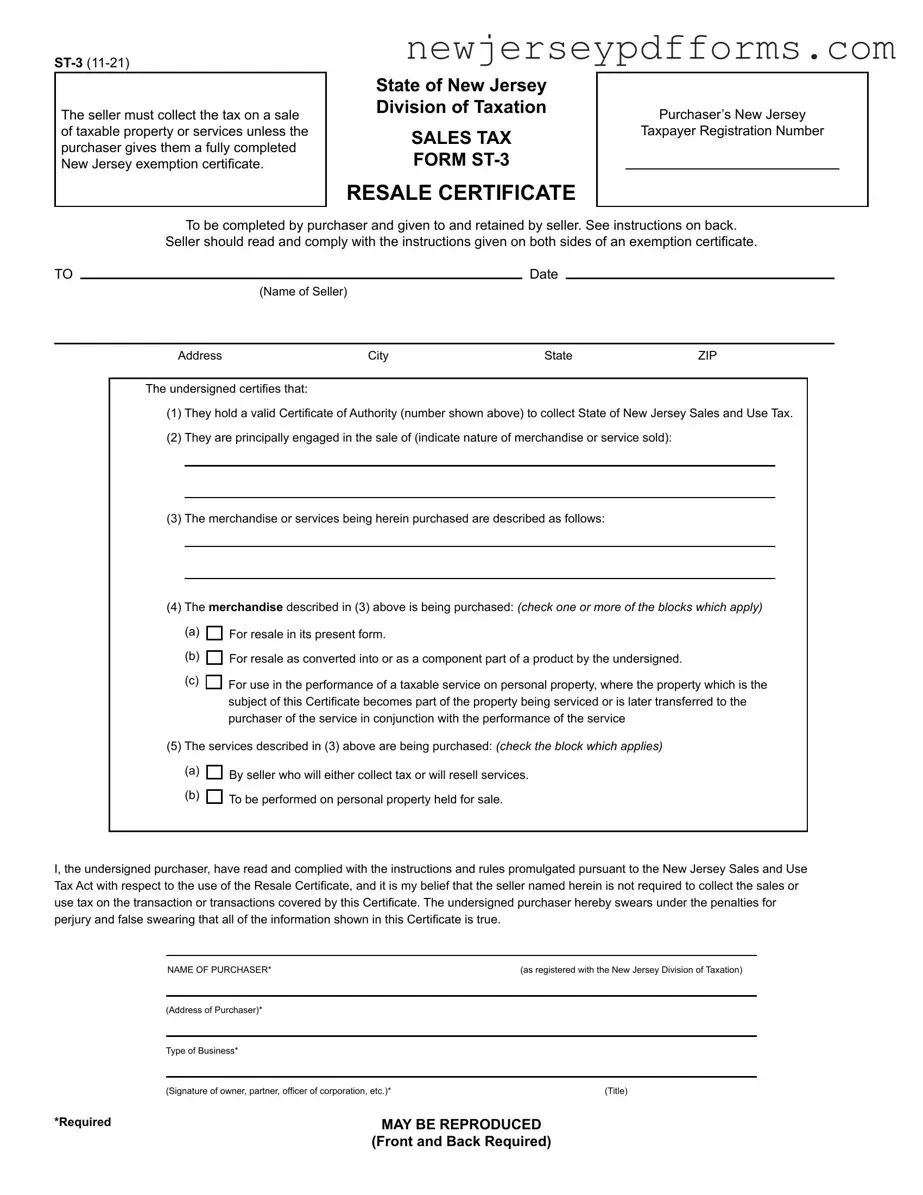

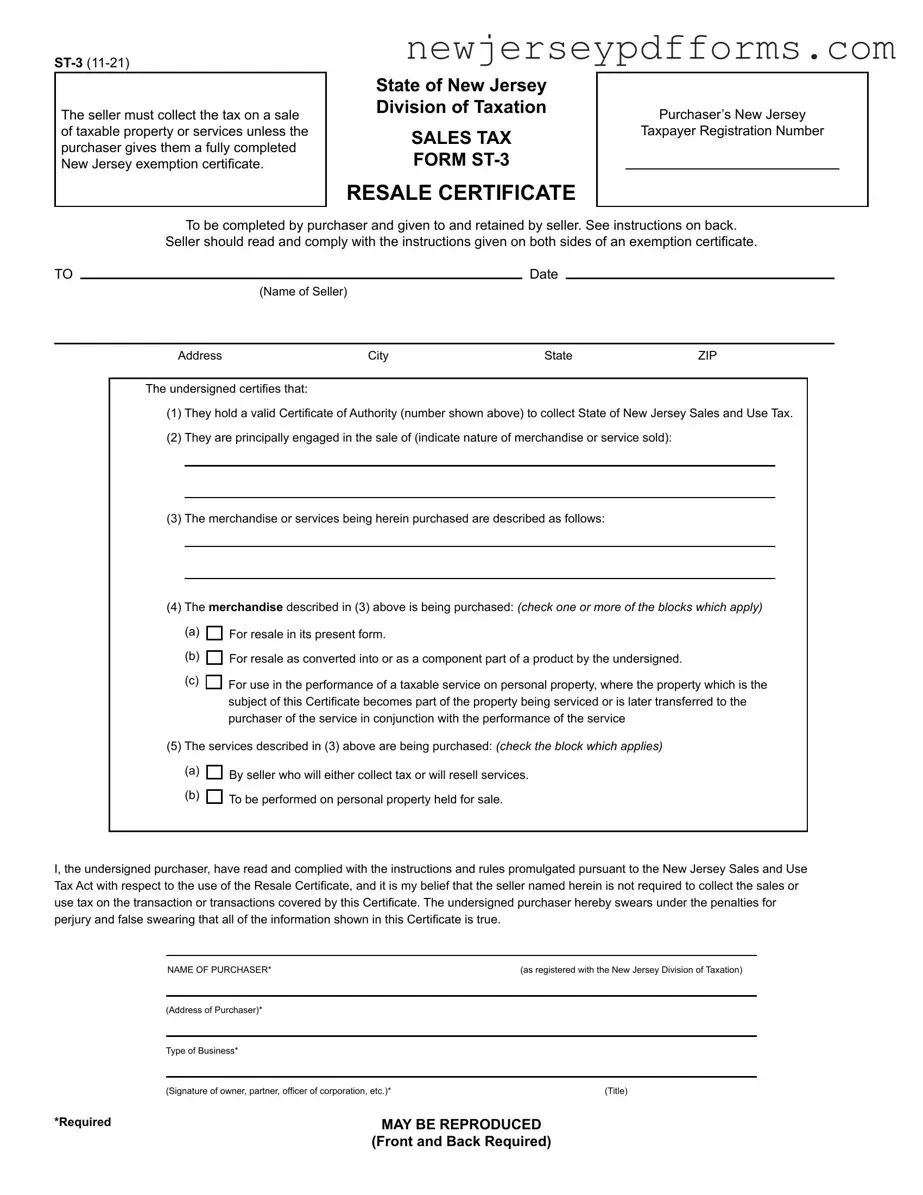

What is the purpose of the ST-3 New Jersey form?

The ST-3 form is a Resale Certificate used in New Jersey. It allows a purchaser to buy taxable goods or services without paying sales tax, provided they plan to resell those items. The seller must keep this certificate on file to show they did not need to collect tax on the sale.

Who needs to complete the ST-3 form?

The purchaser must fill out the ST-3 form. This includes individuals or businesses that hold a valid Certificate of Authority to collect sales tax in New Jersey. They must provide their tax identification number and other relevant information.

What information is required on the ST-3 form?

The form requires the purchaser's name, address, type of business, and New Jersey tax identification number. Additionally, the purchaser must describe the merchandise or services being purchased and indicate the purpose of the purchase.

How long must sellers retain the ST-3 form?

Sellers must keep the ST-3 form for at least four years from the date of the last sale covered by the certificate. It should be readily available for inspection during this time.

What happens if a seller does not collect the sales tax?

If a seller accepts a properly completed ST-3 form, they are relieved from the responsibility of collecting sales tax on that transaction. However, if the purchaser improperly claims the exemption, the purchaser may be held liable for the unpaid tax.

Can the ST-3 form be used for multiple purchases?

Yes, the ST-3 form can cover additional purchases of the same general type of property by the same purchaser. However, each subsequent purchase must still include the purchaser's name, address, and tax identification number for verification.

Are there any situations where the ST-3 form cannot be used?

Yes, the ST-3 form cannot be used if the purchaser is buying items for their own use rather than for resale. Examples include purchasing office supplies for personal use or materials for maintenance of a business facility.

What should a seller do if they receive an incomplete ST-3 form?

If a seller receives an incomplete ST-3 form, they should not accept it for tax exemption. Instead, they must collect the appropriate sales tax. They can also request a fully completed form from the purchaser within 120 days if needed.

Can the ST-3 form be reproduced?

Yes, the ST-3 form can be reproduced without prior permission from the New Jersey Division of Taxation. Both sides of the form should be copied to ensure all necessary information is included.