What is a Small Estate Affidavit in New Jersey?

A Small Estate Affidavit is a legal document that allows individuals to claim assets of a deceased person without going through the lengthy probate process. In New Jersey, this option is available for estates valued at $50,000 or less, or $100,000 or less if the deceased was married. It simplifies the transfer of assets to heirs or beneficiaries.

Who can use the Small Estate Affidavit?

The Small Estate Affidavit can be used by heirs, beneficiaries, or any individual entitled to receive property from the deceased. This includes spouses, children, parents, or siblings. It's important to note that the person filing the affidavit must be at least 18 years old.

What assets can be claimed using the Small Estate Affidavit?

With the Small Estate Affidavit, you can claim various types of assets, including bank accounts, personal property, and vehicles. However, real estate cannot be transferred using this method. If the deceased owned real estate, other probate methods may be necessary.

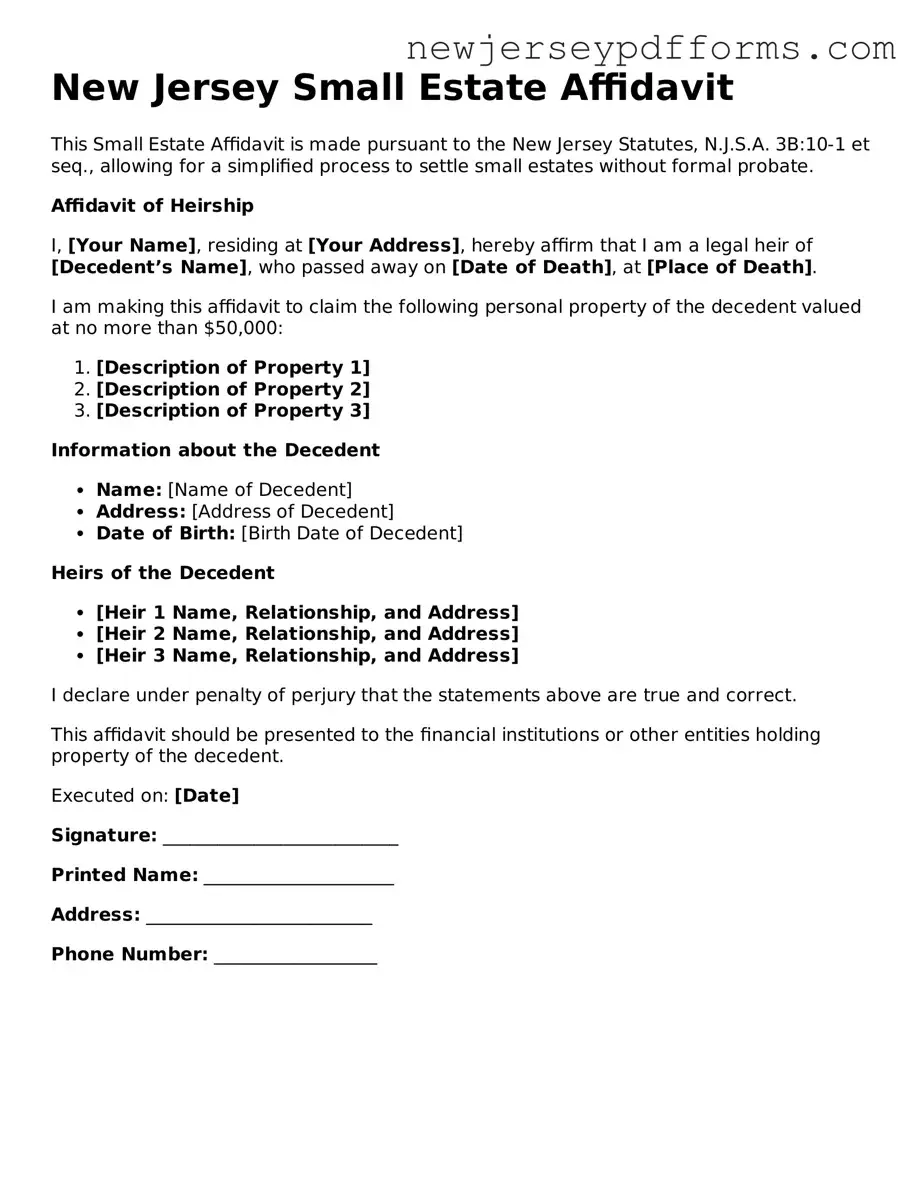

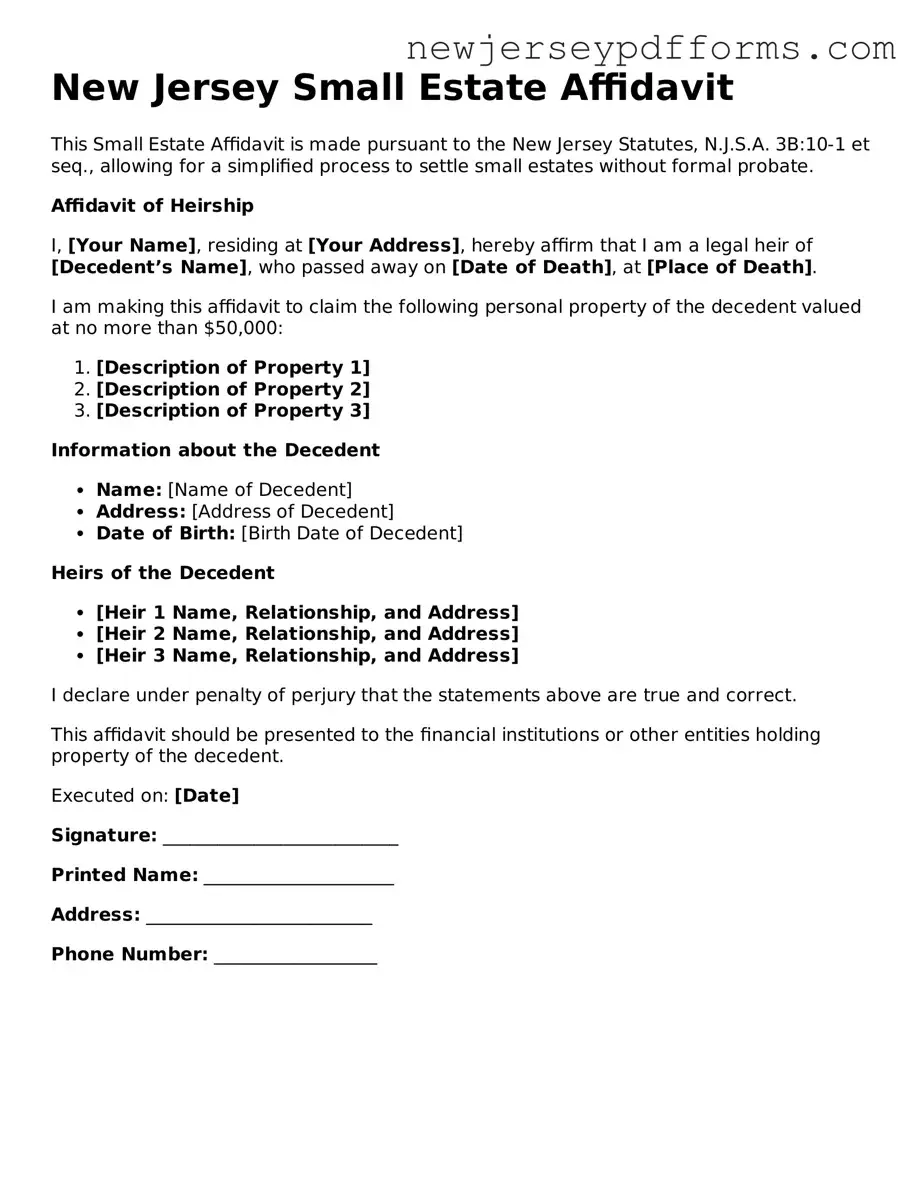

How do I complete the Small Estate Affidavit?

To complete the Small Estate Affidavit, you will need to fill out the form accurately, providing details about the deceased and the assets being claimed. Be sure to include information about the heirs and the relationship to the deceased. It's crucial to sign the affidavit in front of a notary public to validate it.

Is there a fee to file the Small Estate Affidavit?

There is no fee to file a Small Estate Affidavit in New Jersey. However, you may incur costs for notarizing the document or obtaining copies of any necessary records, such as death certificates. Always keep these expenses in mind when preparing your documents.

How long does it take to process the Small Estate Affidavit?

The processing time for a Small Estate Affidavit can vary. Once the affidavit is completed and notarized, you can present it to financial institutions or other entities holding the deceased's assets. They may take some time to review the document, but many institutions process these requests fairly quickly.

What if the deceased had debts?

If the deceased had debts, the Small Estate Affidavit does not protect you from those obligations. Creditors may still come forward to claim what they are owed. The estate's assets must be used to settle debts before any distribution to heirs. If the debts exceed the assets, heirs may not receive anything.

Can I use the Small Estate Affidavit if there is a will?

Yes, you can use the Small Estate Affidavit even if there is a will. However, the will must be probated if it directs the distribution of assets differently than what is outlined in the affidavit. If the will is not contested and the estate falls within the small estate limits, the affidavit can still be a viable option.