Printable St 7 New Jersey Form

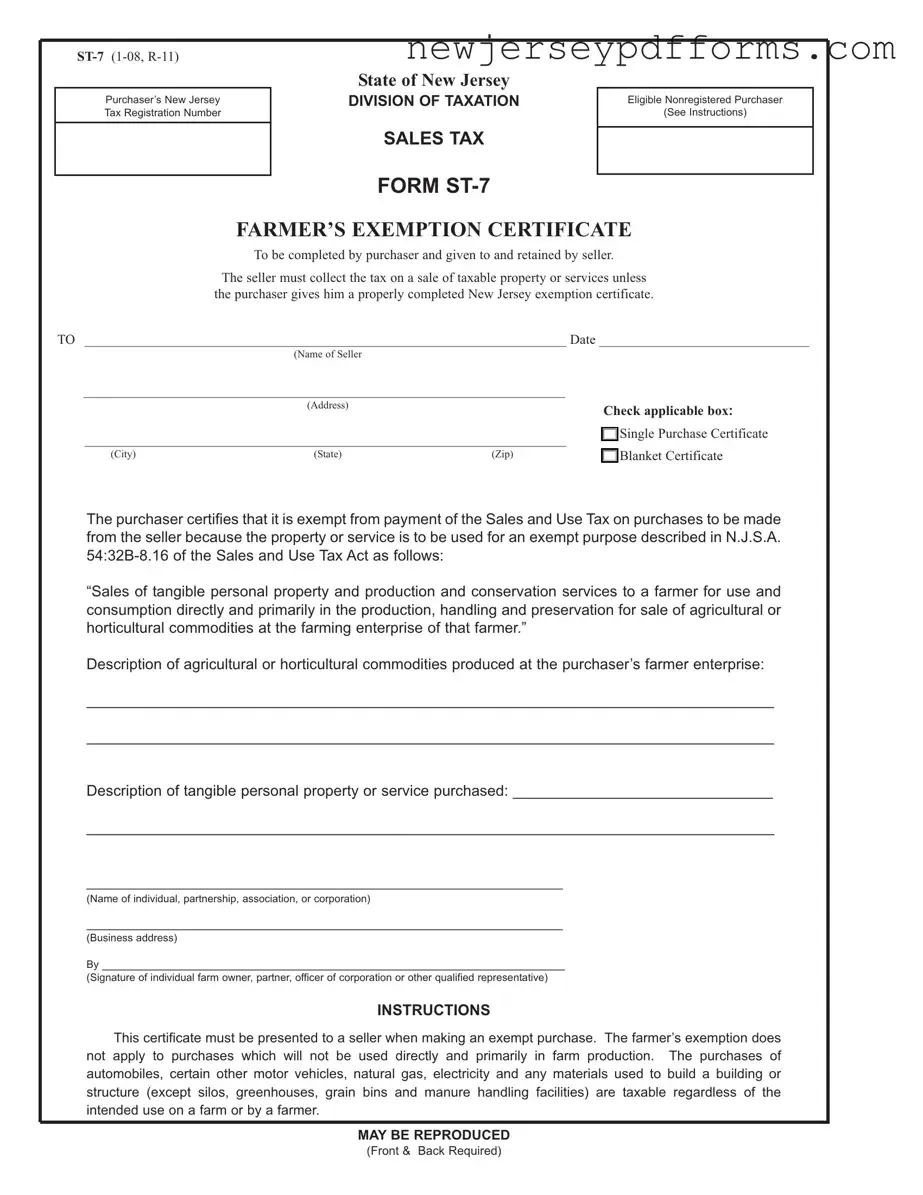

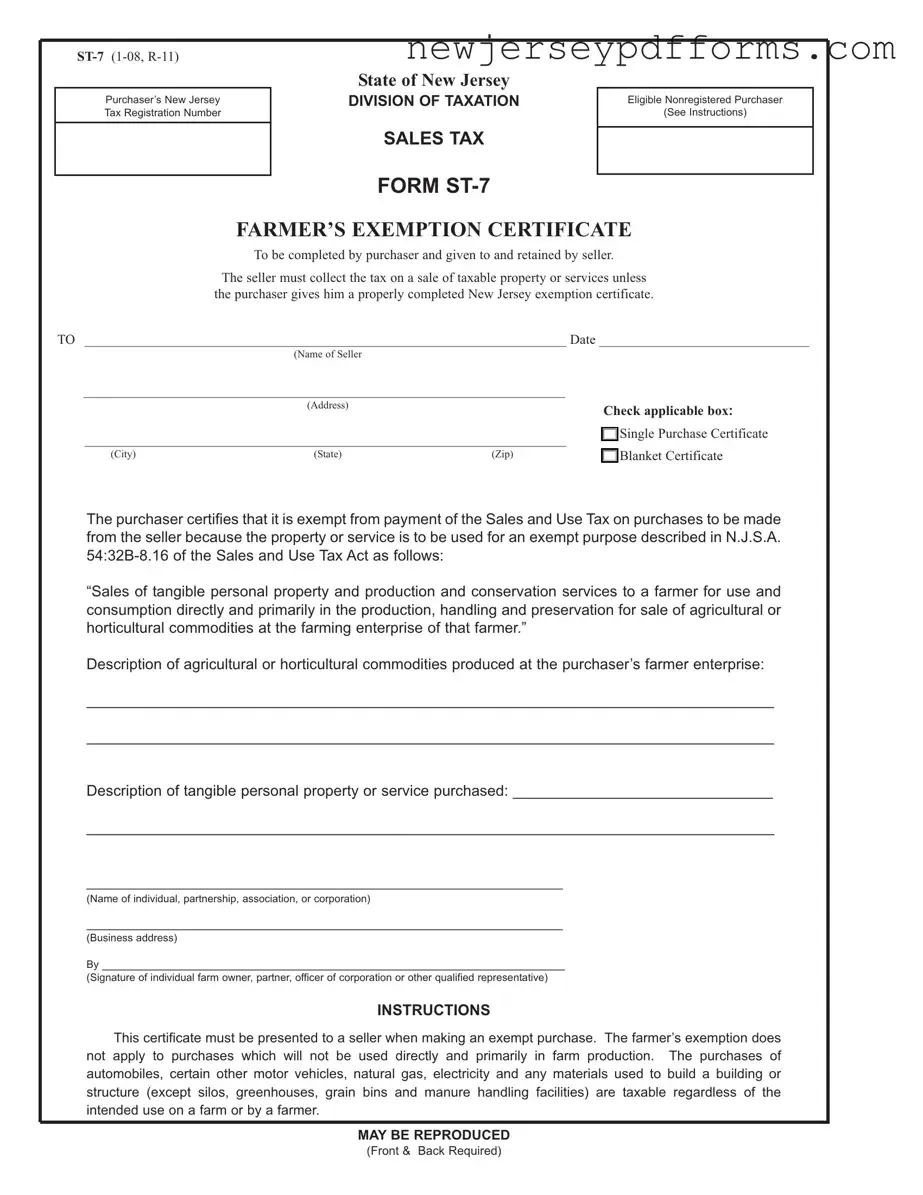

The ST-7 form, also known as the Farmer’s Exemption Certificate, is a document used in New Jersey that allows eligible farmers to make exempt purchases of certain tangible personal property and services. This certificate must be completed by the purchaser and presented to the seller to avoid sales tax on items used directly in agricultural production. To ensure compliance and take advantage of this exemption, farmers should fill out the form accurately and retain it for their records.

Ready to fill out the ST-7 form? Click the button below to get started!

Open Editor Here

Printable St 7 New Jersey Form

Open Editor Here

Open Editor Here

or

Download St 7 New Jersey PDF Form

Complete the form before time runs out

Edit your St 7 New Jersey online and complete it quickly.