is another document that shares a purpose with the REG-C-EA. Both are essential for ensuring that a business is compliant with state regulations. The Business License Application is typically required to operate legally within the state, while the REG-C-EA is used to amend existing records. Both processes involve submitting detailed information and may require a fee.

The REG-C-L form is used for reporting changes in tax or wage registration for sole proprietorships and partnerships in New Jersey. Similar to the REG-C-EA, it requires basic business details, including the business name and identification number. The form allows for amendments but focuses more on operational changes rather than structural amendments, making it essential for smaller business formations in New Jersey. For more detailed financial tracking, consider utilizing resources like the PDF Document Service to manage your profit and loss effectively.

The Certificate of Good Standing is similar in that it confirms a business's compliance with state requirements. This certificate is often needed for various transactions, such as securing loans or entering contracts. While the REG-C-EA is used to amend business records, the Certificate of Good Standing reflects the current status of a business, ensuring it is up to date with all filings and fees.

The Business Entity Registration form is another document that parallels the REG-C-EA. This form is used to officially register a business entity with the state, providing foundational information similar to what is required in the REG-C-EA. When changes occur, such as a change in the business name or structure, the REG-C-EA becomes necessary to update the state’s records.

Lastly, the Annual Report form is also comparable to the REG-C-EA, as it requires businesses to report their status and changes annually. Both documents are crucial for maintaining accurate public records. While the Annual Report focuses on the yearly status of a business, the REG-C-EA is specifically for amendments, ensuring that any changes are formally documented and accessible to the public.